- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- US equities rally, dollar and yields surge on data and hawkish Fed speak

- Home

- News & Analysis

- Articles

- Featured

- US equities rally, dollar and yields surge on data and hawkish Fed speak

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS equities rally, dollar and yields surge on data and hawkish Fed speak

19 May 2023 By Lachlan MeakinUS indices were firmly higher on Thursday with a Big Tech bias, with the Nasdaq outperforming , rallying 1.5%, lifted by the likes of Nvidia (NVDA), Amazon (AMZN), and particularly Netflix (NFLX), which saw near double-digit strength after a positive ad tier subscriber update.

Strong data releases (good news is good news now?) and a more hawkish than expected slew of Fed speakers were not enough to dampen market enthusiasm, Jobless claims coming in at a less than expected 242k, down from 262k previously and Fed governors, Logan , Jefferson and Bullard all taking a stern tone regarding the Fed’s ongoing battle with inflation, Jerome Powell is scheduled to speak in Friday’s session so likely these members were laying the groundwork for possibly more hawkish than expected comments from the Fed head today.

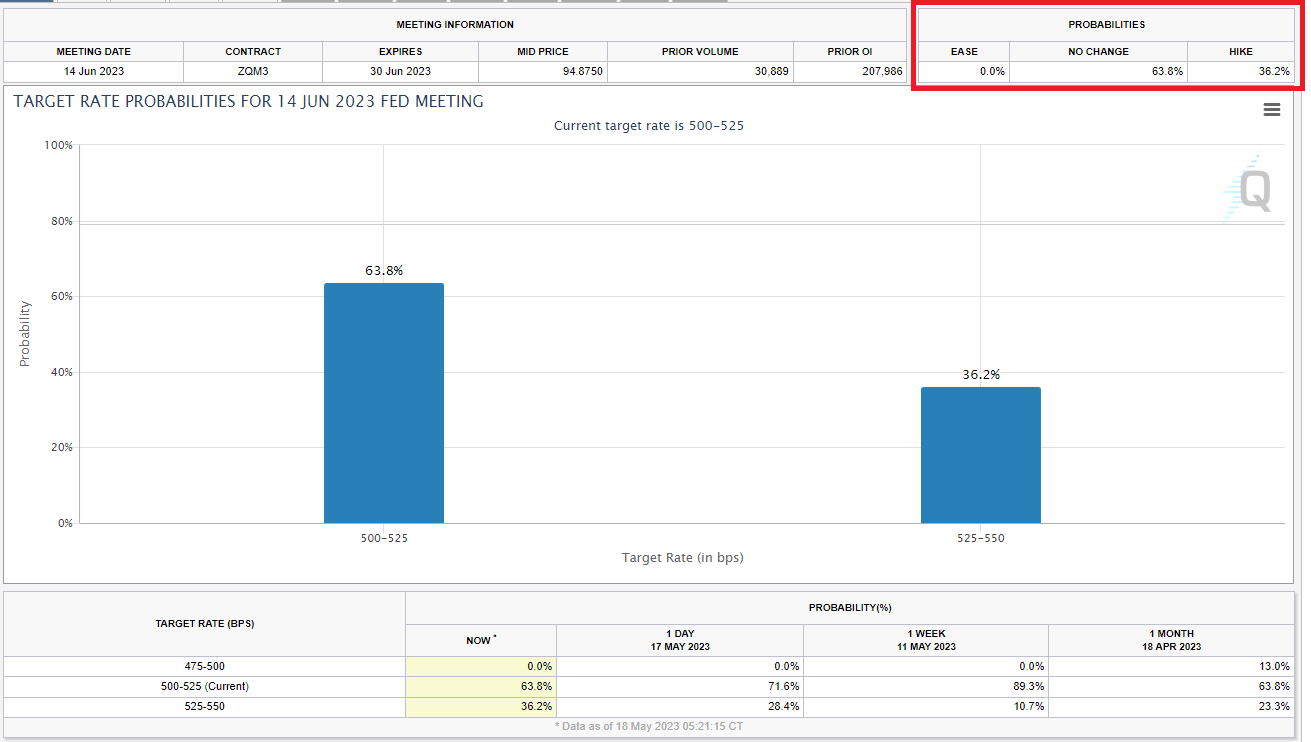

On this rate hike odds for the Fed’s June meeting jumped to 36% from 20% on Wednesday.

Source: CME Fedwatch

FX markets

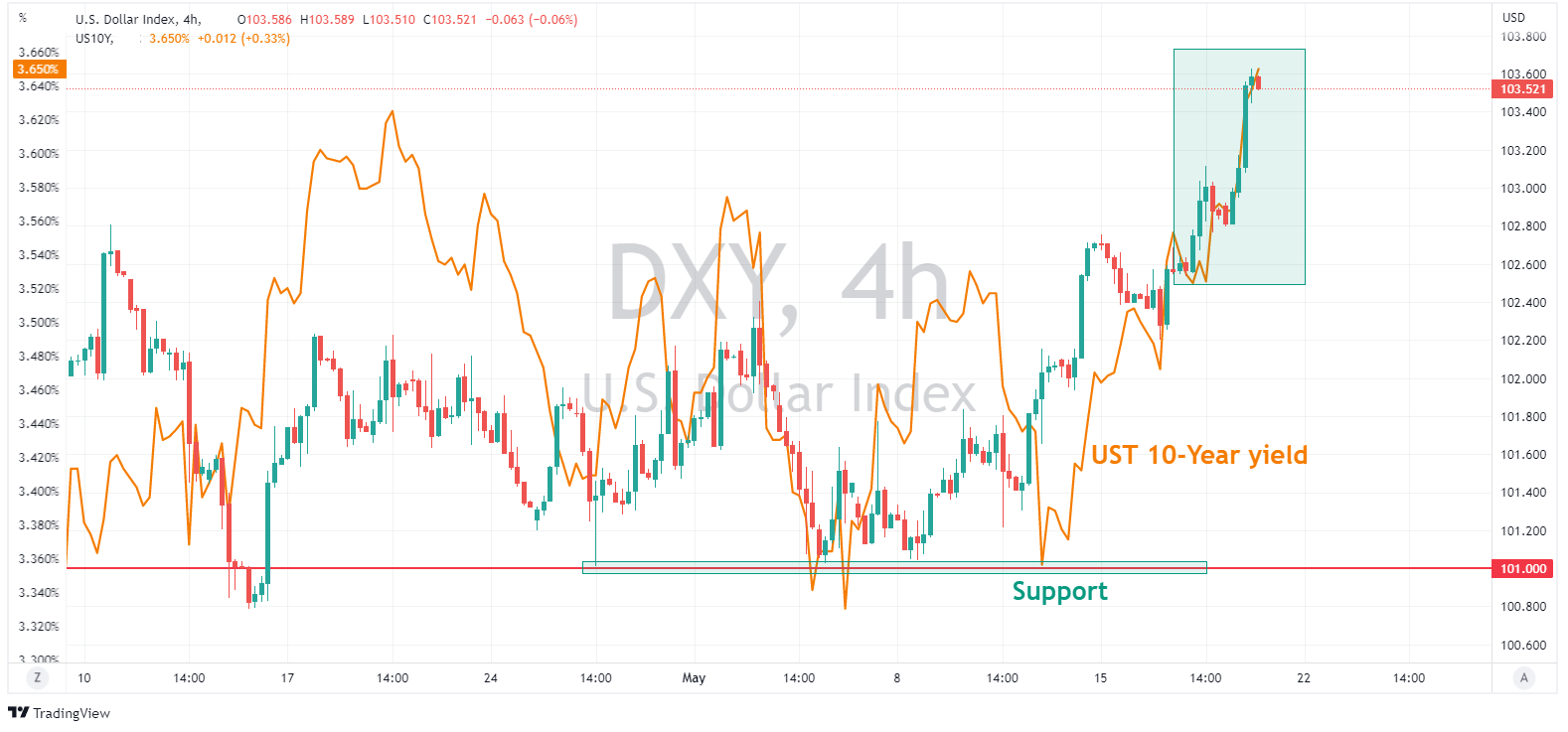

USD rallied strongly with the Dollar Index hitting two-month highs on strong US data, hawkish Fed speak and a rally in bond yields. USD following yields and rate hike expectations almost tick for tick, suggesting the upside may be limited from here without an extra catalyst (debt ceiling?)

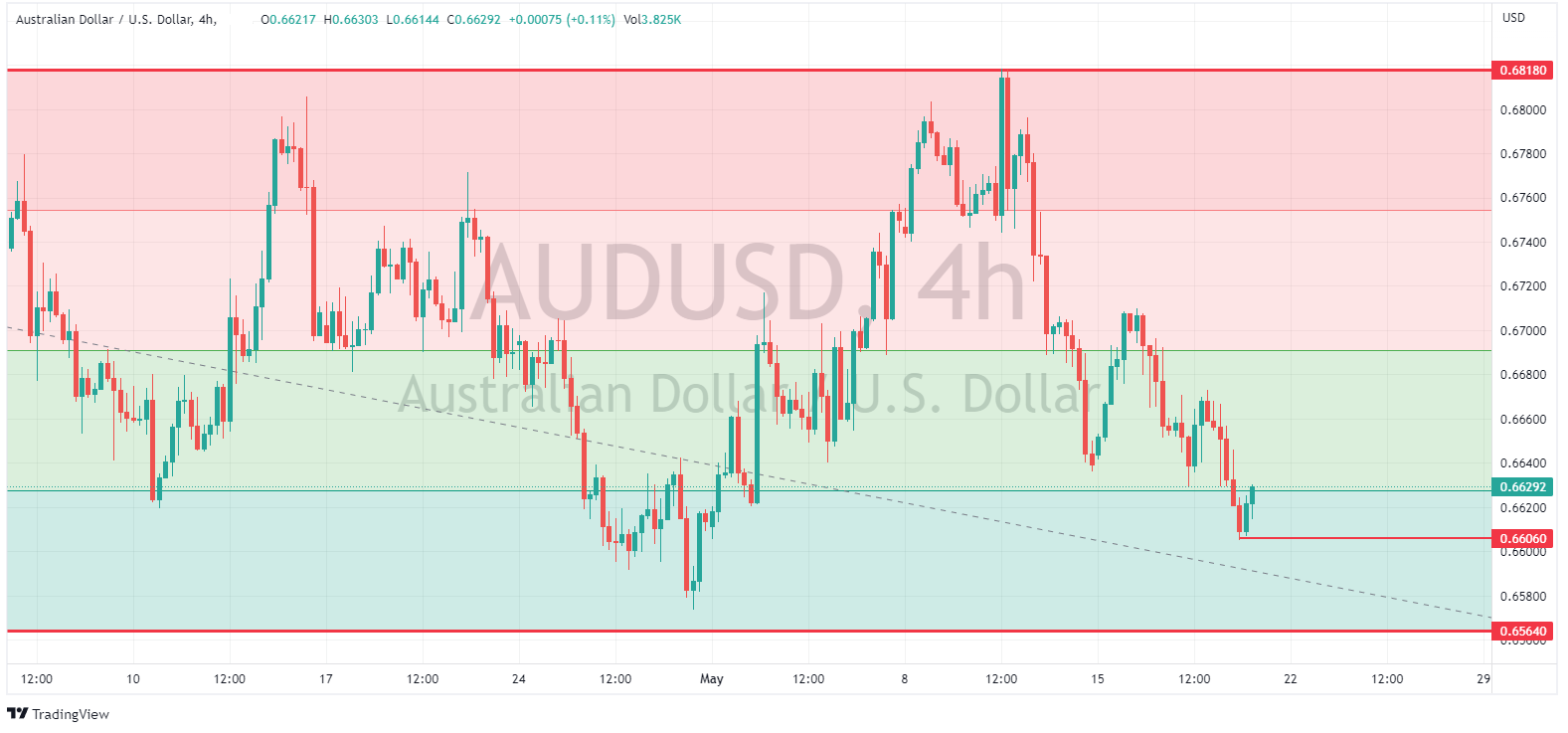

AUD and NZD saw losses against the greenback, with AUD particularly labouring after a weaker-than-expected employment change and rise in unemployment, to see AUD/USD hit a low of 0.6606 before finding some support near the bottom of its recent range.

Commodities

The Gold rout continued Thursday, with XAUUSD again pressured by rising yields, a strong USD and risk appetite returning to the market. XAUUSD crashed through the 1975 support level, not finding any buyers until it tested the April lows at 1952 USD an ounce.

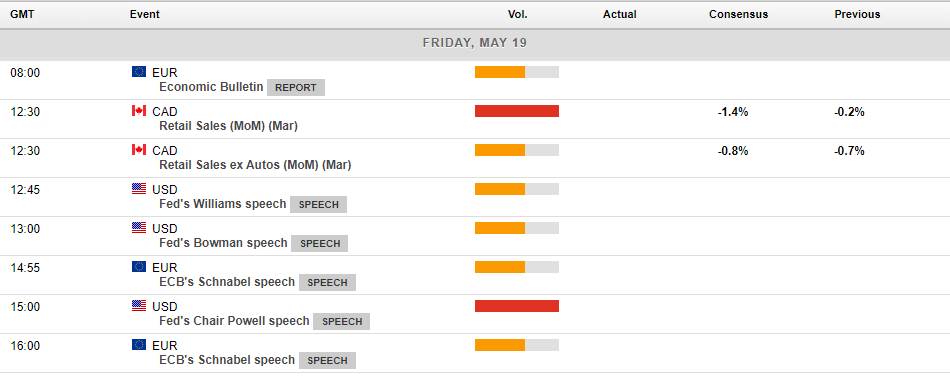

In todays economic calendar there is little in the way of tier 1 releases, but both Fed chair Jerome Powell and a gaggle of ECB head Christine Lagarde are due to speak, with the recent hawkish tone from Fed governors, Jerome Powell’s comments in particular could get the markets moving.

Charts Source : tradingview.com

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

The Week Ahead – RBNZ, UK and US inflation and debt ceiling impasse headline risk events

With Junes FOMC policy meeting still up in the air as far as markets are pricing in, FOMC minutes and US PCE core inflation figures (reportedly the Fed’s favoured measure) released this week will be closely watched and likely go a long way to settling market participants mind as to what the next move from the fed will be. From the UK inflation da...

May 22, 2023Read More >Previous Article

AUD analysis – waiting for a catalyst – range trading and mean reversion opportunities

The Aussie dollar has been fairly directionless since late February with it seemingly waiting for a catalyst to break it’s ranges and take the next ...

May 18, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading