- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- EURUSD, GBPUSD and AUDUSD Forecasts

News & AnalysisAll three pairs had a volatile year. Trade and geopolitical tensions have put significant bearish pressures on those pairs. EURUSD, GBPUSD and AUDUSD have seen new lows in 2018, and if the negative environment persists, we might see fresh lows.

EURUSD

Fundamental Analysis

The EURUSD pair was able to find some support on Brexit news and some positive data last week. This week, eyes will move to the ECB interest rate decision. The ECB failed to provide a bullish picture for the EUR pairs over the months, and it will be interesting to see if there is any upgrade or downgrade to the level of dovishness. Policy divergence between US and ECB will remain a significant driver for the pair.

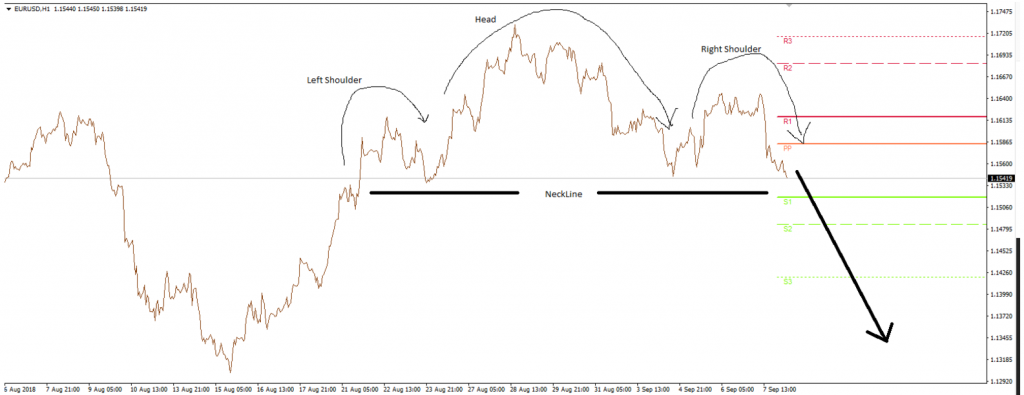

Technical Analysis

We can see that the pair has formed a head and shoulders pattern. A substantial break below the neckline level could bring in sellers. The take profit level will probably be set above the support level.

Overall, a crisis in the emerging markets, a dovish ECB compared to a hawkish Fed, subdued data, trade uncertainties, Brexit jitters and political issues within the Eurozone area is painting a bearish outlook for the pair.

GBPUSD

Fundamental Analysis

Sterling traders found renewed confidence over the positive Brexit news. Now that the main downside risk appears to take a back seat at least in the short-term, investors might begin to concentrate on the fundamentals. Notable data releases – GDP, Manufacturing & Industrial Production, Jobs Report and Rate decision, might help the pair to test the 1.30 level. However, any gains might be short-lived due to the strength of the US dollar.

Technical Analysis

The pair is currently trading in a descending trend line and has potential to slide further. Any upbeat data might face some resistance at the 1.30 level.

There are still no concrete Brexit negotiations, and until there are important agreements, the pair will likely stay gripped by Brexit headlines. Adding to this uncertainty is the trade worries that are clouding the pair as the greenback isbeing favoured.

AUDUSD

Fundamental Analysis

This pair appeared to be the victim of the US-Sino trade war. The pair has been in a bearish channel since the beginning of the year and plummeted to more than a 2- year low. Upbeat data managed to provide momentary support to the pair last week. Amid a few data releases this week, the employment reports will be the highlight of the week. Even if there is an uptick in the data, any upside lift will likely be temporary.

Technical Analysis

Key support levels were broken, and the pair dropped to multiple months low. Since the beginning of the year, the pair encountered 1000 pips fall. Using the Ichimoku, we can see that the pair is trading below the cloud. The thin cloud indicates indecision and potentially, a weakening downtrend. However, the RSI is also bearishly configured suggesting more downward pressure for the pair.

It is unlikely that the trade situation will change by the US mid-term elections in November. A dovish RBA coupled with other negative pressures will likely continue to weigh on the pair.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Bank of England Rate Decision – Preview

All the talk about whether Mark Carney will leave the Bank of England in 2019 or not has ended, the current Bank of England governor has extended his stay at the central bank until January 2020 as Chancellor Philip Hammond announced it on Tuesday. So it is now time to focus on the upcoming Bank of England rate decision at on Thursday. Who Decide...

September 12, 2018Read More >Previous Article

Sweden – First Cashless Society?

When it comes to talking about countries becoming cashless, Sweden appears to be at the forefront of people's minds as the leading contender to achi...

September 7, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading