- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- US stocks choppy in a low volatility session ahead of pivotal CPI and FOMC minutes

- Home

- News & Analysis

- Articles

- Featured

- US stocks choppy in a low volatility session ahead of pivotal CPI and FOMC minutes

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks choppy in a low volatility session ahead of pivotal CPI and FOMC minutes

12 April 2023 By Lachlan MeakinUS equities traded in tight ranges in a low volume session as traders remained cautious ahead of Wednesdays pivotal CPI figure out the US, followed by the release of FOMC minutes a few hours later.

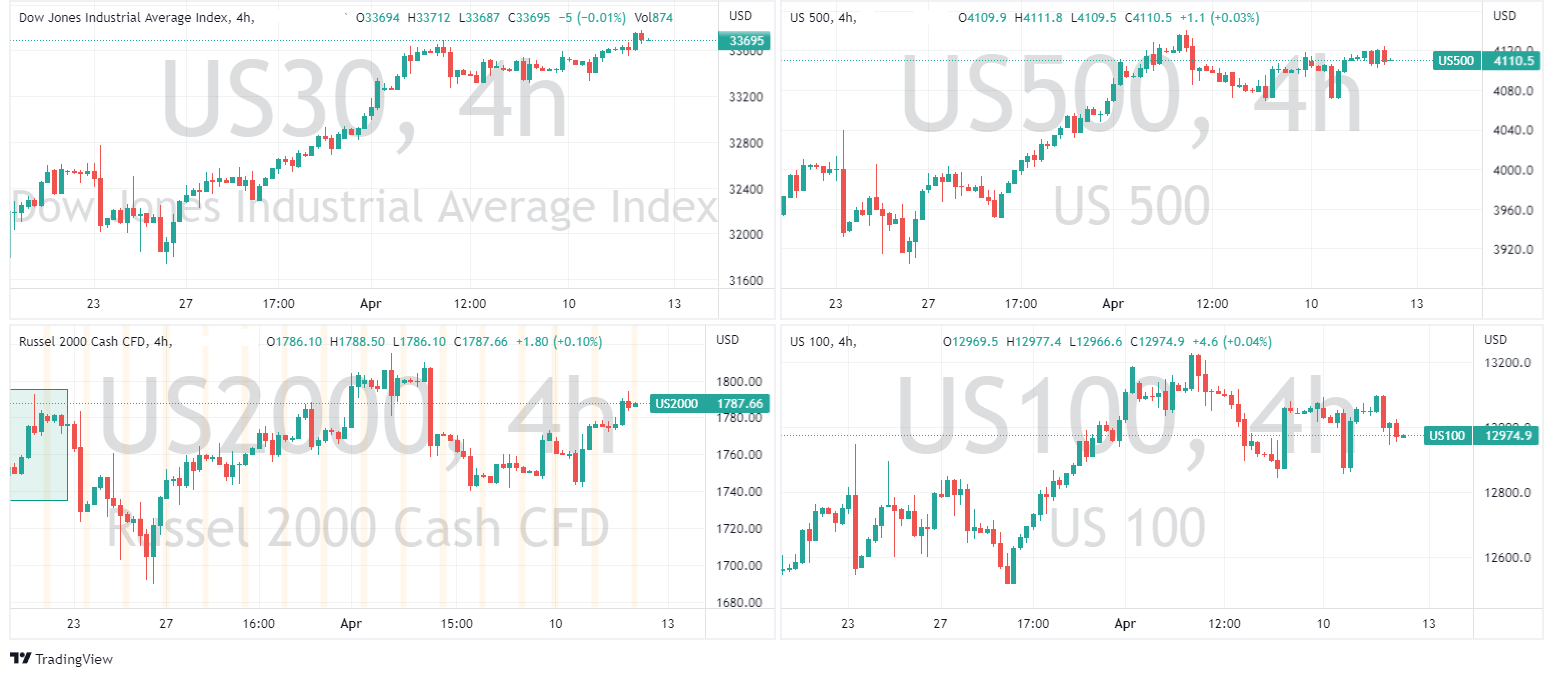

Major indices eventually finished mixed with the defensive Dow and recently battered Russell 2000 finishing in the green, whilst the S&P500 and Nasdaq finished down as Tech stocks underperformed, with selling in cloud titans Microsoft (MSFT), Amazon (AMZN), and Google (GOOGL) after a UBS note saying street estimates for the sector are too high ahead of earnings.

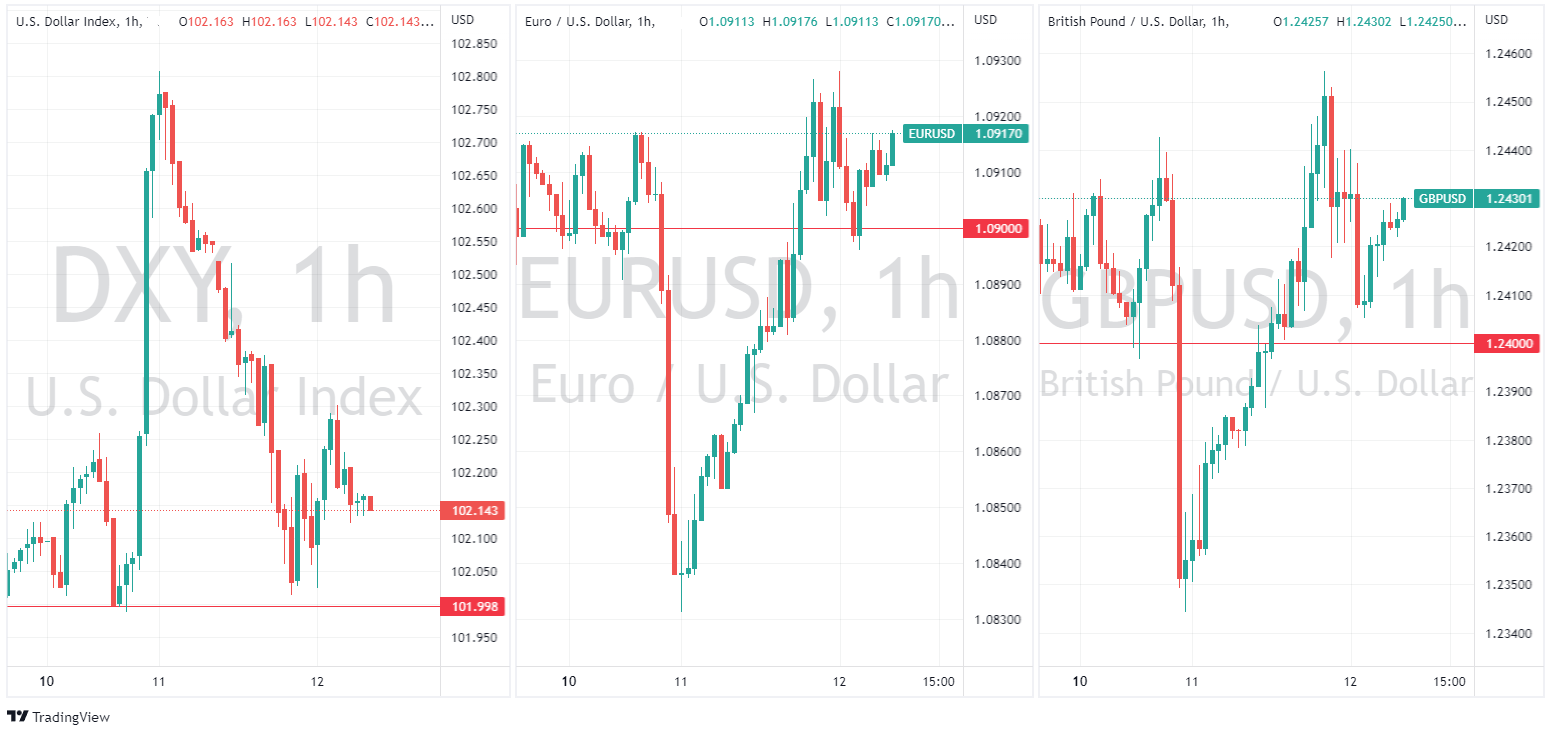

Forex markets saw the USD give back some of its post NFP gains , with the US Dollar Index falling to 102 before finding support and a small late session bounce.

Rising yields in the Eurozone saw the EURUSD regain the psychological 1.09 level and find support there, the GBPUSD had similar price action with the big 1..24 level, moving above and holding it as support.

Anitpodeans saw the AUD outperform, making gains against the Greenback and reclaiming 0.6650 after a strong beat in Australian consumer sentiment and rises in the NAB business confidence data. whilst the NZDUSD dropped below 0.62, AUDNZD surged past the 1.07, again showing that there is good value in this pair under that level.

The Yen also saw losses against the USD as yield differentials again were the main driver, the USDJPY pressing on the upper range and testing resistance at the top of its rising triangle pattern.

The battle of 2000 for Gold continued with XAUUSD regaining and whipsawing around that level as a weaker Dollar gave Gold price support, and rising bond yields caused a headwind for the precious metal. Though attention is starting to be focussed on Silver rising pretty much every day for the past month and seeing the Gold/Silver ratio drop below 80 for the first time since February

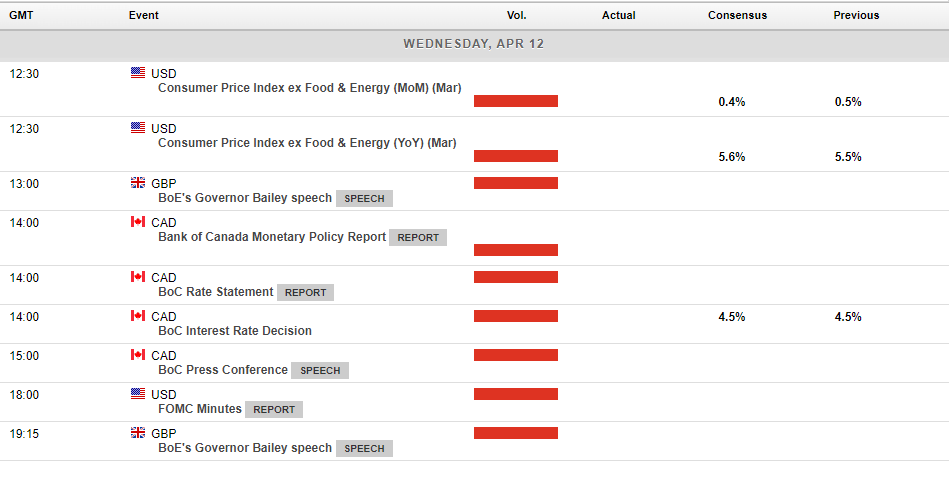

The Economic calendar really ramps up today after a slow start to the week with there not much chance we’re going to get another low volatility day today.

US CPI will start the show, with the markets still split on the result of the May FOMC meeting this figure will be closely watched and should see some nice moves in risk markets. We also have a Bank of Canada interest rate decision, followed by the release of the FOMC meeting minutes from their March meeting as the other main risk events.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

USDCAD Analysis

On the 9th of March 2023, the Bank of Canada (BoC) released its monetary policy decision to keep rates at 4.50%. In the accompanying statement, the BoC indicated that it expected pressures in product and labour markets to ease as inflation growth signaled a slowdown. It also highlighted that while the BoC was assessing the impact of past interest r...

April 12, 2023Read More >Previous Article

Market Analysis 10-14 April 2023

XAUUSD Analysis 10 – 14 April 2023 The gold price outlook is positive in the medium term. As last week's closing of the buying bar was above ...

April 11, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading