- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- US stocks finish flat on hawkish Fed Speak and mixed data, Netflix has a wild ride on earnings

- Home

- News & Analysis

- Articles

- Featured

- US stocks finish flat on hawkish Fed Speak and mixed data, Netflix has a wild ride on earnings

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS stocks finish flat on hawkish Fed Speak and mixed data, Netflix has a wild ride on earnings

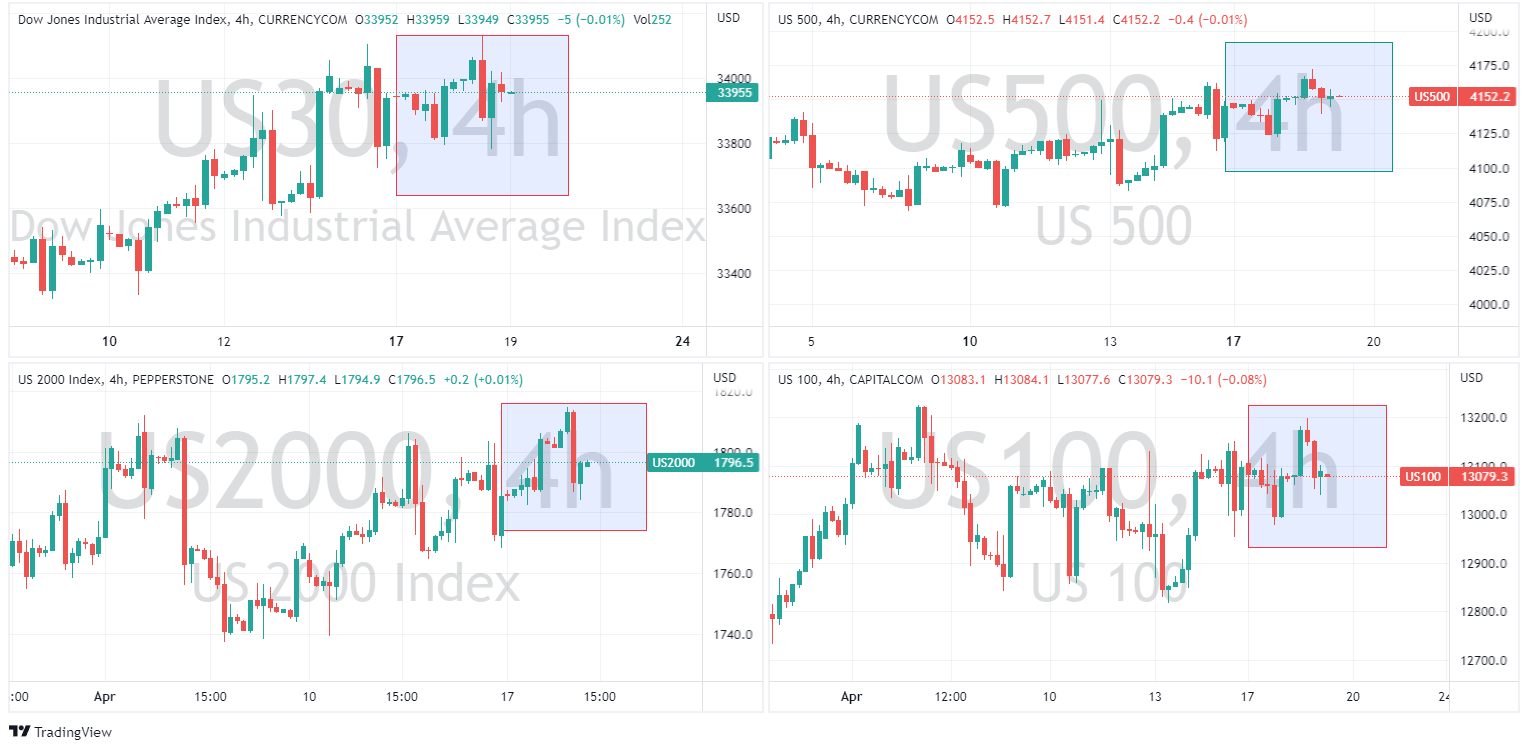

19 April 2023 By Lachlan MeakinTuesday’s session ultimately saw little change in major US indexes in an impressive round trip that initially saw a higher opening as strong Chinese GDP figures cheered investors, only to sell off on Hawkish Fed Speak and mixed earnings results before recovering somewhat to finish (mostly) modestly lower, with only the S&P 500 able to eke out a gain.

Talking of round trips, Netflix (NFLX) stock price dumped and pumped in a wild ride after market hours after reporting earnings. NFLX reported a revenue miss, but a beat on EPS and a surge in free cash flow which saw the initial 10% sell-off quickly retrace fully.

With little on the calendar of importance as far as US data was concerned all eyes were on the group of Fed speakers for clues to the FOMC May meeting result (Markets currently pricing in around an 80% of a 25bp hike).

First up was the Feds Bostic who reiterated that he expects one more rate hike and noted that the economy still has lots of momentum and inflation is too high and the baseline is to hold on rates for “quite a while”. This was followed by Bullard who added that not much clear progress on inflation means rates need to continue to rise. Unsurprisingly, this unabashed hawkishness saw equities take a dive as markets re-priced their Fed rate hike trajectory going forward.

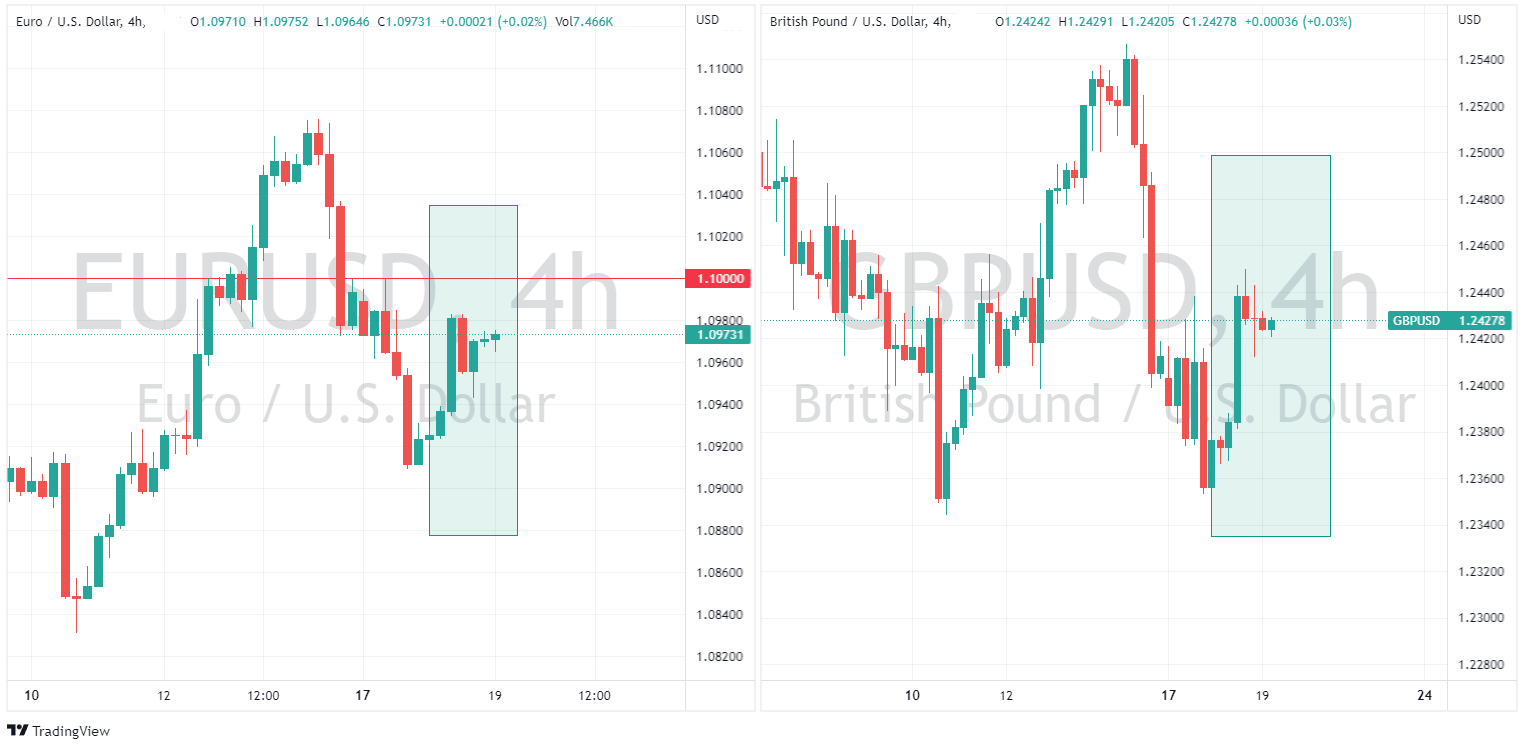

In FX Markets, despite the Fed rhetoric, the USD was weaker on the day. The US Dollar Index found resistance at it’s upper trendline, dipping below 102.

EURUSD benefitted from the weaker dollar again pushing towards the psychological 1.10 level, and also helped from comments from Goldman Sachs which raised its Eurozone terminal rate forecast to 3.75% from 3.50%

GBPUSD was lifted after strong wage data supported hawkish expectations ahead of UK CPI later today.

AUDUSD and NZDUSD also had a strong day on the back of the USD sell-off and further helped by the strong Chinese GDP figure that came out during the Asian session.

Gold also rallied on the day, retaking the 2000 USD an ounce level after a bit of push and shove between the bulls and the bears.

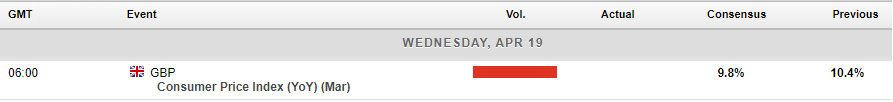

In economic announcements today, the main risk event will be the UK CPI figure. After yesterday’s strong wage growth figure, expectations are to the hawkish side for this one, GBP volatility a big possibility on its release.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Tesla results have arrived

World’s largest automaker, Tesla Inc. (NASDAQ: TSLA), reported Q1 financial results after market close in the US on Wednesday. Elon Musk’s company posted mixed results for the quarter. Let’s take a closer look at how it performed. Company overview Founded: July 1, 2003 Headquarters: Austin, Texas, United States Number of branche...

April 20, 2023Read More >Previous Article

Bank of America beats Wall Street expectations, CEO expects a ”mild recession”

Bank of America Corporation (NYSE: BAC) reported the latest financial results for Q1 on Wednesday, beating analyst expectations for both revenue and e...

April 19, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading