- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- Is the AUDUSD ready to reverse?

News & AnalysisRecent History

The USD has been on a tear in recent months as volatile market conditions have sent the currency rocketing. Inflationary pressures and recession fears have seen investors turn to the USD whilst at the same time taking off risk from the AUD. The AUD’s drop has also been further is largely due to a decrease in the price of commodities such as Iron Ore, Brent Crude, Wheat, and other key resources that rive much of the Australian economy. In addition, the AUD is seen as a risk currency. This means that the currency performs well when the economy is growing and the market is bullish and conversely suffers during times of volatility and slowed growth. There has been some positive price action to indicate that a reversal in the AUDUSD may be imminent.

Technical Analysis

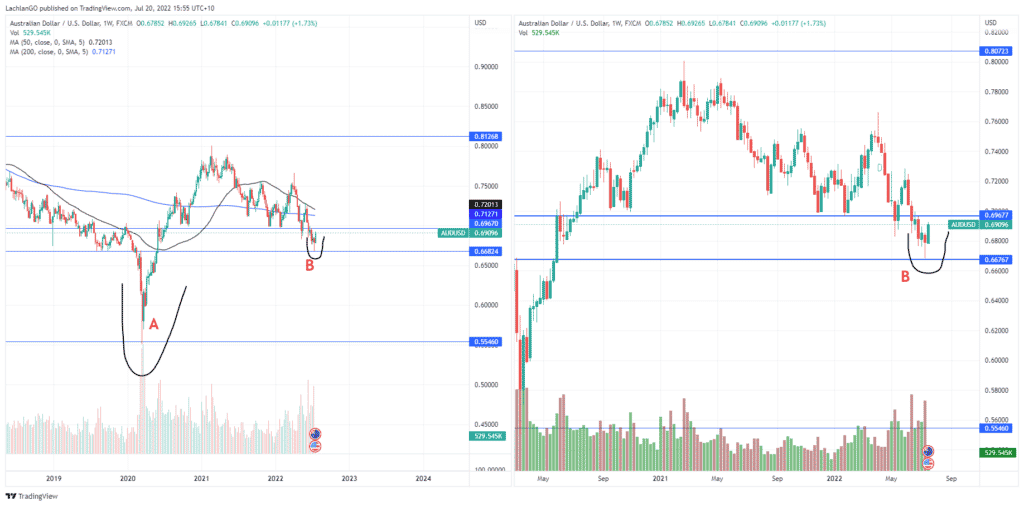

From a long-term perspective, the weekly chart shows that going back since 2015 the AUDUSD has been trading in a relatively stable range between approximately $0.6680 and $0.8126. The one exception to this was the onset of the Covid-19 pandemic which acted as a ‘Black Swan’ type of event towards the pair and the wider market, (A). This caused a mass panic and a subsequent sell off the AUDUSD. Once the initial panic began to subside the pair recovered and was able to recover back into the range. It is interesting to note that over the last few years the pair has reverted to its 50-week moving average, after aggressive moves in either direction. In recent weeks, a reversal does appear to be emerging. The candlesticks also support this by showing a red hammer candle followed by a relatively strong green candle indicating potential exhaustion, (B).

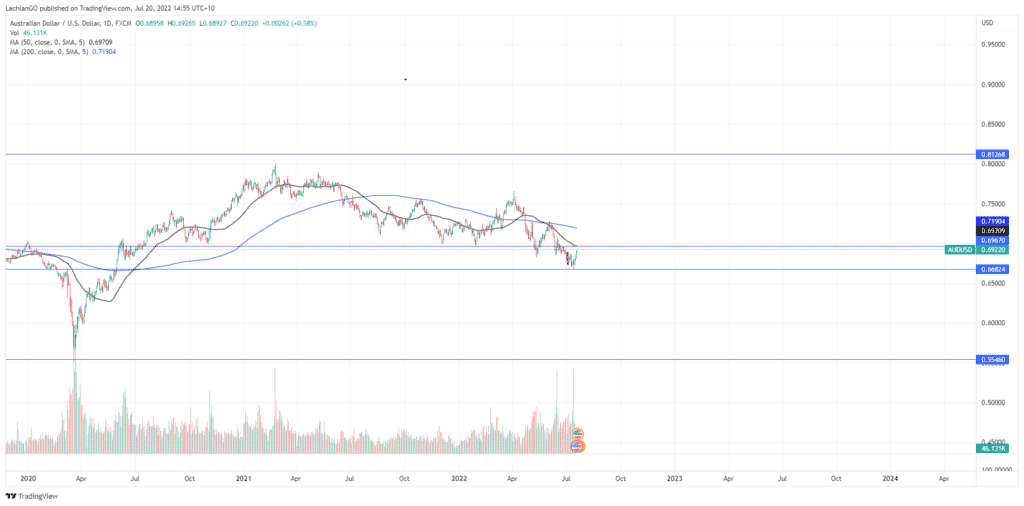

Looking closely at the daily chart can provide a few more targets in terms of potential price targets. The next most reasonable price target could be the 50-day moving average which is also doubles as the next level of resistance at $0.6970. If the price is able to break through this point, then it may go further target the 200 Day average of $0.7190. However, it will likely have to soak up a fair amount of selling pressure.

Ultimately the strength of this pair will largely depend on how accurately the market is pricing in inflation and a recession. If the selloff in equities has maxed out, then it may positively effect the direction of the AUDUSD. However, if there is more pain to come then the pair may sell further down.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Philip Morris exceeds Q2 expectations – the stock gains

Philip Morris International Inc. (PM) reported its second quarter financial results before the market open on Wall Street on Thursday. World's largest tobacco company reported revenue of $7.832 billion in Q2 vs. $6.711 billion expected. Earnings per share reported at $1.48 per share, also beating analyst estimate of $1.25 per share. "First...

July 22, 2022Read More >Previous Article

Tesla delivers in Q2

Tesla Inc. (TSLA) announced its latest financial results after the market close on Wall Street on Wednesday. World’s largest automaker reported s...

July 21, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading