- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Forex

- Possible high return Swing Trade on USDCHF

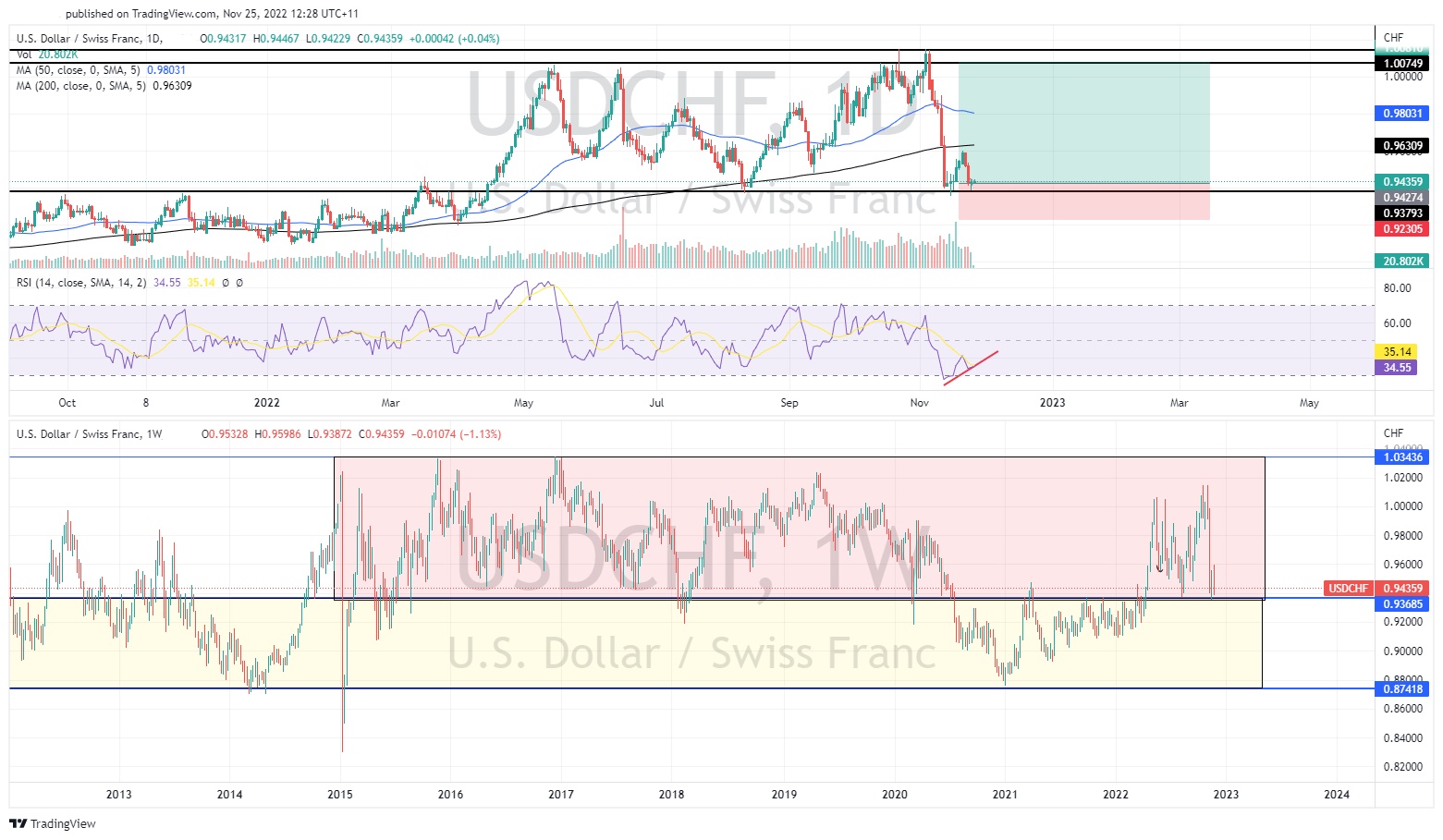

News & AnalysisThe USDCHF has just reached a significant support zone providing a potential entry for a low-risk high return trade. In recent weeks the USD has an aggressive pulled back on the back of weaker then expected inflation figures. This has benefited the CHF and most other non-USD currencies as expectations of a potential pivot grow and money moves away from the Greenback.

From a technical perspective the price of the USDCHF has fallen to its lowest price since August 2022. The price has also largely been in a ranging pattern since 2010 between 1.03436 0.8741. In addition, besides the Covid years, the price has been in a tighter range between 0.94 and 1.03.

The current price zone has been a really important area of support and in the most recent test of this area, in August the price bounced quite strongly. Interestingly, during times of higher market volatility the price extends its lower bound of the range from 0.94 to 0.87. For example, the prices extended its range during the GFC and the Covid pandemic. However, generally, the pair trades in the tighter range. Therefore, as it is arguable if the current market conditions represent volatility as sinister as the GFC or the Pandemic this current price action lends itself to a potential bounce over a further sell off.

The bounce is also supported by the RSI which is not just oversold but showing the potential for a divergence. With the price at an ideal entry point, it allows for a high potential risk reward trade. The trade’s target is 1.0075 as seen on the price chart.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Forex #ForexAnalysis #ForexBroker #ForexCharts #ForexMarket #ForexNews #ForexSignal #ForexTradingNext Article

The Week Ahead – US employment and inflation figures take centre stage

After coming off a fairly quiet, US holiday shortened week, traders will have a plethora of scheduled news to digest as the market continues to swing from risk-on to risk-off as it tries to predict what the Federal Reserves next moves will be. Equity markets drifted up, the US dollar drifted down as a resilient US economy and a dovish Fed minute...

November 28, 2022Read More >Previous Article

What is an Economic Bubble and how to identify it?

Economic Bubbles are highly damaging phenomena’s that occur in financial systems that can cause a great deal of loss and pain to...

November 24, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading