- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- EUR looking Bullish

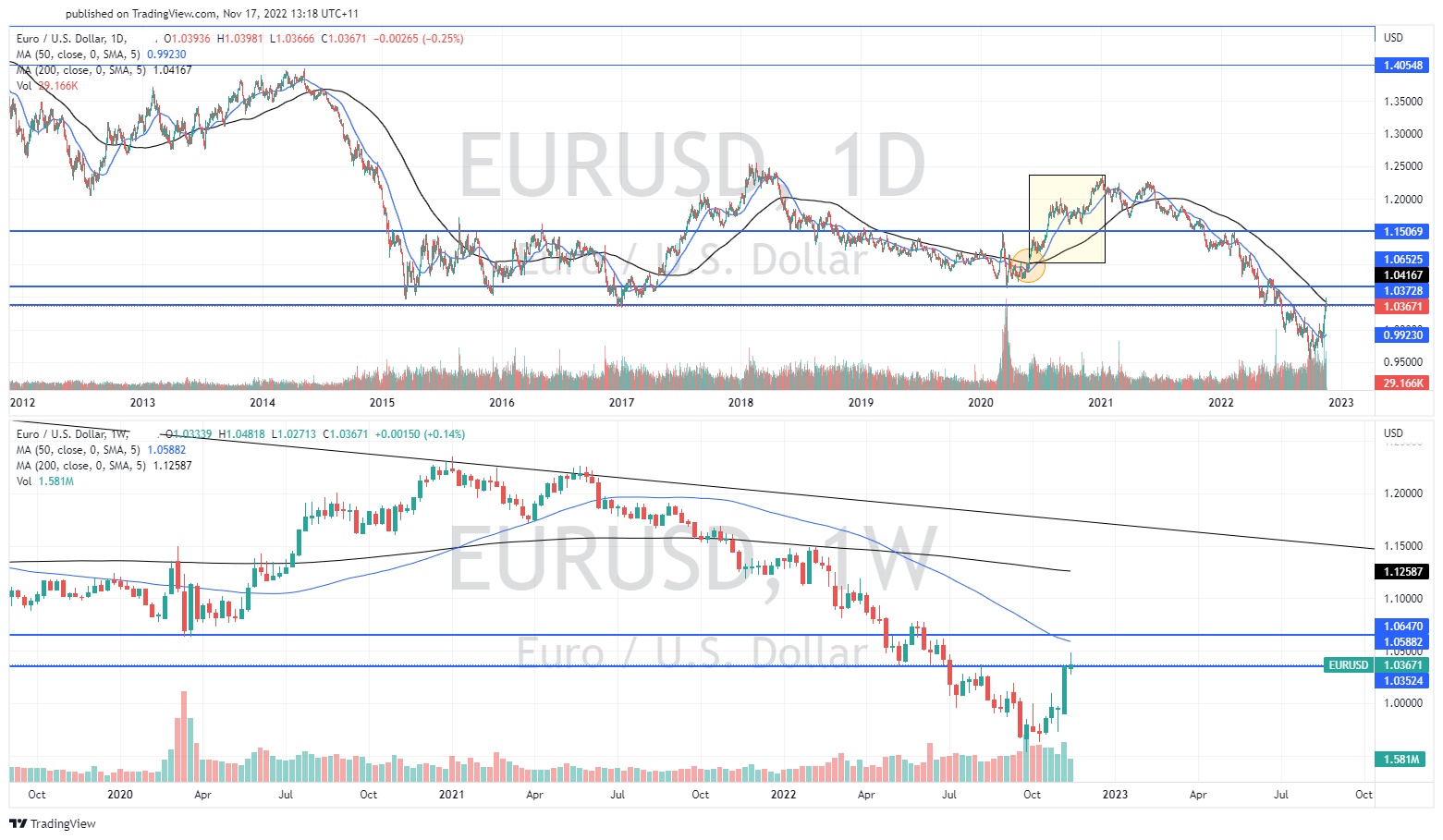

News & AnalysisThe EUR has been on a ‘recovery rally’ since it fell below parity level with USD earlier this year. With inflationary pressures potentially easing across the world the USD has finally taken a breath. The currency which has been haven for many market participants in dealing with the high volatility finally saw a dip after weaker than expected US CPI figures last week. Since this time the USD Index or DXY has fallen by nearly 4.5% which is a significant drop. This has had an overall positive impact on currencies that were struggling such as the AUD, JPY and of course the EUR.

Whilst the EUR has provided a positive move in recent weeks and days there is still some geopolitical concerns especially with the news of a missile killing two citizens in Poland earlier this week.

Technical Analysis

The weekly chart shows that price is currently testing a long terms resistance level at 1.0352. This level acted as support for almost 7 years prior to being broken and therefore has become a significant level. In addition, the price is also fighting against the 50-week moving average which is at 1.0588. The 50 week moving averages is also a short-term long target for long trades.

Looking more closely at the daily chart, the price is showing an important signal that it has not done since May 2020. The price is testing the 200-day moving average. If it can break through it may represent a bullish signal. The last time the price broke through this level it managed to go from 1.10 to 1.23. This time around, the currency pair is having to fight inflationary pressures which may create a headwind. The price action is still showing a potential price target of 1.06 in the near term and if it can break through the 200-day moving average and a longer-term target of 1.15.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The latest Alibaba results are here – the stock is rising

Alibaba Group Holding Limited (NYSE: BABA, HKEX: 9988) announced the latest financial results on Thursday. The Chinese e-commerce giant reported revenue of $29.124 billion (up by 3% year-over-year), falling slightly short of $29.288 billion expected. Earnings per share topped analyst estimates for the quarter at $1.816 per share (an increase ...

November 18, 2022Read More >Previous Article

Australian employment figures beat forecast – Rates markets and AUD reaction

Australian October employment figures released at 11:30 AEDST handily beat expectations with 32.2k jobs added for the month (15k expected), the unempl...

November 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading