- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Forex

- Market Analysis 15-19 May 2023

News & Analysis

XAUUSD Analysis 8 – 12 May 2023

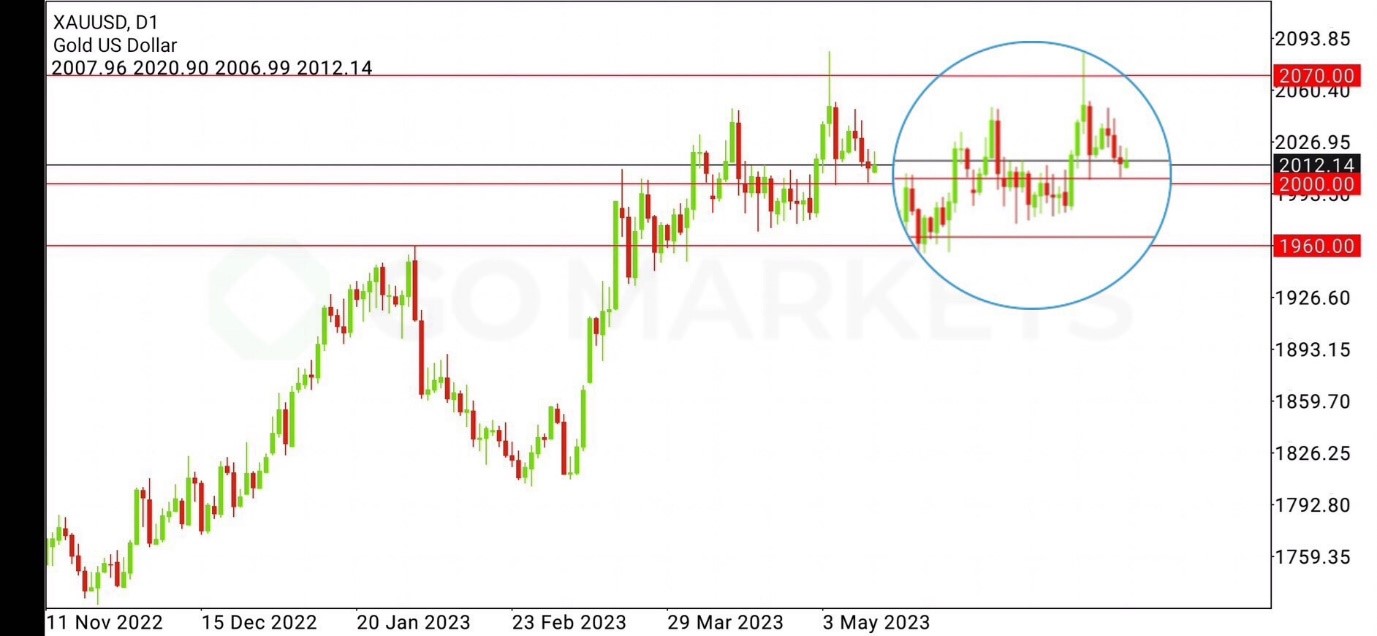

The gold price outlook is generally positive in the medium term. Although the close of last week’s sell pressure bar indicates a significant loss of buying momentum, due to the sell-off during the week but the price is still moving above the 2000 support level after a rebound to test and then rebound. It is very likely that the price will continue to move or sideways above the 2000 support and there is a chance to rise further to test the 2070 resistance which is a key resistance on the timeframe level. Weekly and is the price that gold used to do the most in history.

Forecasting the price of gold In the short term, the price may move down to test the 2000 support again and if it can hold on without falling further, it may have a sideways correction before rising to test the resistance. 2070 again in the medium term on the daily timeframe level, but if the price moves sharply down with continuous selling momentum, it can break out the 2000 support level and continue down to the next important support at 2070. Should be closely monitored is 1960, which is a support level on the daily timeframe.

GBPUSD Analysis 15 – 19 May 2023

GBPUSD is bearish after rallying to test the 1.26660 resistance to successfully form a new high on the Daily timeframe, before strong selling momentum emerges on the Daily and Weekly timeframes. Currently, the price has dropped to support 1.24470, which is an important level to watch. Because the former price used to form a Double Top pattern on the daily timeframe level.

forecasting that price This week, the price may have sideways at the 1.24470 area before plunging further. There is a high probability that the price will test the support area of 1.22700 before a correction. But if the selling momentum continues to sell continuously and is very strong This will result in the price being able to break out at the 1.22700 support area and go further down to test the next support, 1.18080, which is an important support at the Daily timeframe level.

EURUSD Analysis 15 – 19 May 2023

EURUSD has a bearish view after rallying to test the 1.11000 resistance zone, which was the last high on the daily timeframe level, but failed to make a new high and strong selling momentum is evident. Looking at the close of the candlestick, selling pressure on the Weekly time frame last week indicates a strong sell-off in the market.

forecasting that price This week the price will continue to decline. There is a high probability that the price will rebound to test the support area of 1.07450 before a correction. But if the selling momentum continues to sell continuously and is very strong This will result in the price being able to break out at the 1.07450 support area and go further down to test the next support, 1.05250, which is an important support at the daily timeframe level.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

AUD analysis – waiting for a catalyst – range trading and mean reversion opportunities

The Aussie dollar has been fairly directionless since late February with it seemingly waiting for a catalyst to break it’s ranges and take the next leg up or down, data this week has failed to provide that. This opens up a couple of very good opportunities for traders, range trading the AUDUSD and mean reversion trades on the AUDNZD. Starting ...

May 18, 2023Read More >Previous Article

US stocks surge on bounce in regional banks and debt ceiling optimism

Major US indices finished solidly in the green in a broad rally as risk appetite returned to the market amid optimism debt ceiling negotiations and a ...

May 18, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading