- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- NZDJPY – Kiwi Gathers Momentum Eyeing 77.88

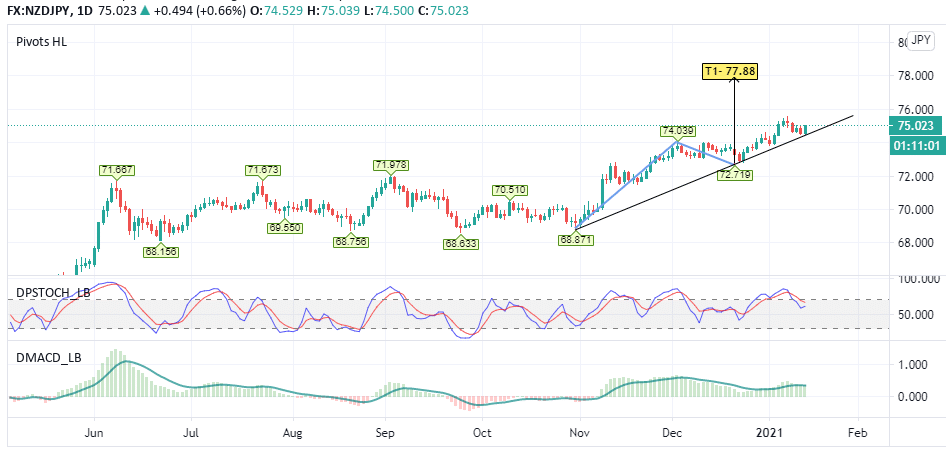

News & AnalysisNZDJPY- Daily

NZDJPY-

The Japanese Yen finally regained some ground against the US Dollar during this afternoon’s London session but continues to display weakness against many of its counterparts. In particular, the NZDJPY and AUDJPY crosses remain technically bullish in the short-term.

Looking at the NZDJPY daily trend, we see a validated bullish trendline that began in November last year following many months of extended consolidative activity. Another point to consider concerning the direction is the divergence between the Stochastic indicator and MACD. Notice we had a recent sell signal on the fast stochastic line, yet the MACD remains bullish. It suggests some potential buying opportunities as the market produces some corrective price action or perhaps even short-term profit-taking.

Regarding upside targets on the daily chart, the primary one is 77.88, which the NZDJPY pair last visited in December 2018. This price is based on the DiNapoli levels (68.67 / 74.03 / 72.71 ) as shown. The area of 72.71 may also become an area of support should the current trend breakdown and develop bearish tendencies.

Note: Click on charts to enlarge.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

Week Ahead: Equity markets take a breather, US dollar strength and Crypto pullback

Major Indices took a breather last week, with US equity markets closing down more than 1% after posting record highs the week prior. In economic news, the incoming US administration announced a $1.9 USD trillion fiscal-stimulus plan that aims to counter the effects of COVID-19 and support markets as recent weak economic figures are indicating the...

January 18, 2021Read More >Previous Article

Electric Car Stocks on the Move

2020 was a good year for electric car space. We have seen shares of most electric car makers surge considerably and take steps to take the industry...

January 13, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading