- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- How to Trade Gold CFDs – Fundamental and Technical strategies

- Home

- News & Analysis

- Articles

- Featured

- How to Trade Gold CFDs – Fundamental and Technical strategies

- How to use CFDs to trade gold

- Fundamental forces that drive the price of gold

- Technical strategies for trading gold CFDs

- Trade 23 hours a day, unlike an ETF or gold miner listed on a stock exchange that is only open while that stock exchange is open.

- Leverage – the margin required to open the trade will be a fraction of the face value of the position depending on what leverage your account is set to.

- Flexibility in position sizing starting from 1 ounce ($1USD per point movement in gold) unlike gold futures which have rigid contract sizes.

- Rolling contract, no expiries such as in options or futures to worry about.

- The gold price relationship to US bond yields

- Safe haven flows

- Central Bank buying

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisGold has always been one of the most popular and highly traded markets for CFD traders, especially recently as its price has risen to test its all-time highs. It’s easy to see why, Gold has been a store of value throughout history, and with CFDs it’s possible to take a position in this exciting market, whether you think the price will head up or down.

In this CFD gold trading Article we will look at the following:

How to use CFDs to trade gold

CFDs or Contracts For Difference allow you to speculate on the price of gold, without owning the underlying asset (No gold vaults needed!) A spot gold CFD tracks the price of the spot market being the cleanest and most efficient way to speculate on the price of gold.

They also allow you to take a position in both directions, you would enter a buy (Long) positions if you believed the price will rise, or a sell (Short) position if you believe the price will fall.

With Long positions you are looking to buy and sell at a higher price at a later time to profit on the trade. With a Short position you are selling with the view to buy back at a later time to profit on the trade.

At GO Markets we offer our clients the worlds most popular gold trading platform in Metatrader 4 and 5, another advantage to these CFD trading platforms is the ability to automate gold trading strategies.

Other advantages to trading gold CFDs with GO Markets:

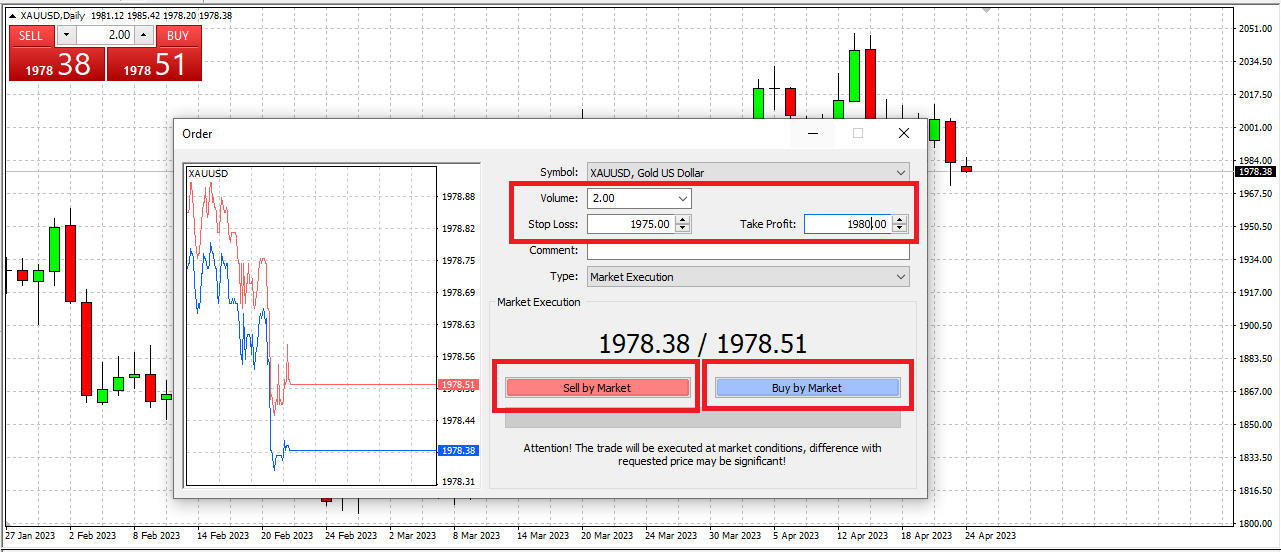

To Enter a position in Metatrader, you would bring up a deal ticket by clicking “New Order” then select your position size, any Stop Loss or Take Profit levels you want the position to automatically close at and hit Buy or Sell.

As with any instrument, make sure you are familiar with the lot sizing. 1 standard lot in gold (XAUUSD) is 100 ounces, or $100 USD a point so make sure you set the volume to a level commensurate to your account size and risk appetite.

Now, the next question is how you decide on a buy or sell, lets look at the fundamentals of what drives gold and some technical analysis you can use to answer this question.

Fundamental forces that drive the price of gold

While no one reason can be fully attributed to movements in the price of gold, there are an important few fundamental drivers that will influence the price of gold and whose relationship has been time tested. None of these on their own should be used as a sole reason to enter a position, but having the fundamentals on your side will certainly give you an advantage.

The main fundamental drivers in my experience are (not an exhaustive list by any means!)

Real Yields and Gold

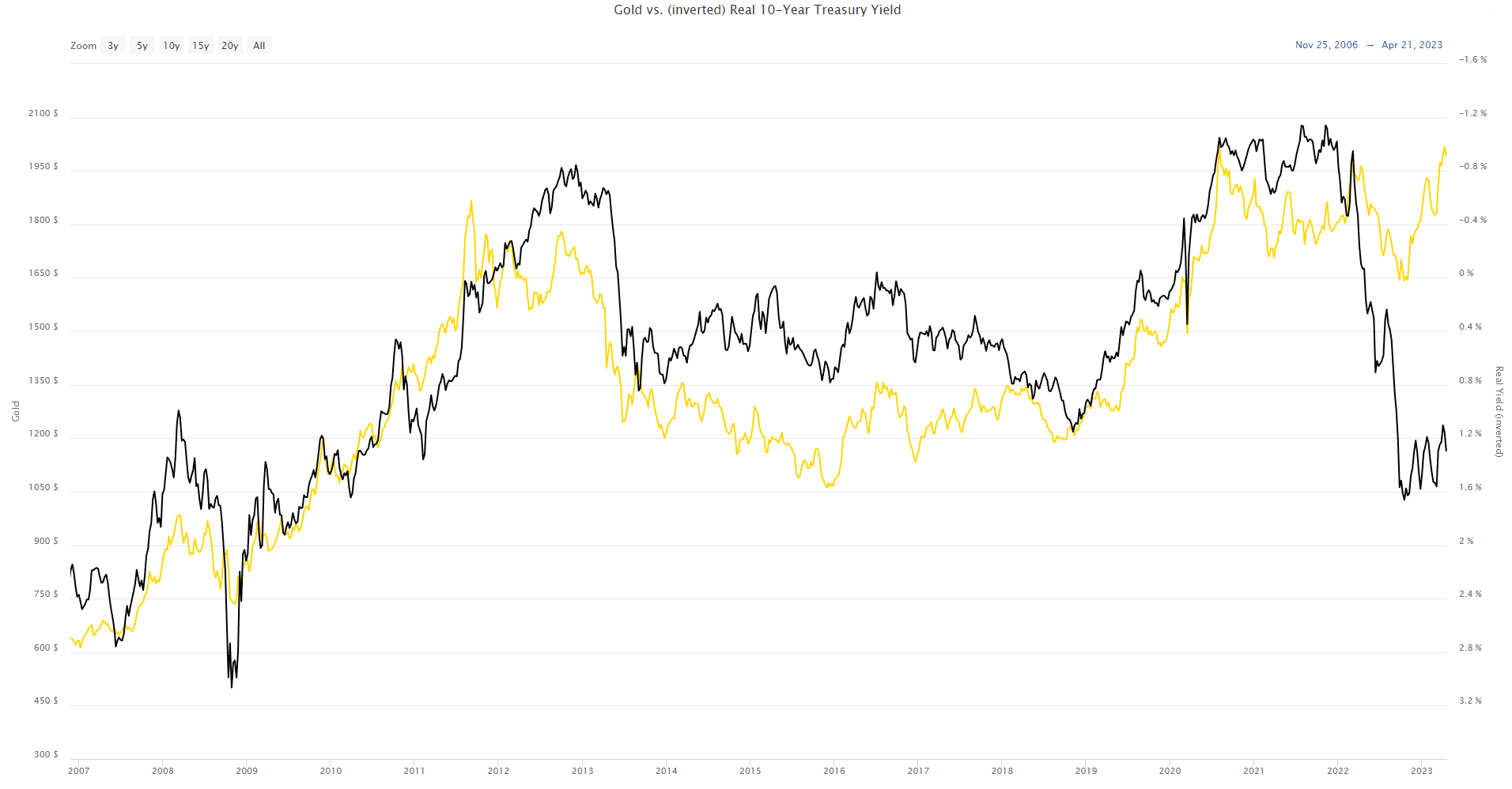

The inverse relationship between bond yields and the price of gold is well established, especially the real yield on the US 10 year bond. The reason for this mainly is because the real yield (the real yield is calculated by subtracting inflation expectations from the actual yield of the US 10 year government bond) is seen as the “risk free” rate on an investment, the higher the “risk free” rate is, the less attractive a non-yield paying asset like gold is. As both gold and bonds are seen as safe havens, they are competing for the same investors. See the screenshot below to illustrate this point.

The gold line is the price of gold, the black line is the inverted real yield of 10 year treasuries. This chart stretches back 16 years, but the close relationship has gone back much longer than that. This chart is showing that historically, gold is expensive at the moment as compared to real yields as can be seen by the growing gap between the two recently, this interesting decoupling has been mainly caused by our second fundamental driver – Safe haven flows.

Safe Haven Flows

Geopolitical strife with war in Ukraine and doubts over the health of the global economy got things started with the surge we have seen in gold prices in the last 5 months, but things went into overdrive in March 2023 when Signature bank and Credit Suisse collapsed, bring into question the integrity of the banking system and massive safe haven flows into gold which has pushed the price to within touching distance of hitting all-time highs. With the banking crisis seemingly under control (for now maybe?) gold has lost some momentum, but the fact it is holding around these elevated prices indicates some investors may not think the crisis is over just yet.

Central Bank Buying

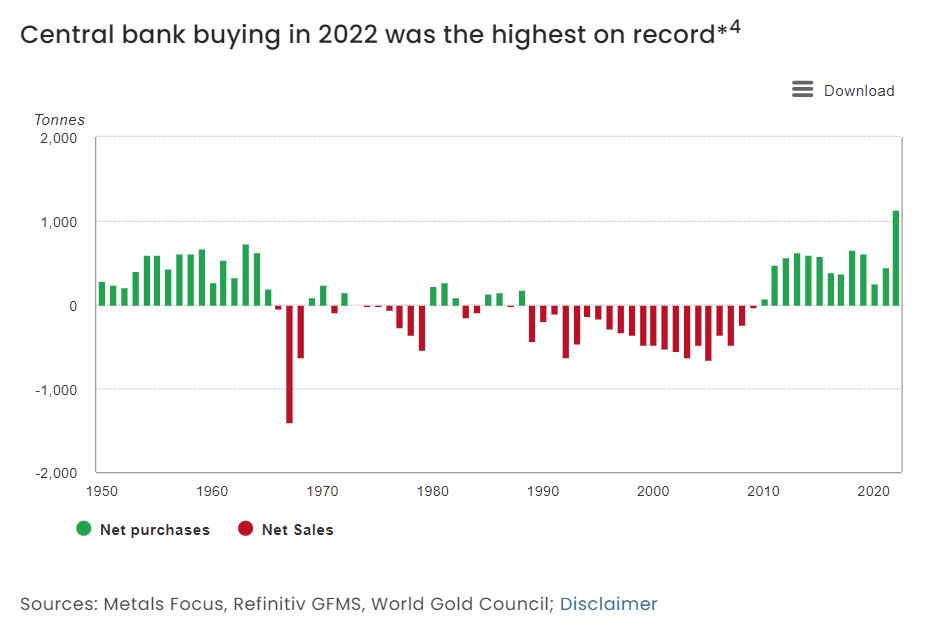

Central banks are some of the biggest buyers of gold on the open market, and 2022 saw the most central bank buying of gold on record.

Whatever the reasons for this, such massive amounts of buying would be seen as a bullish sign for the gold price (if it continues)

Technical strategies for trading gold CFDs

While having a good understanding of the fundamentals (in my opinion) is important to help you choose the best trades most traders will use a combination of technical analysis and fundamentals with the aim for higher probability outcomes in their trades. Some traders will use technical analysis exclusively without any interest in the fundamental drivers using things such as RSI oscillators, support and resistance areas and trend lines solely to decide on their trade direction. Which option is best is solely up to the trader, their time frames for the trades and risk appetite, all can work, and all can fail neither option can be seen as “better” than the other, it all depends on the individual trader.

Technical analysis is an art in itself and there is a lot to learn on this subject, I encourage anyone interested to research the many weird and wonderful technical analysis strategies that are documented online. But let’s take a look at a couple of popular technical indicators that gold traders use to make their trades.

Support and Resistance

Support and resistance are one of the most widely used and accurate (when used correctly) technical indicators that can be used by traders. Support and Resistance areas are points in the market where the price is held from going lower (Support) or going higher (Resistance) , these are areas where buyers or sellers are entering the market as they see value in the asset at that price. These levels can last a long time, or be temporary and can be used to predict turn arounds in the market, or a break of these levels could indicate a further push in that direction. Lets take a look at the recent Gold chart for examples below:

From the above you can see that there are areas that Gold will find its price supported. or upside resisted as buyers and sellers battle it out. These areas are very important to keep in mind when deciding on trade direction.

Trend Channels

Another simple, but effective and popular Technical Analysis tool is trend channels. These channels are a common sight on the gold chart and can give the trader some confidence in levels that will provide support or resistance, or a break of these channels can indicate a trend change. Example of trend channels on gold below:

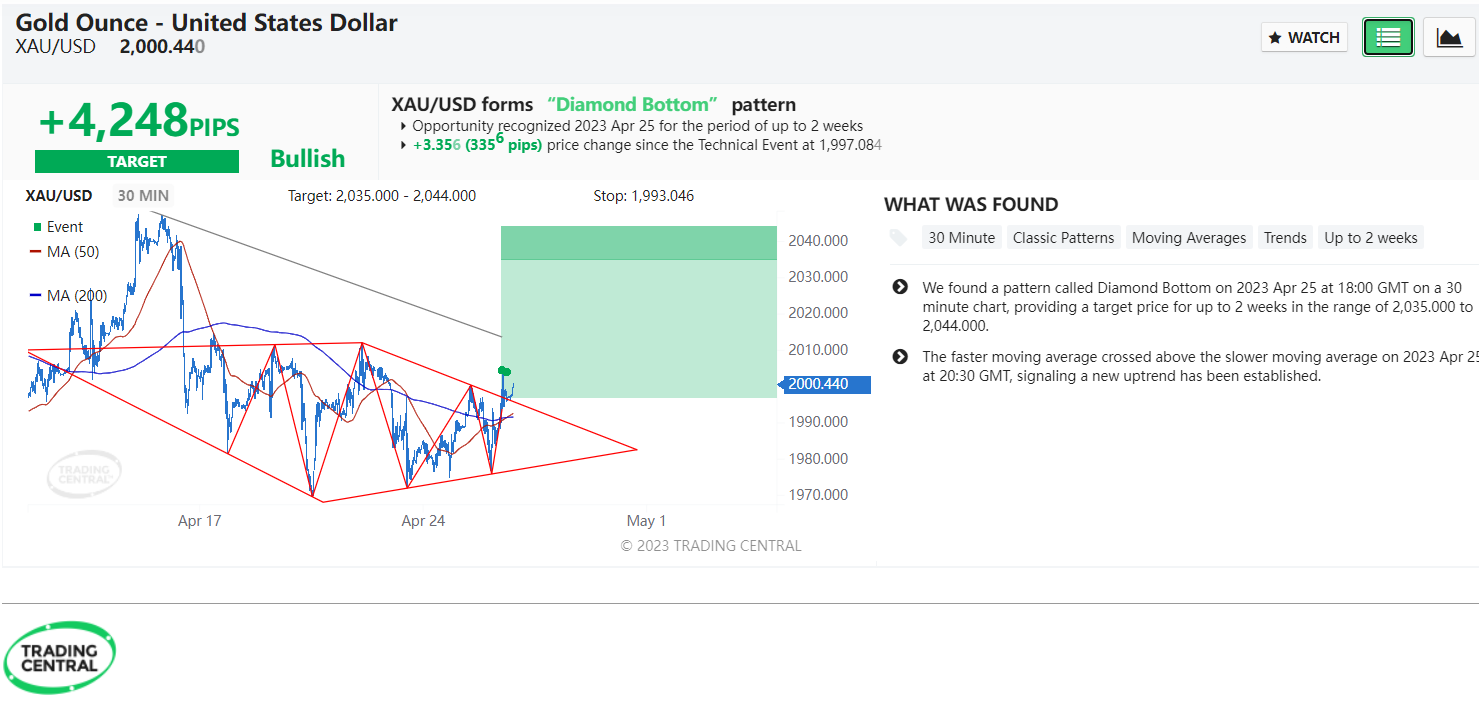

While technical analysis is useful for gold, it can be difficult to spend the time analysing all the patterns that may form, in that regard GO Markets clients have access to Trading Central which automatically detect technical set ups for our traders to add to their decision making. Trading Central can be accessed by account holders through their Client Portal.

Trading Central Pattern example below:

Hopefully this article has given you an interest to learn more about trading gold with CFDs. Fell free to contact the GO Markets team if you have any questions on trading gold CFDs and opening an account with us.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Inflation growth slows for the Australian Economy

The Australian Consumer Price Index (CPI) y/y was released at 6.3%, lower than the market forecast of 6.5% and from the previous data of 6.8%. With inflation growth on a clear downtrend following its peak of 8.4% in January 2023, this is likely to reduce the need for further rate increases from the Reserve Bank of Australia (RBA). The Australian...

April 26, 2023Read More >Previous Article

Market Analysis 24-28 April 2023

XAUUSD Analysis 24 – 28 April 2023 The gold price outlook is positive in the medium term. Although the close of last week's sell pressure bar...

April 26, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading