- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- Yen well placed ahead of Bank of Japan meeting

News & AnalysisThe Bank of Japan is set to release its rate decision and policy statement later today in what could shape as an important catalyst for the JPY. The JPY will likely see some increased volatility in the lead up to and as the BOJ announces its rate decision.

There is no clear consensus on what the BOJ will do but it ranges from the Bank holding the status Quo, expanding its intervention bands again from -0.5 and 0.5 wider or even scrapping the process altogether. When the Bank extended its intervention bands from -0.25-0.25 to -0.5-0.5 it was largely seen as a hawkish move, akin to raising interest rates. This brought some much-needed momentum to a ravaged JPY. However, even since this intervention the BOJ has had to step in and buy the Japanese government bonds on multiple occasions.

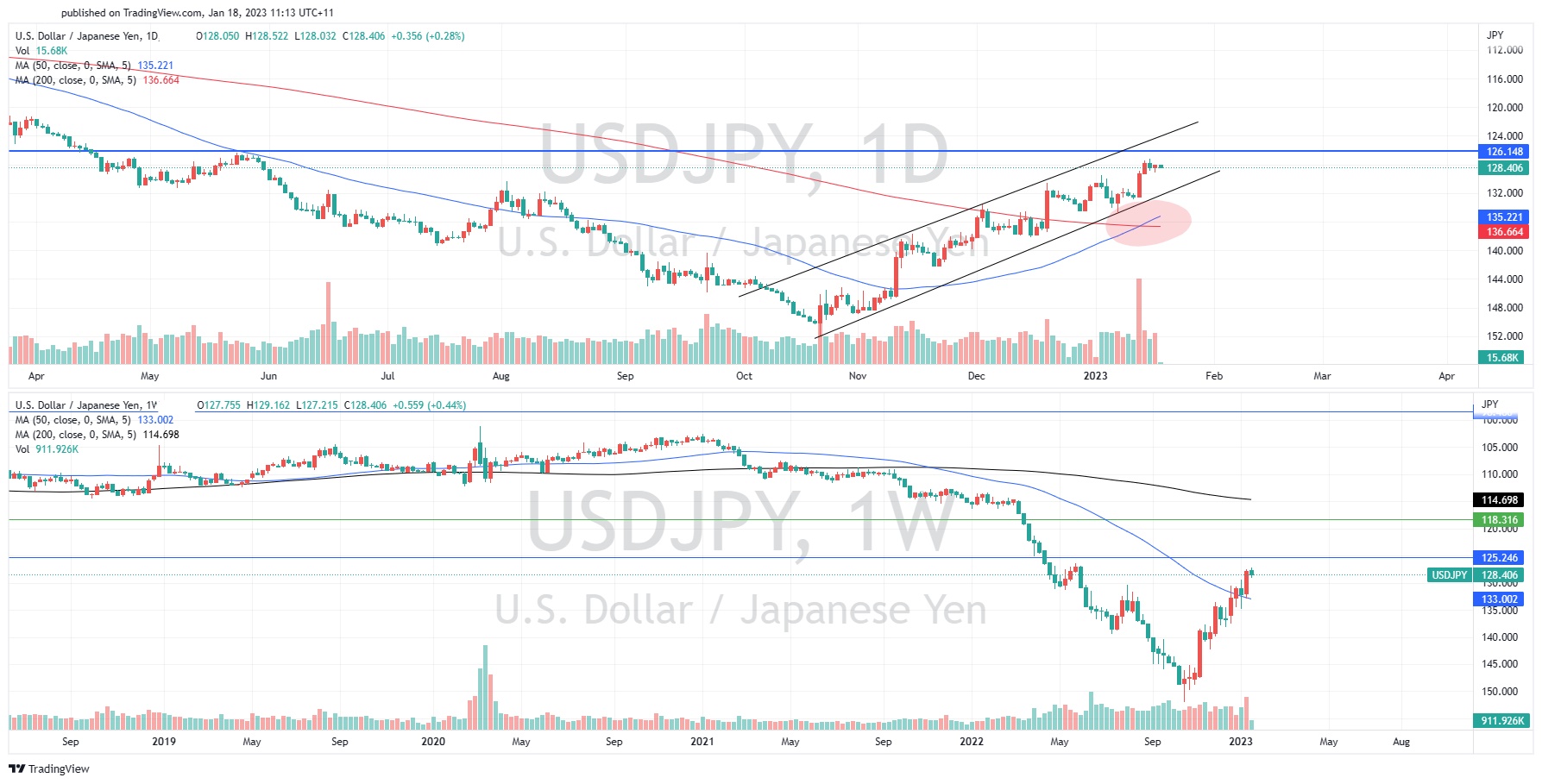

This recent intervention created a resurgence in the JPY. On the chart below which is an inverted price of the USDJPY, the JPY has broken from a long downtrend and is now reversing towards the long-term weekly price range. The weekly long-term range for the last ten years has been between 98 and 125. The 125 level is extremely important as a break above may see the price return to its long-term range. This may see the price reach a target of 120 in the medium to long term. However, if the price fails to break through 125 it may reject the range and fall back down towards 150.

On the daily timeframe the price has been following a typical channel pattern as it continues its reversal. This channel can help provide potential signals for breakouts or breakdowns. This pattern can also provide entry triggers by entering when the price hits the bottom of the price channel and selling at the top. Another positive sign that supports a continued move to the upside is the 50 daily average crossing over the longer 200 day moving average. This golden cross is seen as a very bullish signal as buyers in the short term are beginning to overwhelm the sellers.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Natural Gas price continues to tumble, but the bottom may be near

The price of Natural Gas has continued its drive back down after peaking in the middle of last year. The price has had an aggressive sell off after an equally aggressive run during the initial stages of the Russian and Ukraine conflict. This was due to Russian gas exports being banned and elevated inflation levels. However, as the conflict has subs...

January 19, 2023Read More >Previous Article

Is the ASX heading toward all-time highs?

The outlook for the Australian equities market is one of the best globally and is set up to cope with a potential recession. The Australian market sho...

January 17, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading