- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- AUDNZD falls from the top of its range

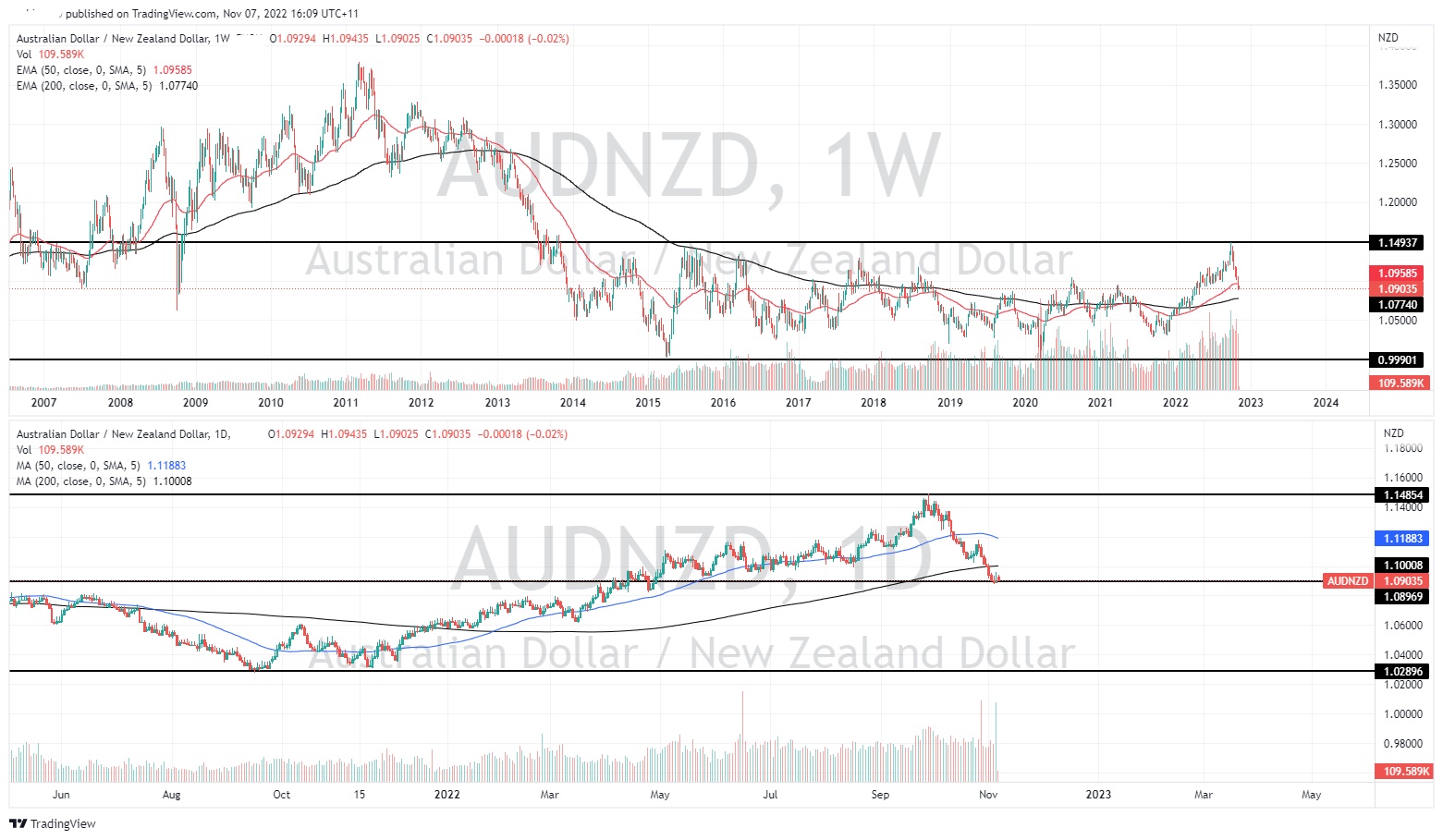

News & AnalysisThe AUDNZD pair has seen a large drop in the last few weeks and months as the Reserve Bank of Australia has brought about softer interest rate changes then compared to many other countries. Most other countries have dealt with inflation by raising interest rates aggressively. However, the AUD has been the victim of the RBA’s softer stance. The last two interest rate rises have only been 25 bps hikes which is less aggressive than England and the USA where both increased rates by 75 basis point it has weakened the Australian dollar.

Technical Analysis

The AUDNZD has been in a long-term range between 1.00 and 1.15 since 2015. As it can be seen on the weekly chart, the pair has fallen from the top of its range which it reached in early October. Since then, the price has fallen 5.37%. Both Australia and New Zealand are very similar geographical, political, and how they react to macroeconomic events. Therefore, the currencies are quite similar in how they are seen and act.

When assets trade in this range pattern, they often revert to the mean. This means they move back to some long-term average. On the weekly chart the price has fallen all the way back to the 50-week moving average which is an important support level. It is almost right in the middle of the long-term range which can be seen as a long-term average. The chart is quite choppy and can make for difficult trading. Although, due to the aggressiveness of the selloff it may indicate either a short-term bounce is imminent or a longer-term reversal may occur, if the price approaches 1.00.

Ultimately both currencies are risk on currencies and whilst they tend to move quite closely, the softer approach to interest rate hikes that the RBA has taken so far has seen it perform worse than the NZD. If the RBA decides to become more aggressive with their rate hikes, the price may move back towards the top of the range.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The Week Ahead – US Mid-terms set stage for another volatile week

Another week done, another roller coaster for equity and risk markets as the bulls and the bears battled to take control of the narrative in a data rich week. Markets pumped on what was taken initially as a dovish FOMC statement, only to dump as Fed chair Jerome Powell threw cold water on that idea during his presser, then pumped again on Friday...

November 7, 2022Read More >Previous Article

US mid terms loom as a potential catalyst for equities.

The US midterm elections are coming up next week on 8 November and have the potential to have a big say on the direction and volatility of the US and ...

November 4, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading