- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- AUD hits $0.71 for first time since August 2022

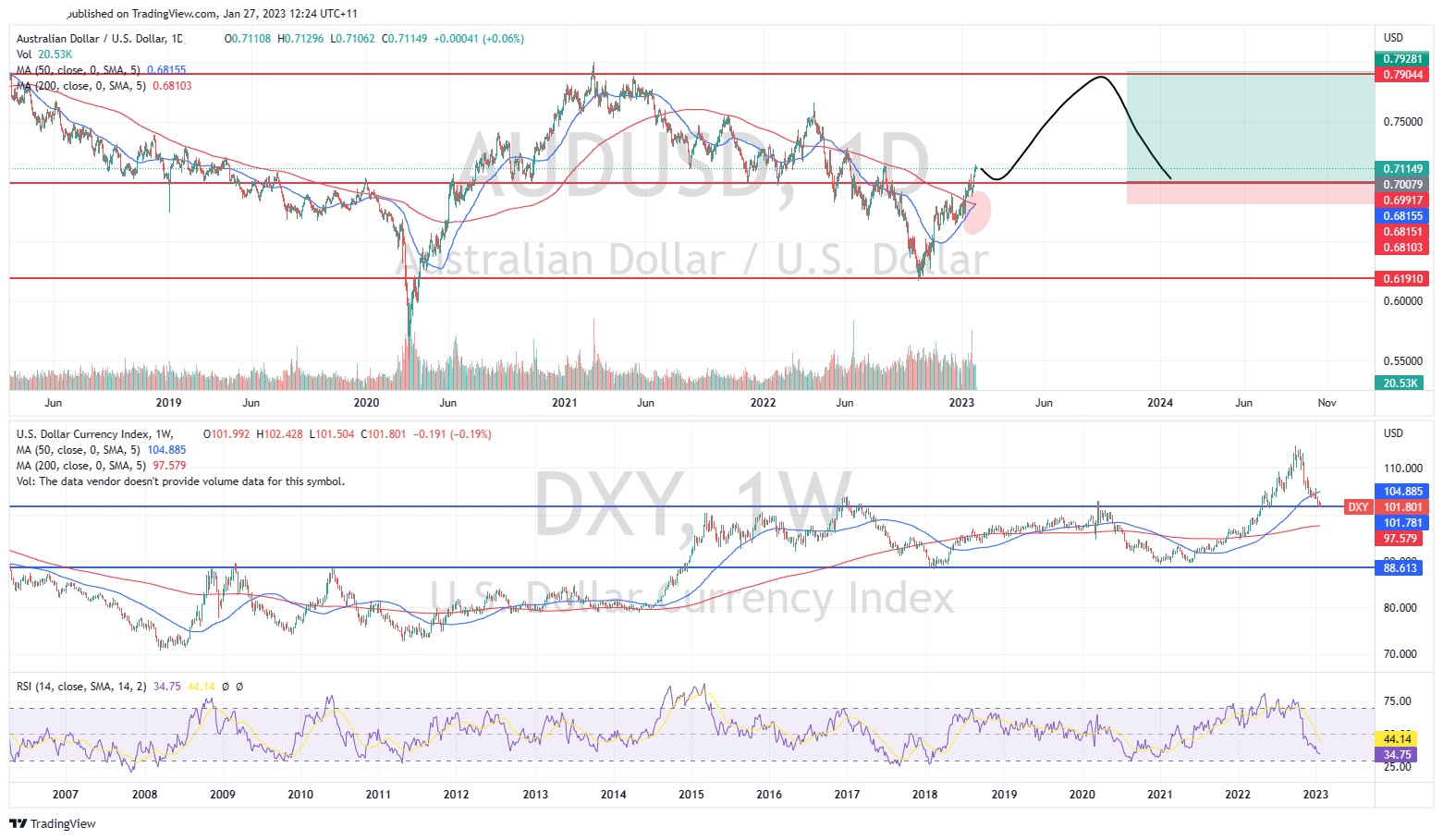

News & AnalysisThe Australian dollar has continued its rise against the USD reaching the highest level in almost 3 months. With risk on assets receiving a boost and the USD weakening the Australian dollar has been a big beneficiary. As hopes for a Federal Reserve pivot increase the greenback has seen aa pullback and growth assets have seen an influx of money. With the FOMC meeting scheduled for next week the decision by the Federal Reserve and its accompanying statement may provide more of a direction for the next movement of the USD.

Since its peak in September 2022, the DXY has seen a retracement of nearly 12%. Since that time the DXY has fallen back to its major support level at 101. At this stage it has been unable to break down through this point. However, if it does, it will likely fall back into its long-term range which it sustained for more than 5 years. This range is between 88 – 100. This overall drop in the DXY may support a move in the AUD to top of its own channel.

More specifically, the AUDUSD chart shows that the price has broken back into its own long-term range of which it has sustained for 7 years, excluding the outbreak of the Covid pandemic. The price is also about to perform a golden cross in which the short term 50 day moving average will crossover the 200-day moving average which is a very bullish signal. The price may still retest the lower bounds of the long term of the range at 0.70 again, before potentially climbing higher. A potential trade long trade on the AUDUSD may originate with an upside of almost 5:1 risk reward.

Ultimately, the direction of AUDUSD will largely be dictated by the sentiment surrounding growth assets and the USD. However, in the short term the price of action of the AUD is positive and bullish.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Week Ahead :FOMC meeting looms as next major catalyst

All eyes will be on the Federal Reserve this week as they meet again to decide on the next set of interest rate hikes. The Fed is expected to raise rates by 25 bps with the accompanying statement providing important insight as to their sentiment going forward. The question to be answered will be whether a recession will be avoided, or inflation is ...

January 30, 2023Read More >Previous Article

Mastercard Q4 results announced

Mastercard Inc. (NYSE: MA) announced the latest financial results for the previous quarter before the market open on Thursday. World’s third larg...

January 27, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading