- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- No Turkish Delight – Is A Currency Devaluation Of 40% Justified?

- Home

- News & Analysis

- Forex

- No Turkish Delight – Is A Currency Devaluation Of 40% Justified?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisNo Turkish Delight – Is A Currency Devaluation Of 40% Justified?

14 August 2018 By Adam TaylorMost political scientists believe that all problems in the world are related to politics, and most economists believe that all problems are rooted in economics. However, what’s happening in Turkey now seems to be a combination of both as I’ll explain.

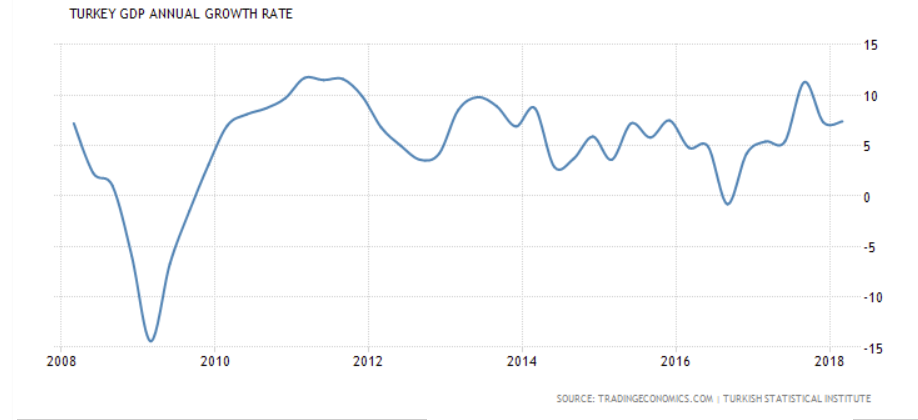

Firstly, investors have always regarded Turkey as one of the Emerging Markets with good economic growth. We can see from the statistics that the GDP has remained an average 7% to 8% growth in the past ten years, and it even exceeded 10% in 2015.

It looks pretty, right? But this is just nominal GDP. From Economics 101 we know that we should divide nominal GDP by inflation rate to get a real GDP figure.

Here is the inflation rate of Turkey:

It looks bad. In July 2018 this number soared to 15.8%, which begs the question: what caused such high inflation?

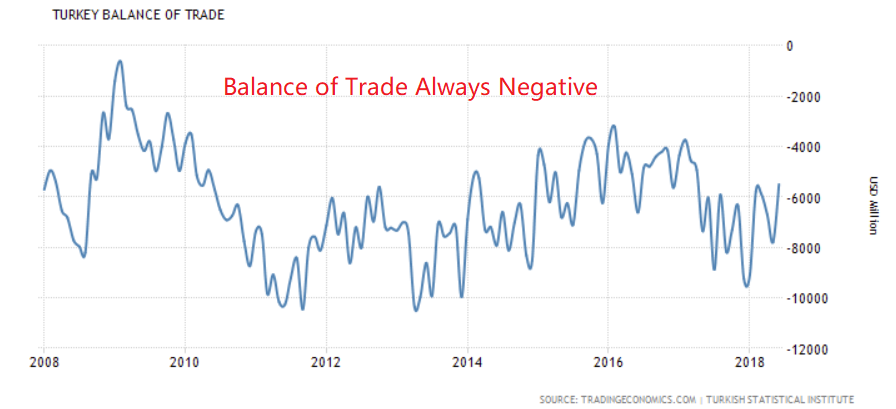

Let me give you the overall picture, and then we can discuss the detail. Firstly, the high inflation is boosted by food prices and household goods such as furniture. Secondly, Turkey relies heavily on importing foods and merchandises from foreign countries, which has created a consistently negative trade balance since the 1990’s.

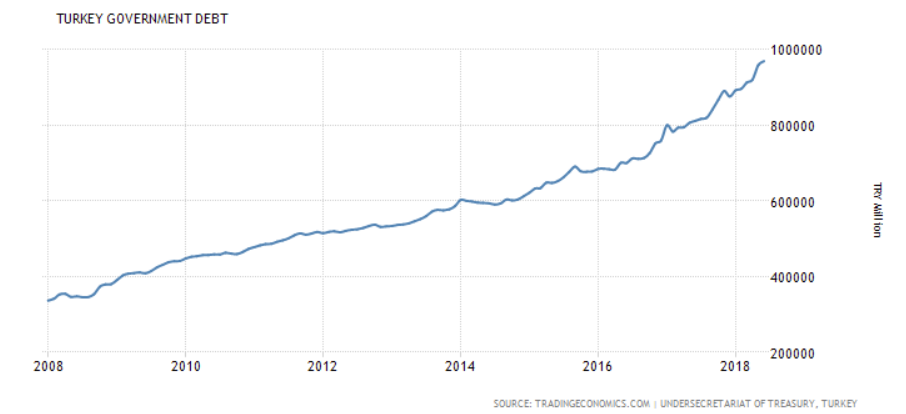

A constant trade deficit means you have to borrow debt to satisfy the consumption of that imported good. See how Turkey’s Government debt accumulated in the past decade:

Today only one country, the US, appears to escape from this natural law, by borrowing infinite new debts to cover its old debts and prolong repaying these obligations until…well… the end of the world.

On the surface, it would seem all other countries need to obey this rule and repay their debts, unlike the US. Thus, when a country’s debt is accumulating to a relatively high number (we often use Debt to GDP ratios to monitor), this country’s economy become vulnerable and potentially easier to be attacked by other financial powers. You could argue that this is an unlevel playing field in some respects and the US could well be using its ability to take advantage of this situations as they arise.

A perfect example of this was George Soros who famously attacked the currency of southeast Asia Countries in 1997. Note the foreign debt-to-GDP ratios rose from 100% to 167% in the four economies within the Southeast Asia region during 1993–96.

If Turkey can somehow avoid getting involved in any significant conflicts of the world and focus on developing its economy, this whole debt issue might sort itself out over time. But unfortunately, given Turkey’s geographic location, it appears destined to be pulled into most conflicts simply by proximity. We all know how vital areas such as Istanbul and the Turkish Straits are throughout history.

Internally, Turkey has a Kurdish ethnic issue and a high household debt issue; externally it has the downing of a warplane issue with Russia, and also an Armenian genocide conflict with Germany. The list goes on. In short, this patch of land is no stranger to dealing with massive problems.

Ultimately this latest crisis comes down to one thing. Does Turkey compromise with America’s arrogant request, or make a stand against Washington’s tactics and attempt to go their own way? That is the dilemma that President Erdogan is currently facing.

Lanson Chen

GO Markets Analyst

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: TradeEconomics.com

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Another Blow to the Emerging Markets

Emerging Markets (EMs) are being dragged down by the deepening crisis in Turkey. The collapse of the Turkish Lira has rattled the financial markets, ripped through the emerging FX markets and brought down the stocks markets at the start of the week. Fears have gripped the EMs over various issues at once. EMs have received not one but several pun...

August 15, 2018Read More >Previous Article

The New “Lows”

By Deepta Bolaky Trade and geopolitical risks were at the forefront of the meltdown that rattled the markets on Friday. Turkey’s currency crisis...

August 13, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading