- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- Emerging Markets and a Hawkish Fed

News & AnalysisIn 2018, we have seen a growing interest in the Emerging Markets (EM) as a lot of advisers or asset allocators have been upbeat about these markets. The emerging countries are improving on different factors such as stability of employment, growth in money or opportunity for innovation which make the overall outlook for EM promising.

However, the enthusiasm might have faltered over a broad rally in the US dollar and the strength in the US economy. Along with the resurgence of the US dollar which have caught investors off-guard, the EM are currently being underpinned by trade tensions and policy uncertainties.

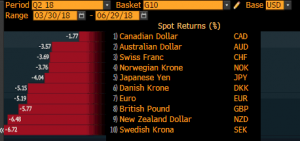

As the monetary tightening takes hold in the US, stocks in many emerging markets plunged and the dollar appreciated against major emerging currencies. The sudden shift in the second quarter in 2018 compared to 2017 Q4 shows that the US dollar has made an impressive comeback and appreciated against major EM and G0 currencies.

Quarter 4, 2017

Quarter 2, 2018

Even though the markets are navigating through various challenges: trade tensions, geopolitical upheaval and US sanctions, monetary policy remains the major factor for investors to monitor when looking for opportunities in the EM economies. The policy divergence between US and other central banks are the catalyst behind the strength of the US Dollar.A more aggressive Fed could have a magnifying effect on the EM economies and their respective currencies.

The Chinese Yuan and Turkish Lira continue to slide over the ongoing tensions with the US and a hawkish Fed. The Mexican Peso has also been under pressure but has recently found some relief over the renewed optimism around NAFTA.

USDCNH, USDTRY, USDZAR and USDMXN (Daily chart)

Source: GO Markets MT4

Similarly, in the equity markets, the slump in Chinese equities over trade concerns are weighing on the EM indices. Trade tensions are indeed a matter of concern but it might not necessarily be bad for growth as global supply chains might eventually adjust.

In the short-term, the Emerging Markets might remain volatile but the question is that investors need to ponder on whether the current situation is an opportunity.

Does this situation represent a good entry point for long-term traders??

Despite the fact that many EM are trapped by political instability, they have potential to grow even faster than the developed countries and has wealth in the form of oil or other commodities. Moreover, some emerging countries are engaged in key structural reforms that will likely boost business confidence and encourage stronger investment and consumption.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Venezuela – The New Zimbabwe?

Venezuela: A Latin American Crisis Venezuela’s economy has been in turmoil in recent times with its inflation skyrocketing and with no signs of slowing down, the situation may worsen. The political tensions have also been rising in one of the OPEC (Organization of the Petroleum Exporting Countries) member country whose economy has been slowly de...

August 8, 2018Read More >Previous Article

Lacklustre Gold Weighing Heavy On Markets

Free-falling gold prices The latest weekly chart for gold does not look favourable for the precious metal. Below we can see that in twelve of the past...

August 7, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading