- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- Risk events in the week ahead – BoE set to hike, US CPI

- Home

- News & Analysis

- Articles

- Featured

- Risk events in the week ahead – BoE set to hike, US CPI

News & AnalysisNews & Analysis

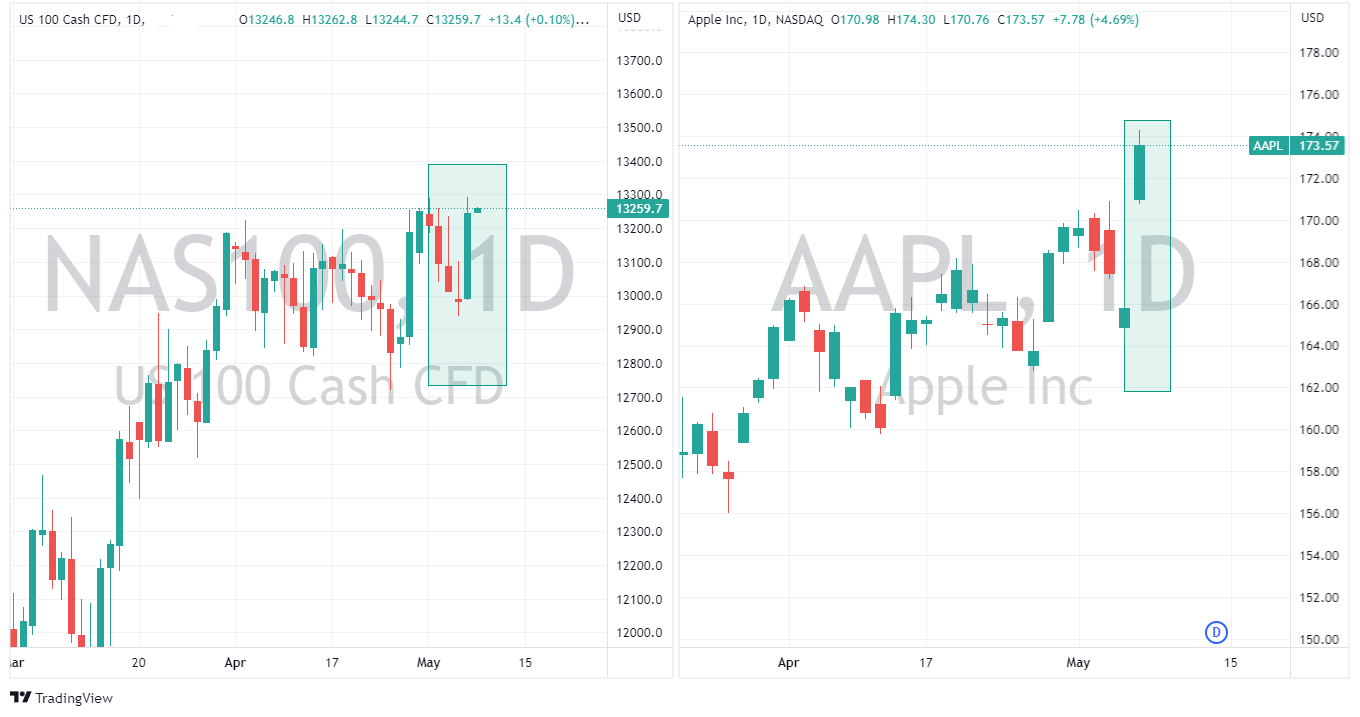

News & AnalysisNews & AnalysisUS stocks rallied strongly on Friday on a stronger than expected Jobs report, improved banking sentiment and strong earnings from Apple (AAPL) which saw the Nasdaq up over 2% and erasing the weeks losses to finish the first week of May modestly in the green.

Non-farm payrolls smashed expectations, coming in at 253k new jobs created in April against an expectation of 180k, the unemployment rate also dropped to 3.4% vs the 3.6% that was the consensus showing that the US labour market remains resilient, giving investors hope for a soft landing and seeing risk assets rally strongly.

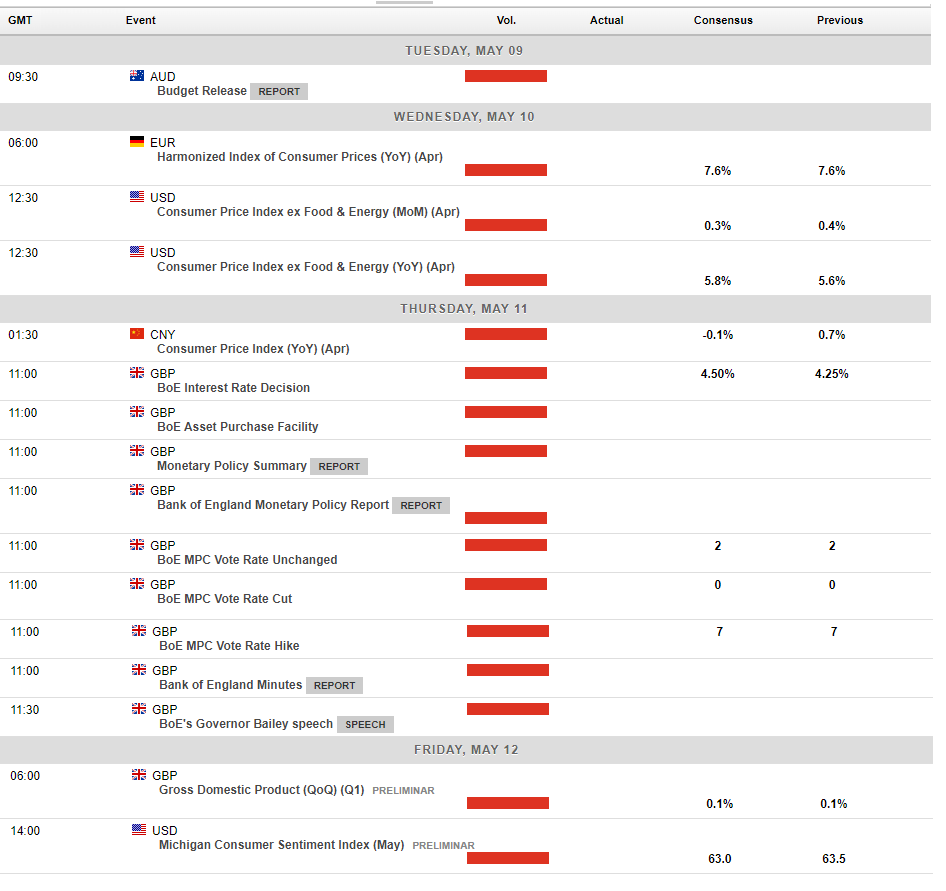

The Fed has a dual mandate of inflation and employment, so with the employment part out of the way all eyes this week will be on a raft of inflation figures out of the US. Starting Wednesday, we will be seeing import price inflation, producer price inflation and consumer price inflation with all three, according to consensus, set to show that the disinflation trend is now firmly in place.

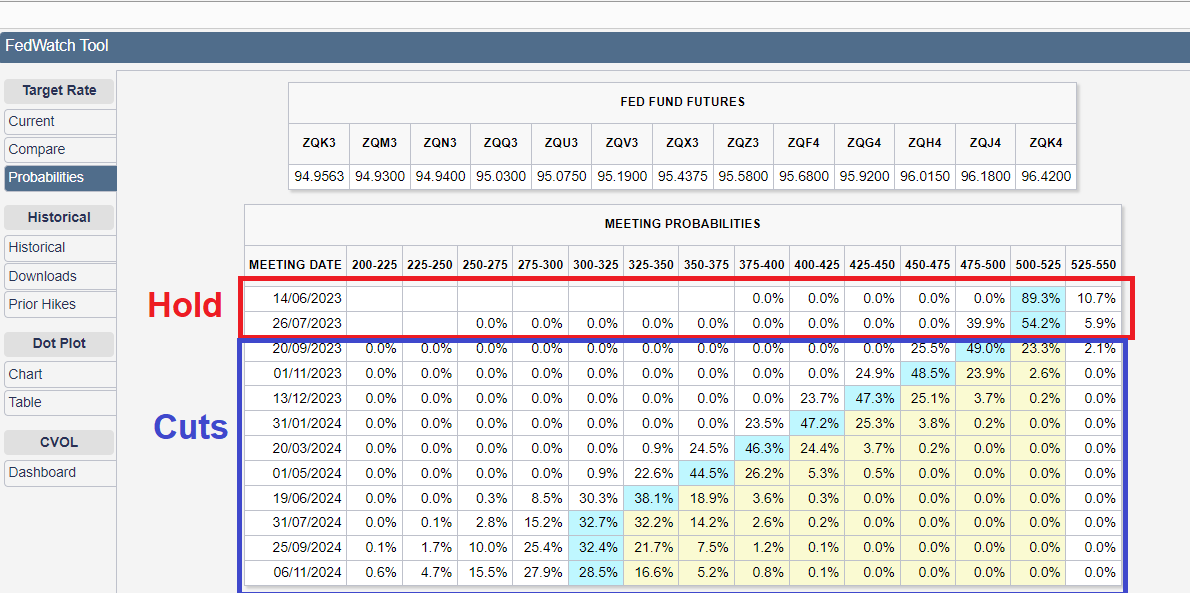

Though with the futures market now dovishly pricing in no further rate hikes from the Fed and cutting to begin in September, the risk is to the downside in risk assets if these inflation figures do come in hot.

Bank of England

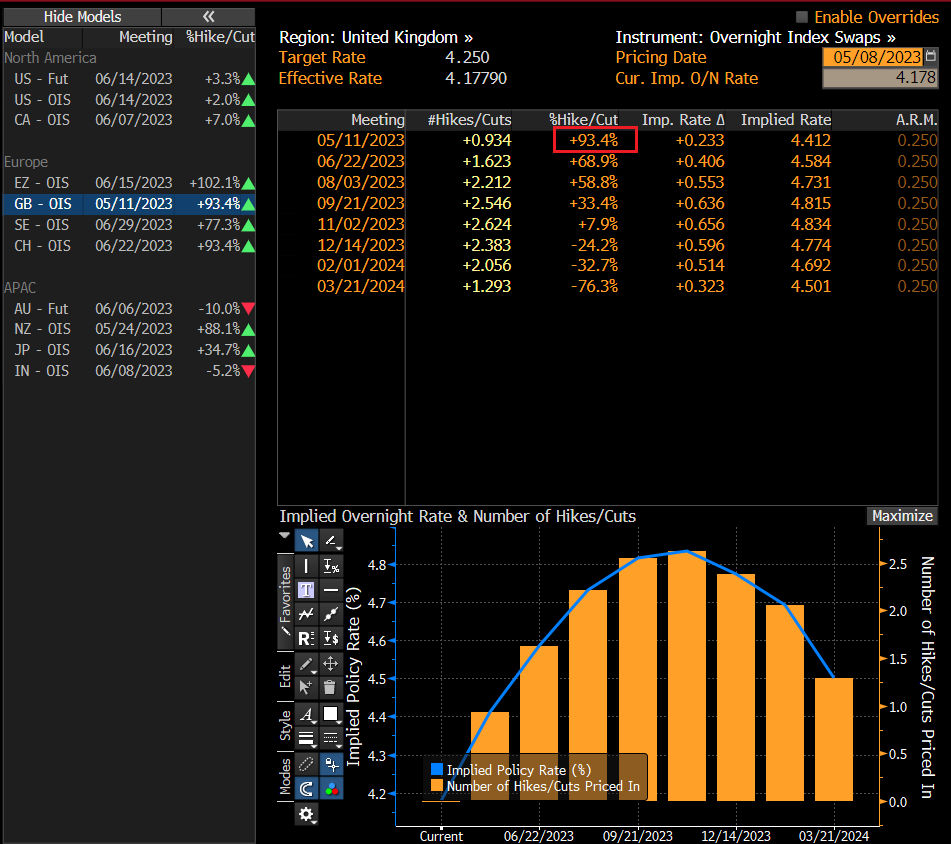

On Thursday the BoE will release their monetary policy report and official bank rate. After some hawkish inflation and wage data last month, BoE is expected to hike rates another 25 bp to bring the official rate to 4.5% and will probably be their last hike in this cycle, though it’s unlikely the Bank will shut down its options going forward in the accompanying statement so expect the Bank to retain its guidance that implies further tightening is possible if further data requires it. Markets are currently pricing in a 93% chance of a 25bp hike, so again like recent Central Bank decisions, it will be the forward guidance in the statement driving volatility rather than the rate decision itself.

Charts to watch

Gold – Gold flirted with all time highs last week, falling short by about $8 an ounce before retracing to test its support level at 2010. This level was resistance to the range Gold was trading in for the second half of April and now looks to have switched to support after the breakthrough on 23-5 and is a pivotal level as to whether Gold can again test that all time high. With the Fed out of the way, the big drivers this week will be inflation figures and how yields react. Any further banking stress could also see a move higher so gold traders need to keep an eye on the headlines and that 2010 level.

GBPUSD – Cable remains firmly in an uptrend after breaking previous 2023 highs and testing the resistance level of 1.2667 which was the highs set back in June last year. While GBPUSD has rallied strongly from its lows in late 2022, it still has someway to go to move back to it’s median value against the USD, a hawkish BoE on Thursday could see a break of this resistance and another leg higher.

Full calendar of the weeks major economic announcements below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Asian markets looking to open flat after US stocks finish mixed in choppy, rangebound session

Major US indices finished mixed to flat on a slow news day and lighter than usual volumes not helped by the UK being on a holiday as traders seem to be waiting for pivotal inflation data released later this week. The Nasdaq, lifted by lingering good feeling from recent Tech earnings outperformed, finishing up 21 points, while a paring back of a ...

May 9, 2023Read More >Previous Article

ECB hikes rates to 3.75%

Following the lead of the US Federal Reserve, the European Central Bank (ECB) announced its decision to hike rates by 25 basis points, taking interest...

May 5, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading