- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- US stocks finish flat in choppy low volume session, JP Morgan buys First Republic

- Home

- News & Analysis

- Articles

- Featured

- US stocks finish flat in choppy low volume session, JP Morgan buys First Republic

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks finish flat in choppy low volume session, JP Morgan buys First Republic

2 May 2023 By Lachlan MeakinMajor US indices finished little changed in a lighter than average session with London and Europe closed for the May Day holiday with traders looking ahead to a busy week in Central Bank action.

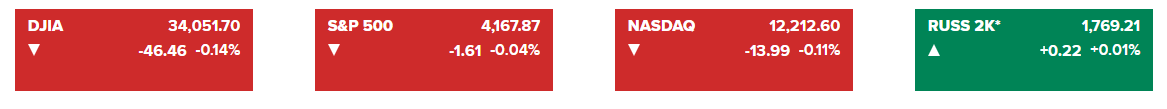

The Dow Jones, S%P 500 and Nasdaq all finished modestly in the red, with the Russell 2000 being the only index to finish positively after a last-minute deal that saw JP Morgan buy distressed regional bank First Republic lifted the mid-size banking sector.

First Republic Bank officially became the second-largest bank failure in US history after FDIC regulators announced that they were to close it and sell-off its USD 93.5bln of deposits and most assets to JPMorgan. The deal also guarantees all depositors cash but looks like equity holders in FRC stocks and bonds will lose out.

FX Markets

With London and Europe closed FX markets were similarly choppy and trading on light volume, the USD was firmer after getting a tailwind from better than expected US Manufacturing figures, especially the prices paid component which jumped to 53.2, well above the expected 49.4, this indicator of sticky inflation saw rate hike odds from the Fed later in the week jump to 93.5% and lifted the Greenback.

The US Dollar index pushing to it’s major April resistance at 101.80 before pulling back modestly.

The Yen was the underperformer with USDJPY pushing to a high of 137.53 late in the session. USDJPY has entered it’s resistance zone which has kept any further upside in check during 2023, the next level to watch will be the psychological 138 level, following on from Friday’s dovish BoJ and this week’s rise in US yields.

AUDUSD was the outperformer to start the week, on what appeared to be positioning ahead of the RBA meeting today as opposed to anything fundamental. While the market is pricing in a 91% chance of a hold, the small chance of a hike and/or a hawkish accompanying statement saw some buying of the Aussie.

Commodities

Gold had a wild ride in Monday’s session, with XAUUSD rallying strongly on the JPM – FRC news to break back above the 2000 USD an ounce level, only to once again be forcefully rejected to finish the session relatively flat.

Crude Oil dipped again, gapping down at Mondays open on weak Chinese manufacturing data released on the weekend, expectations for a Fed hike on Wednesday also weighing on the price.

USOUSD dropped early in the session before finding support at Fridays lows around the 74.55 level.

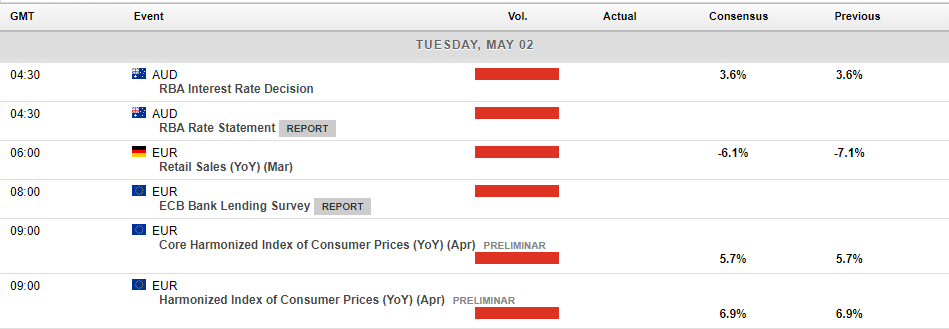

In Today’s economic calendar, the Central Bank action begins, starting with Australia’s RBA rate decision. Markets are almost fully pricing in a second hold in a row from the RBA to keep the cash rate at 3.6%. It’s likely the rate decision itself won’t move markets much, but the accompanying statement certainly has the potential to as traders look for clues as to whether we have hit peak rates or if more may be coming down the track.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

RBA surprises the market hiking 25bp against expectations

The Reserve Bank of Australia rate meeting today was supposed to be a done deal of another hold in rates, with futures markets pricing in an over 90% chance of that being the outcome. The RBA however, showing their determination to get an inflation rate still well outside their target band instead delivered a 25bp hike after last months pause, s...

May 2, 2023Read More >Previous Article

Natural Gas analysis – another bull run coming?

Natural Gas price action has had an amazing two years, with the usually pretty boring commodity showing extreme volatility pushing it to all time high...

May 1, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading