- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- EURGBP – Sterling Applying The Pressure

News & Analysis

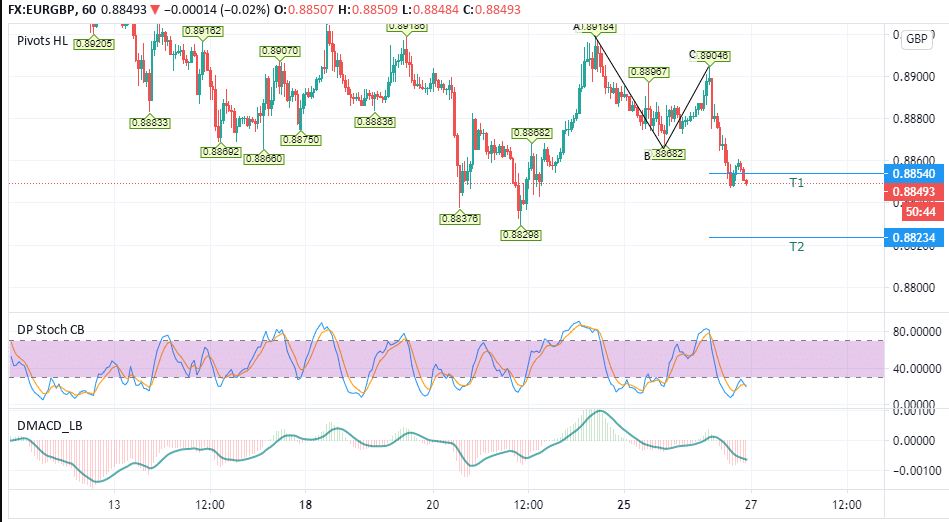

EURGBP – Hourly

Since the 12th of January, we’ve seen much choppy price action in the EURGBP cross, with Pound Sterling applying the more significant selling pressure. This shorter-term bearish bias is what we’ll be looking at in today’s Chart of The Day using the hourly time frame.

Firstly, we can see the initial DiNapoli target of 0.8854 or (T1) has already been achieved early today during the London session. The second target of 0.8823 (T2) is still active. Note both potential targets were calculated using the price points labelled (A),(B), and (C), respectively.

Next, we can see a divergence between the fast stochastic indicator and the MACD shown. While the stochastic just provided a buy signal, the MACD remains considerably bearish. Based on this data and the general view that the Pound is gaining strength, I suspect we may see a slight bounce around the current levels of 0.8851, mainly as it’s acted as support recently before the pair falls to lower levels.

To the upside, the recent high around 0.89 looks to be the central area of resistance for the time being. Of course, anything is possible in these Covid-19 times, especially with negative talks brewing across Europe over vaccine distribution. Still, GBP appears to be riding the choppiness more favorably at this stage.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

See-sawing equity markets, US Dollar strength and stimulus hopes

Equity markets Global markets see-sawed from record highs to steep declines in an eventful month that saw a new US administration sworn in, promises of record US stimulus and the FOMC spoiling the party somewhat. Global equities Major Indices in the US and Europe saw record highs this month on hopes of fresh stimulus from the US and signs of glo...

January 29, 2021Read More >Previous Article

Stimulus euphoria leads to all time highs, a new US administration and Bitcoin bust

We had an eventful week on global markets with the inauguration of a new US administration and a dovish stance from the European Central bank fuelli...

January 22, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading