- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- Asian session looking to open up after Wall St rallies on strong earnings and data releases – tech leads after Meta beats

- Home

- News & Analysis

- Articles

- Featured

- Asian session looking to open up after Wall St rallies on strong earnings and data releases – tech leads after Meta beats

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisAsian session looking to open up after Wall St rallies on strong earnings and data releases – tech leads after Meta beats

28 April 2023 By Lachlan MeakinUS stock indices rallied as risk appetite returned as banking fears seemed to take back seat and strong tech earnings saw the bulls in charge. The Dow and S&P 500 had their best day since January while the Nasdaq led the charge higher, rallying almost 2.5% after impressive tech earnings continued with Meta rallying 14% in the session.

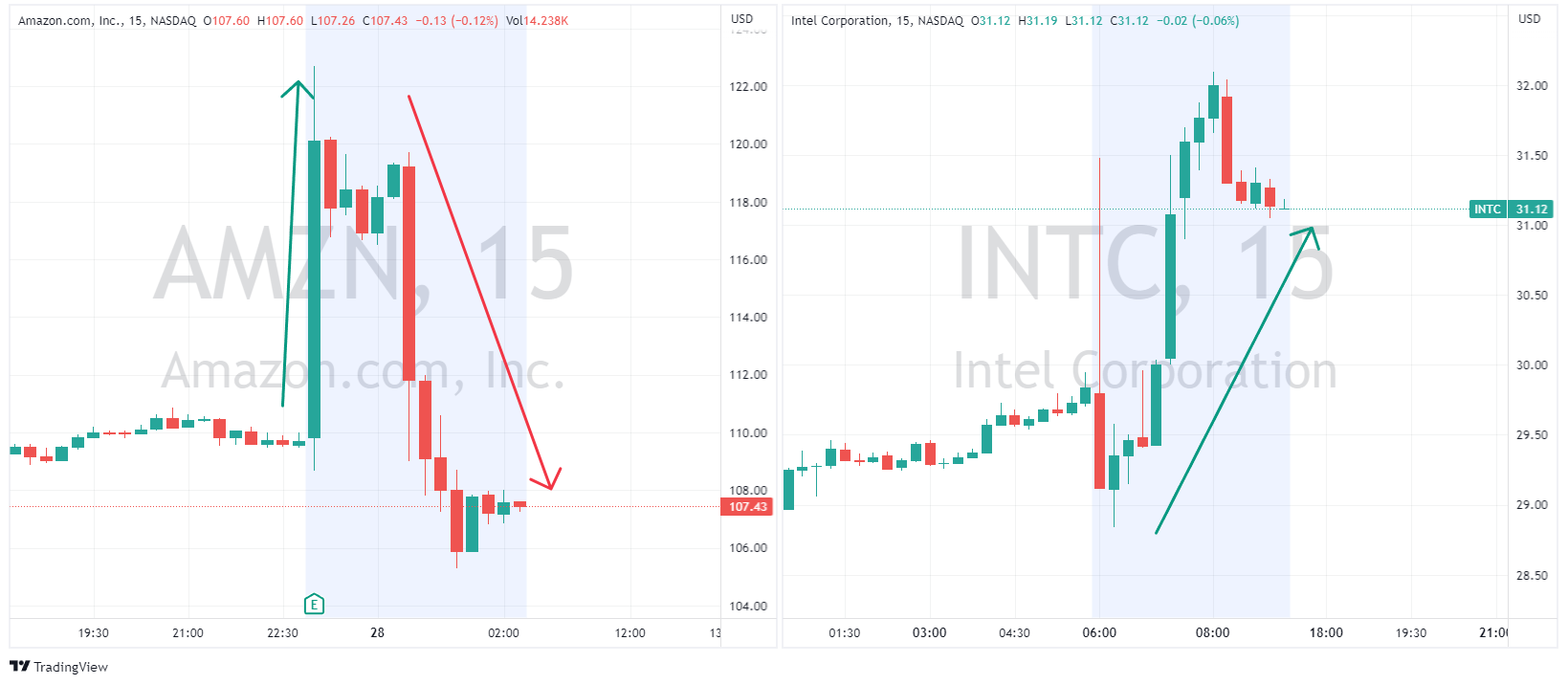

Tech earnings again saw some big moves after hours, with Amazon (AMZN) and Intel (INTC) both reporting after the bell, Amazon pumped and dumped over 12% in either direction after some initial confusion on the strength of earnings, Intel after some volatility rallied over 4% after hours on positive earnings.

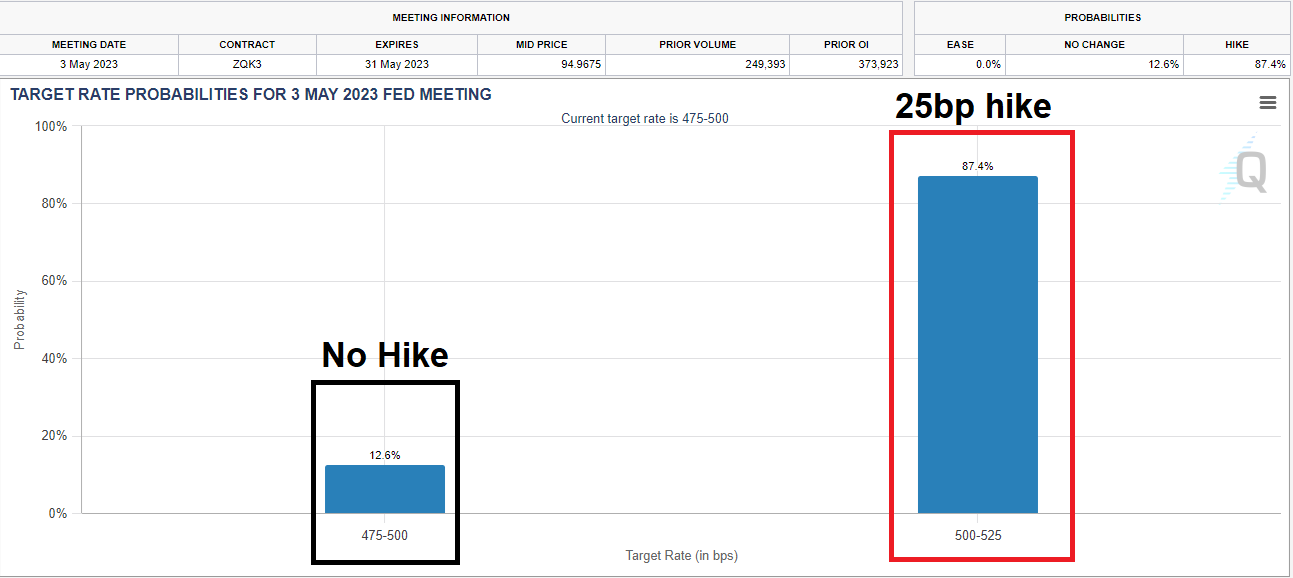

Data releases out of the US came in mixed with Q1 GDP coming in well below consensus at 1.1% vs 2.0% expected, while jobless claims fell to 230k vs 247k expected, neither moved the needle on the expectation of a Fed hike next week, with 25bp priced in with a 87% probability according to Fed Fund futures.

FX Markets

USD saw mild gains ahead after mixed data in Thursday’s session and ahead of today’s PCE inflation figure. The US Dollar index rose to 101.80 after the weaker than expected GDP figures saw safe haven flows, only to retrace most of the gain as equity markets continued to rally.

The Yen and the Euro were both modestly weaker against the USD. EURUSD pivoted around the psychological 1.10 level, dipping below briefly before reclaiming it while USDJPY rallied as rising US bond yields saw rate differentials increase, and a positive stock market session saw safe haven buying of the Yen evaporate.

Commodities

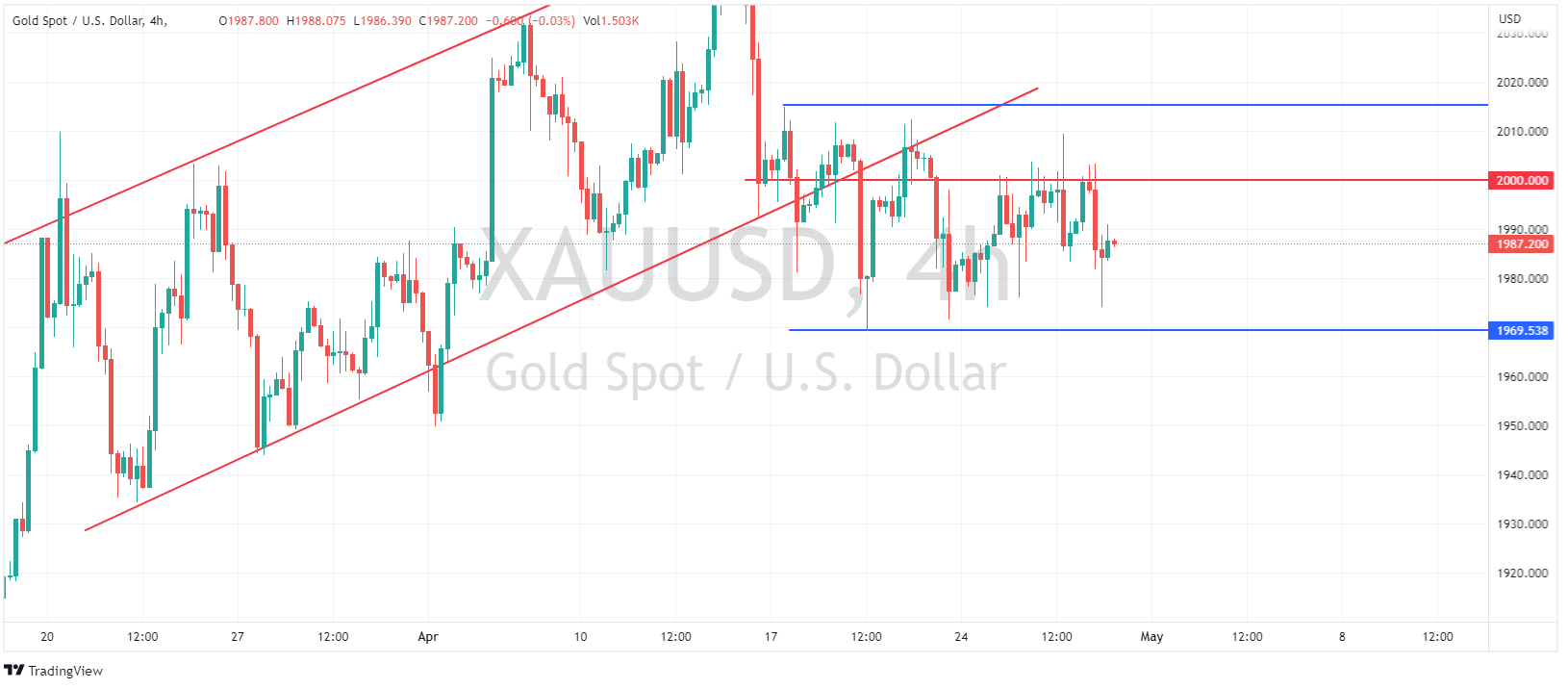

Gold again traded in it’s range and again was rejected at the 2000 USD an ounce level, this level is a major psychological level which has been major resistance for Gold recently, similar to the JPY, rising yields and risk on stymying safe haven flows were major headwinds for the precious metal.

Copper rebounded off support at its March lows, rallying for the first time in seven sessions on improved risk sentiment.

Interestingly the Copper-Gold ratio is approaching the 2022 lows, this ratio is seen as a bellwether of global economic health and could be indicating recessionary forces ahead.

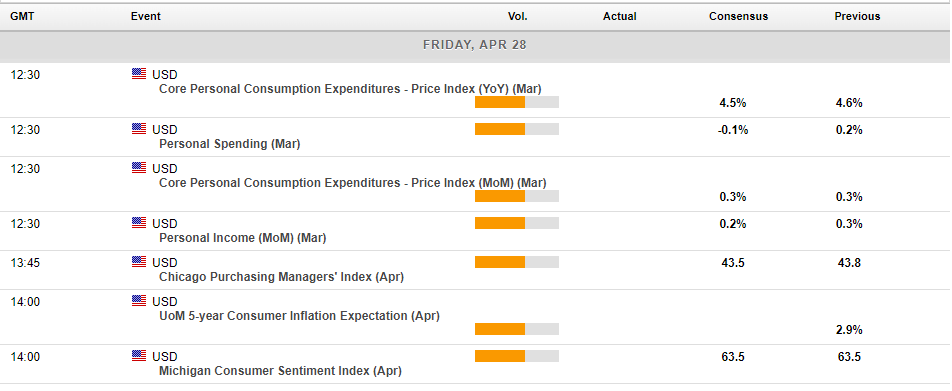

In todays economic releases, the big one will the Core PCE inflation reading out of the US. This reading is supposedly the Feds favoured inflation gauge, so whilst it is unlikely to change the Feds path next week, it may lead to a repricing of future Fed meetings and see some volatility especially in the USD on its release.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

BoJ Governor Ueda’s first monetary policy meeting

The Bank of Japan is due to hold its first monetary policy meeting under new Governor Ueda on the 29th of April 2023. Since his appointment, Governor Ueda has frequently indicated that the BoJ will continue with its current easing stance on monetary policy with targets for long and short-term interest rates. Although headline and core inflation run...

April 28, 2023Read More >Previous Article

US Stocks finished mostly down on bank stress – Nasdaq lifted by tech earnings

Major US Stock indices were mixed in Wednesdays session after further banking woes dragged down the Dow, S&P500 and Russell while the Nasdaq hel...

April 27, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading