- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Featured

- US Stocks finish mixed in choppy session after Hot UK CPI spooks the markets

- Home

- News & Analysis

- Articles

- Featured

- US Stocks finish mixed in choppy session after Hot UK CPI spooks the markets

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisUS Stocks finish mixed in choppy session after Hot UK CPI spooks the markets

20 April 2023 By Lachlan MeakinMajor US indexes finished mixed in a choppy session for equities and FX after a hotter than expected re-ignited inflation fears and a global hawkish re-pricing of risk assets.

Decent earnings and the big bounce back in Netflix encouraged the “Buy the Dip” crowd, pulling stocks up from their lows to see the major US indexes finish mostly flat for the day, the Dow being the underperformer, down 79.62 points or 0.23%, whilst the Nasdaq eked out a green finish.

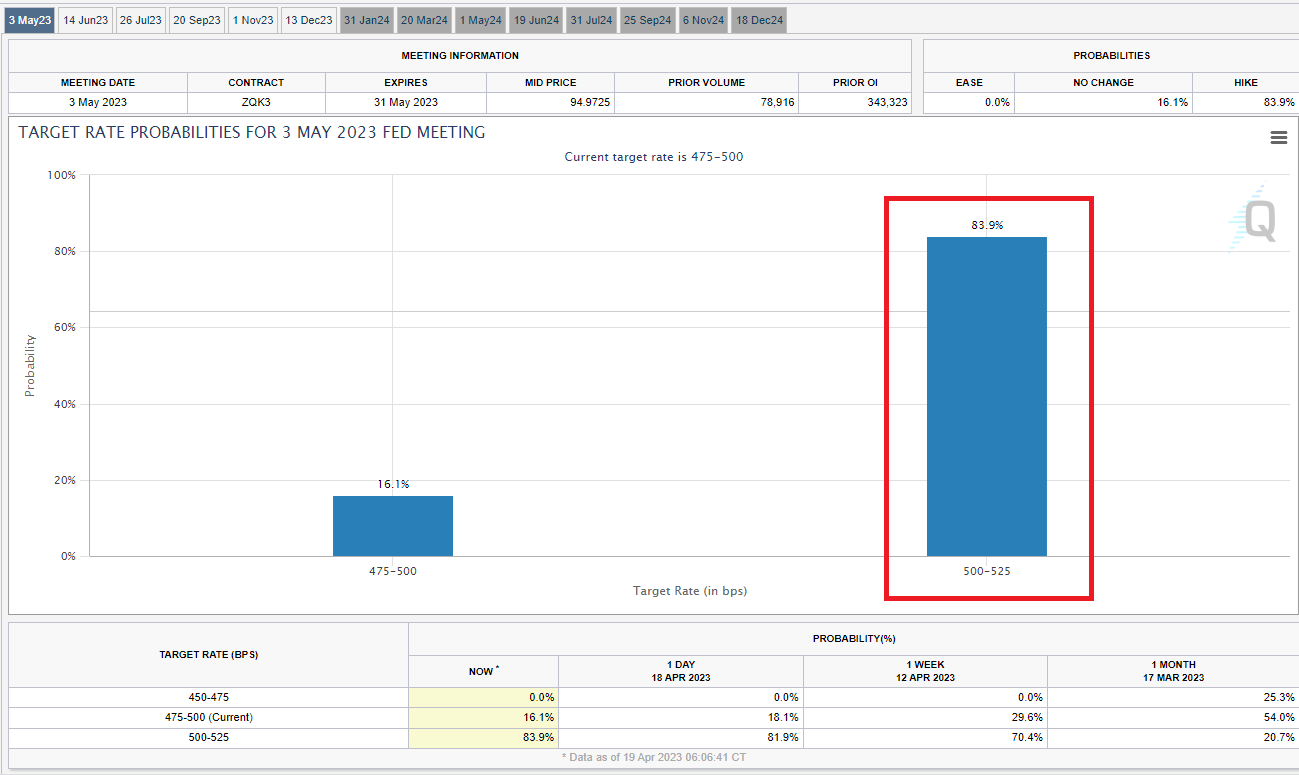

UK inflation figures showed an easing from 10.4% y/y February to 10.1% Y/Y in March, but still well above the expected 9.8% Y/Y that markets had priced in which saw a hawkish move in rates markets for all major Central banks, not just the BoE, Fed Fund odds of a FOMC 25 bp rate hike climbed to 84% as the global inflation story remains stubborn.

One market that didn’t seem to by phased by this hawkish re-pricing was the VIX or “fear Index” which continued the recent volume sell-off, hitting its lowest level since 2021. The VIX is a measure of the Put/Call ratio, a lower level means less investors buying Puts (downside protection) showing that even against the sticky inflation, a lot of investors (rightly or wrongly) remain optimistic on equities.

FX Markets

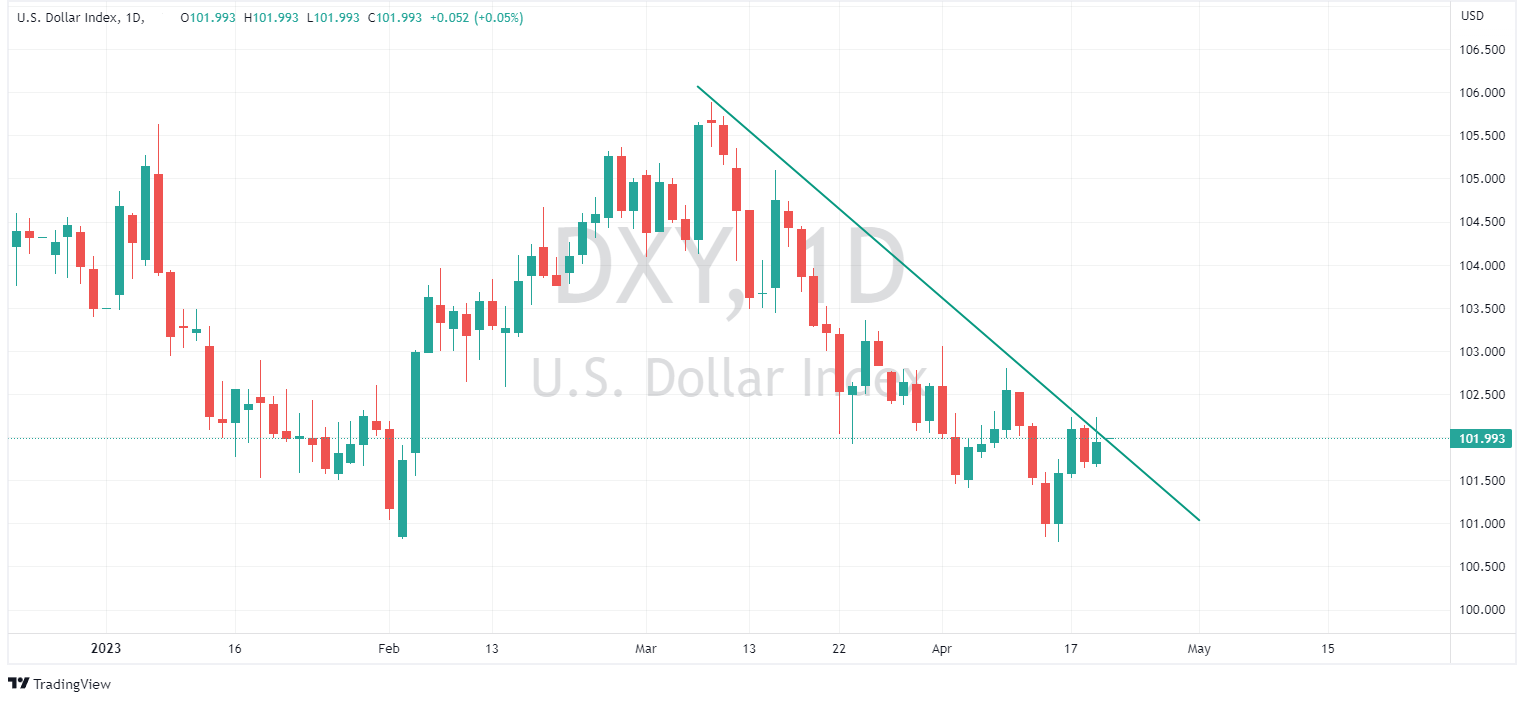

FX Markets, like equities, had a choppy session on Wednesday, with the US Dollar mostly stronger , supported by a hawkish re-pricing of the Feds rate hike trajectory, with any rate cuts from the Fed later in the year now being unlikely according to the futures market. This saw the US dollar index poke above 1.02 before finding resistance at its upper trend line and pulling back.

EURUSD was marginally lower Wednesday with trading either side of 1.0950, while GBPUSD was the outperformer after the hot UK CPI figure, managing to hold post CPI gains against the USD in a choppy session as UK Bond markets are now pricing in a 99% probability for a 25bp hike in May.

Commodities

Crude Oil continued to dip, trading back to the low end of the range it formed after the Surprise OPEC+ cuts a few weeks ago amid 4yr high Russian exports and hawkish central bank pricing.

Gold Dipped below the 2000 USD an ounce level on a stronger USD and higher yields, but did find some serious buying at the 1970 support area, recouping most of its losses.

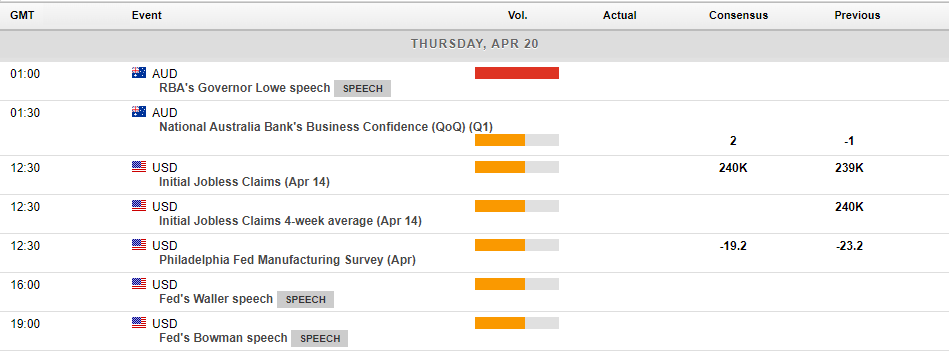

In todays economic announcements, RBA governor Lowe will be speaking at Midday AEST, after the this weeks RBA minutes , which were seen as hawkish, this is one to watch for AUD traders.

Also later, US unemployment claims for the week will be released which will give another indicator of the strength (or not) of the US labour market and by extension the US economy.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Economy #Economics #Finance #MarketsNext Article

Gold technical and fundamental analysis – How to trade it’s recent price action

Gold has been one of the most popular and highly traded markets recently as price action in the precious metal has really come alive, rate hikes, the war in Ukraine and Bank Crises have all played a part in the fundamental reasons for gold price movements in the last 12 months. Let’s take a look at the chart to see these fundamental effects and h...

April 20, 2023Read More >Previous Article

Tesla results have arrived

World’s largest automaker, Tesla Inc. (NASDAQ: TSLA), reported Q1 financial results after market close in the US on Wednesday. Elon Musk’s company...

April 20, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading