- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- Key events in the week ahead – ECB, RBA and FOMC

- Home

- News & Analysis

- Articles

- Featured

- Key events in the week ahead – ECB, RBA and FOMC

News & AnalysisNews & Analysis

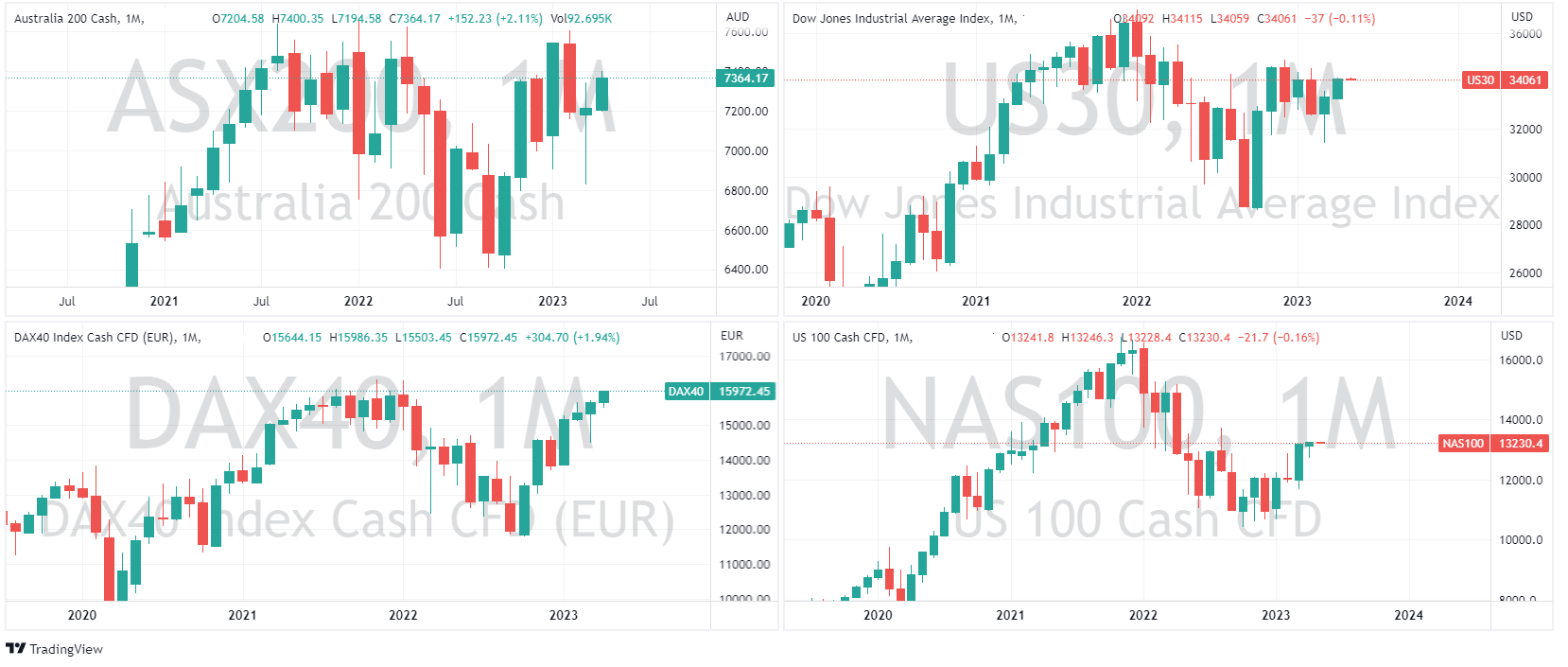

News & AnalysisNews & AnalysisUS stocks rallied into month-end on Friday with the VIX falling beneath 16 to finish off a volatile but ultimately positive month for global markets despite news of another bank collapse in the US. Risk appetite returned on mostly strong US earnings and the markets belief we are close to the end of Central Bank hiking cycles, the Dow Jones having its best month since January, rallying 2.5% in April.

US government seizure of First Republic Bank seems imminent with a Sunday deadline passing with no bids from rival banks to rescue the flailing bank which seems to be a prelude to authorities to place First Republic into receivership.

Monthly charts of major global stock Indices:

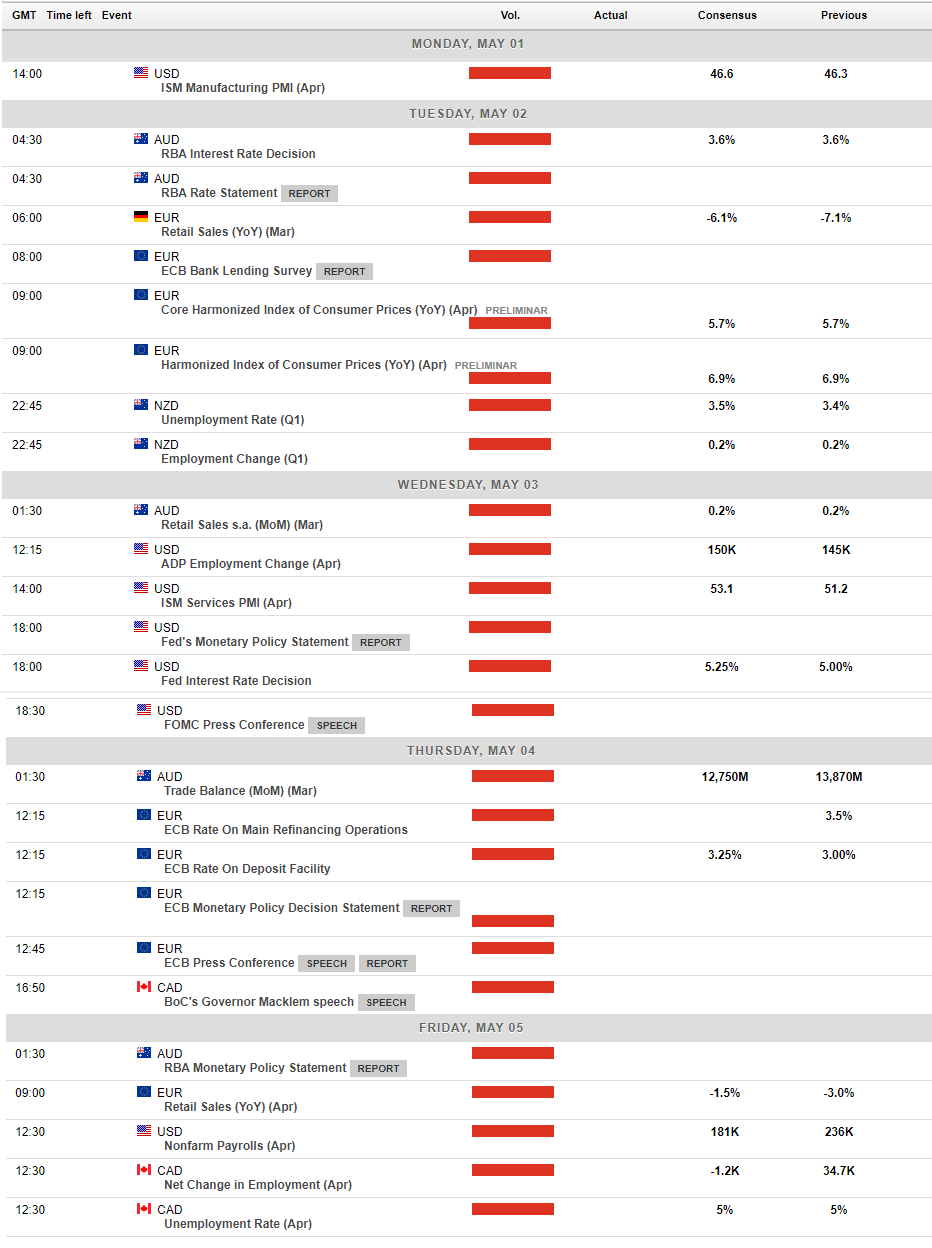

The Week Ahead – Central banks take the spotlight.

Coming up this week we have rate decisions out of Australia, the EU and USA which are sure to keep traders busy as the market digests what actions and clues to future actions these meetings present.

RBA – Tuesday

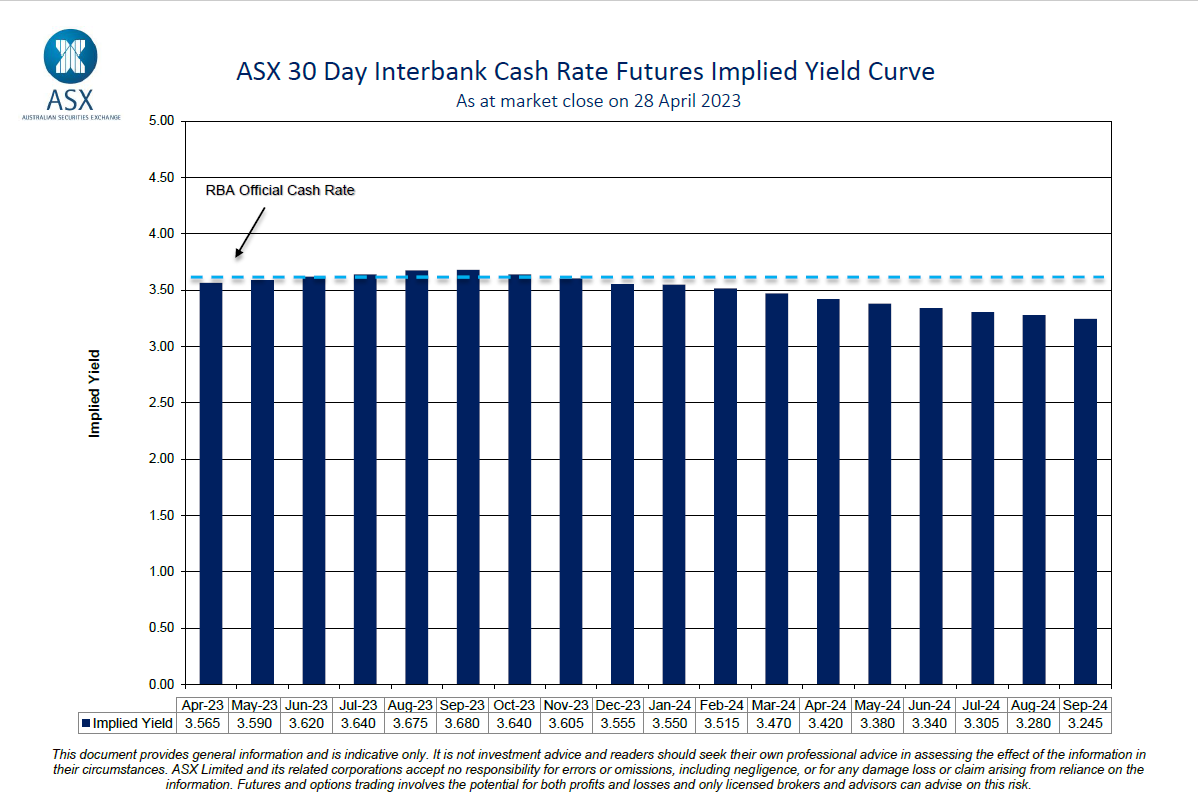

The RBA is to decide on rates next week with 26 out of 34 economists surveyed by Reuters forecasting the Cash Rate Target to remain unchanged at the current level of 3.60%. Recent inflation figures out of Australia have indicated that the economy had passed peak inflation, though with inflation still firmly above the RBA’s 2-3% target band further rate hikes can’t be ruled out, but this meeting looks very unlikely for any move on the official rate.

Futures markets are pricing in a 100% chance of a hold, so a hike in rates would be a massive surprise to the markets. With that scenario extremely unlikely the main driver of AUDUSD after this meeting will be the accompanying statement, whether it is seen as hawkish or dovish for future rate moves.

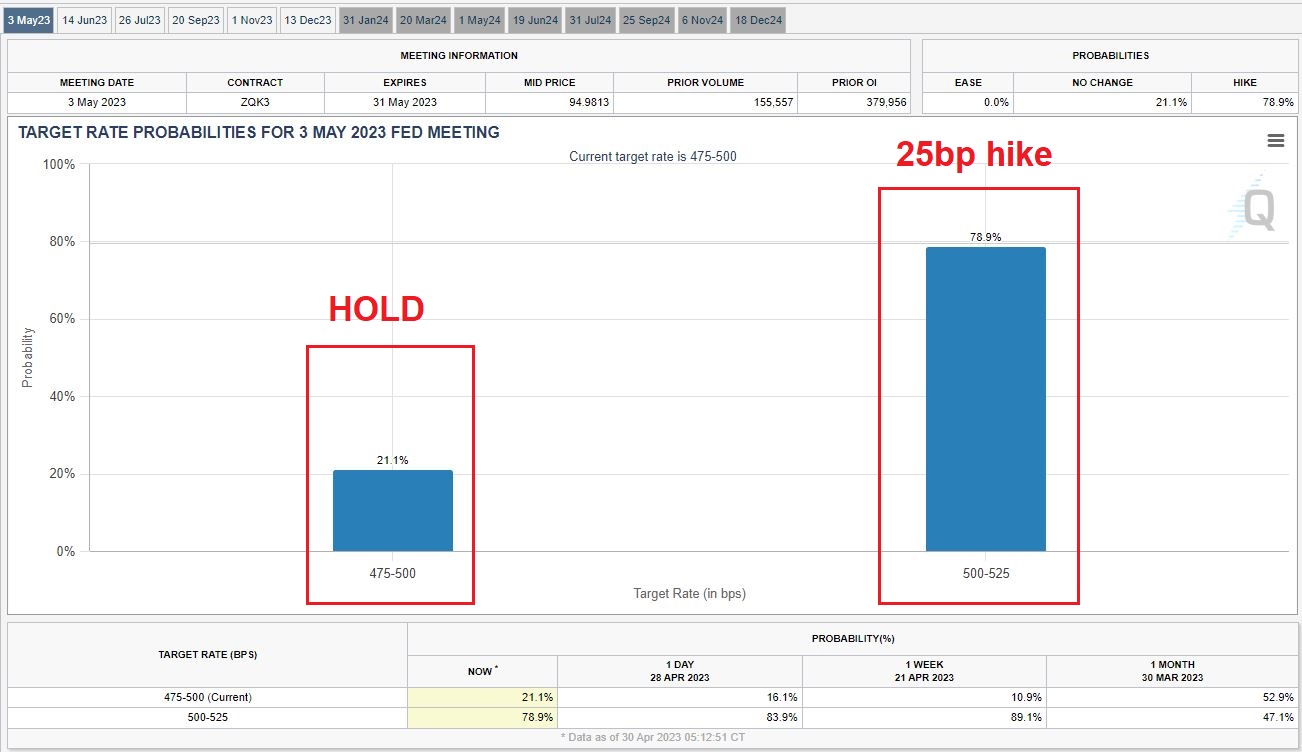

FOMC – Wednesday

Wednesday sees the US Federal Reserve meet to set rates where the consensus expectation is for the FOMC to lift rates by 25bp and indicate a pause going forward. Fed Fund futures are pricing in a 79% chance of a 25bp hike so we should see some movement in the USD over this announcement as rates markets re-price whatever the Fed does. Some pressure has been taken off the Fed with recent banking stresses are leading to a tightening of lending conditions and assisting them in the fight against inflation so it is likely that we will see a 25bp hike, followed by the statement and presser that hint that this is it for now which could see the USD come under pressure.

ECB – Thursday

The European Central Bank meets on Thursday to release their rate decision and monetary policy report. Rates markets are fully pricing in a 25bp hike, with a bit extra to modestly price in a chance of a 50bp hike. Up until recently the market favoured a 50bp hike after hawkish commentary out of several ECB members, though odds have since moved to a “compromise” 25 bp hike as the doves in the ECB argue that the banking stresses of the last few weeks should have been a clear reminder that hiking interest rates – and particularly the most aggressive tightening cycle since the start of the monetary union – comes at a cost.

With a 25bp fully priced in not much movement in EURUSD would be expected, unless they did surprise with a 50bp move or an overly hawkish accompanying statement with the decision.

Along with the above Central Bank decisions we also have a raft of important US data worth keeping an eye on, including Non-Farm payrolls which rarely disappoints FX traders looking for some volatility.

The weeks calendar of major events below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Natural Gas analysis – another bull run coming?

Natural Gas price action has had an amazing two years, with the usually pretty boring commodity showing extreme volatility pushing it to all time highs before a dramatic collapse seeing it back where it started in 2020. Like all the energy complex, Oil being a good example, the start of the Covid panic saw wild price fluctuations as traders came...

May 1, 2023Read More >Previous Article

Why Trade Gold with GO Markets?

Gold has always been one of the most popular and highly traded markets for CFD traders, especially recently as its price has risen to test its all-tim...

May 1, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading