- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Forex

- BoJ Governor Ueda’s first monetary policy meeting

- Home

- News & Analysis

- Articles

- Forex

- BoJ Governor Ueda’s first monetary policy meeting

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Bank of Japan is due to hold its first monetary policy meeting under new Governor Ueda on the 29th of April 2023. Since his appointment, Governor Ueda has frequently indicated that the BoJ will continue with its current easing stance on monetary policy with targets for long and short-term interest rates. Although headline and core inflation runs above 3% and the 10Y JGB yields have again climbed close to the ceiling at 0.50%, it is unlikely that Gov Ueda would introduce a widening of the Yield Curve Control (YCC) at this meeting.

However, while a lack of action from the BoJ is widely expected, this could still result in a further weakening of the Japanese Yen across the board.

The USDJPY currently trades along the 134 price level, with the upside capped by the 135 resistance level which coincides with the 61.8% Fibonacci retracement level from the longer term. A weakening of the Yen could see the USDJPY break above the resistance level and climb higher toward the next key resistance level at 138. This potential move higher is also signaled by the cross-over on the MACD indicator.

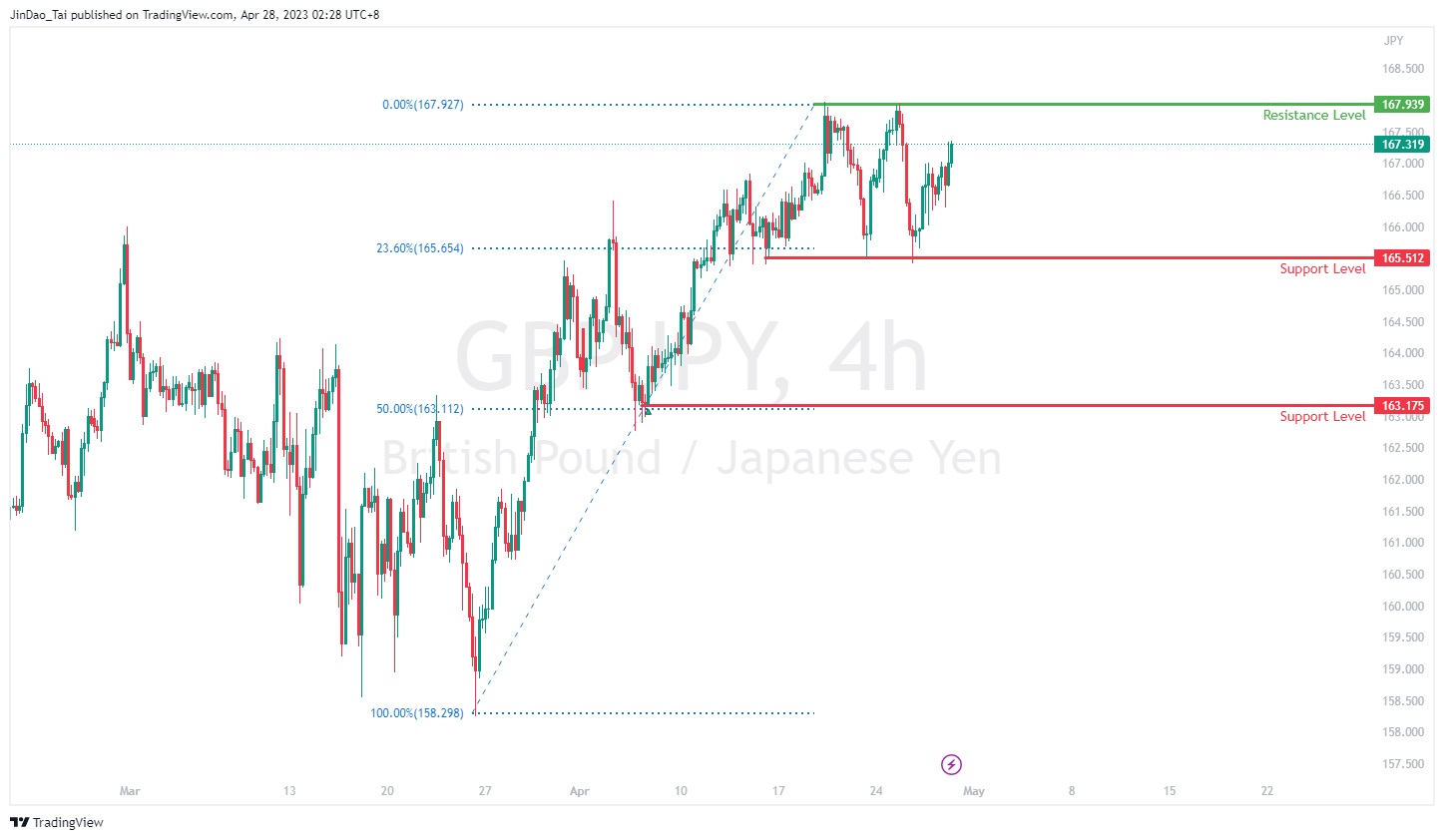

Alternatively, if the BoJ surprises markets by announcing a widening of the YCC or an adjustment to the current monetary policy, this could result in a sharp strengthening of the Japanese Yen. In this scenario, the GBPJPY could reverse strongly from the resistance area of 168 to trade significantly to the downside toward the immediate support level at 165.50 which aligns with the 23.6% Fibonacci retracement level.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

Why Trade Gold with GO Markets?

Gold has always been one of the most popular and highly traded markets for CFD traders, especially recently as its price has risen to test its all-time highs. It’s easy to see why, Gold has been a store of value throughout history and now with institutional grade spreads and zero commission there has never been a better time for GO Markets client...

May 1, 2023Read More >Previous Article

Asian session looking to open up after Wall St rallies on strong earnings and data releases – tech leads after Meta beats

US stock indices rallied as risk appetite returned as banking fears seemed to take back seat and strong tech earnings saw the bulls in charge. The Dow...

April 28, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading