- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- July update on Brexit

News & AnalysisAn Update on Brexit

The dust has finally settled after the UK Snap elections and now the United Kingdom can turn their heads to discussions with the European Union about how and on what terms they will leave the Union. The Brexit negotiations officially began on 19th June in Brussels, the opening day mainly consisted of the timing and structure of the negotiations with actual trade talks expected to begin on 24th July.

One of the main issues that both parties want to get resolved as soon as possible is the status of EU nationals in the UK and the UK citizens living within the European Union. On 26th June, Theresa May set out her plans for the EU citizens living in the United Kingdom, advising she wants the EU nationals to stay in the UK. Mrs May outlined that all EU citizens living in the UK before it leaves the EU will be able to apply for a ‘settled status’ but only if the UK citizens will get the same deal within the EU and with the actual trade talks beginning towards the end of July, we should soon see what the details of the Brexit divorce will look like.

Financial Markets

The Pound

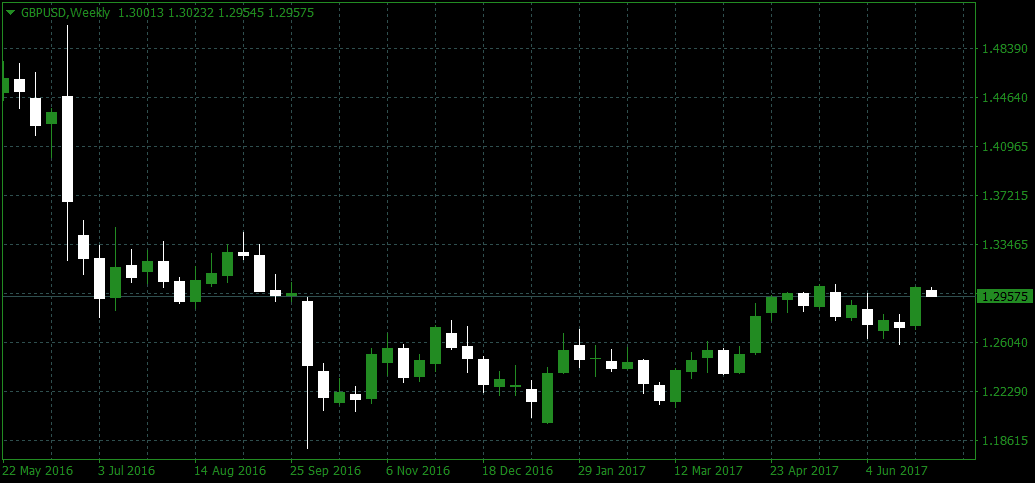

When the UK Election results came in, we saw the Pound weakening against the US Dollar as it emerged that Theresa May did not win the majority which meant more uncertainty for Britain going into the Brexit negotiations. Since then, the Pound has strengthened against the US Dollar, but with the beginning of Brexit talks we can expect some movements in the financial markets in the coming months.

Source: GO Markets MT4

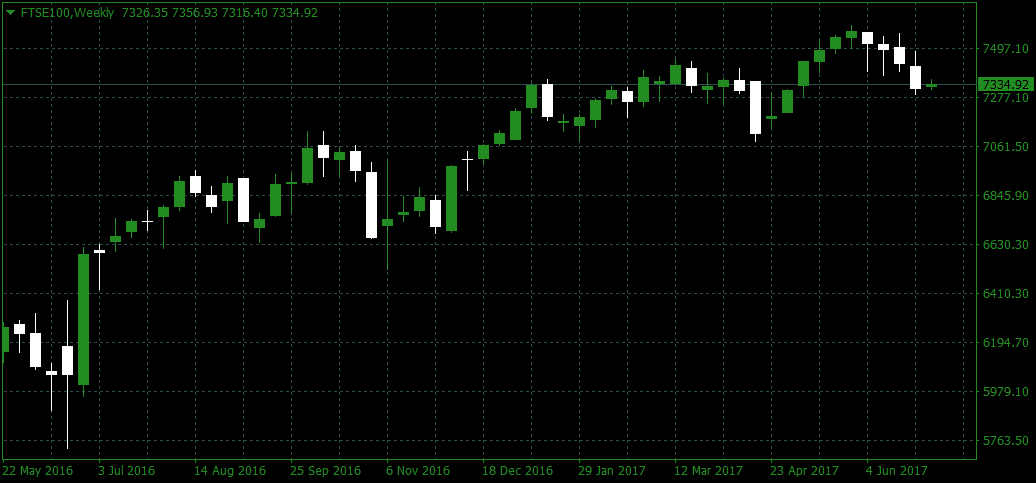

Source: GO Markets MT4FTSE100

We saw the FTSE100 reach record highs at the beginning of June, however since then there has been slight decline in the Index.

Source: GO Markets MT4

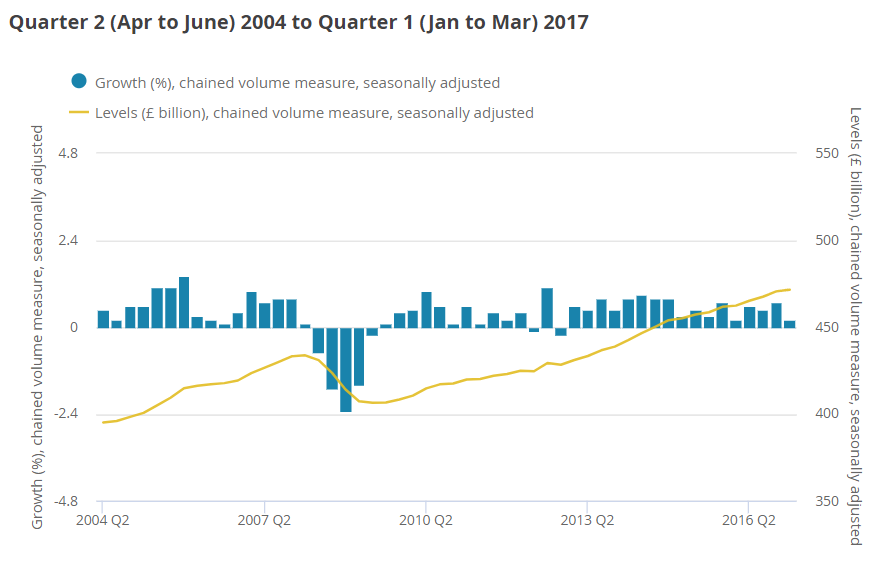

Source: GO Markets MT4Economy

A lot of people expected the UK economy to slow down drastically after the Brexit vote but instead we saw a steady growth in the months after the result was announced. The latest economic figures show that UK economy was the worst performer in European Union with economic growth of just 0.2% in the first three months of 2017 with Romania, Latvia and Slovenia with the strongest expansion with 1.7%, 1.6% and 1.5% respectively. However, in terms of year-on-year the UK is still closer to the EU performance and ahead of 19-nation eurozone (EU countries with Euro as their currency).

Source: Office for National Statistics

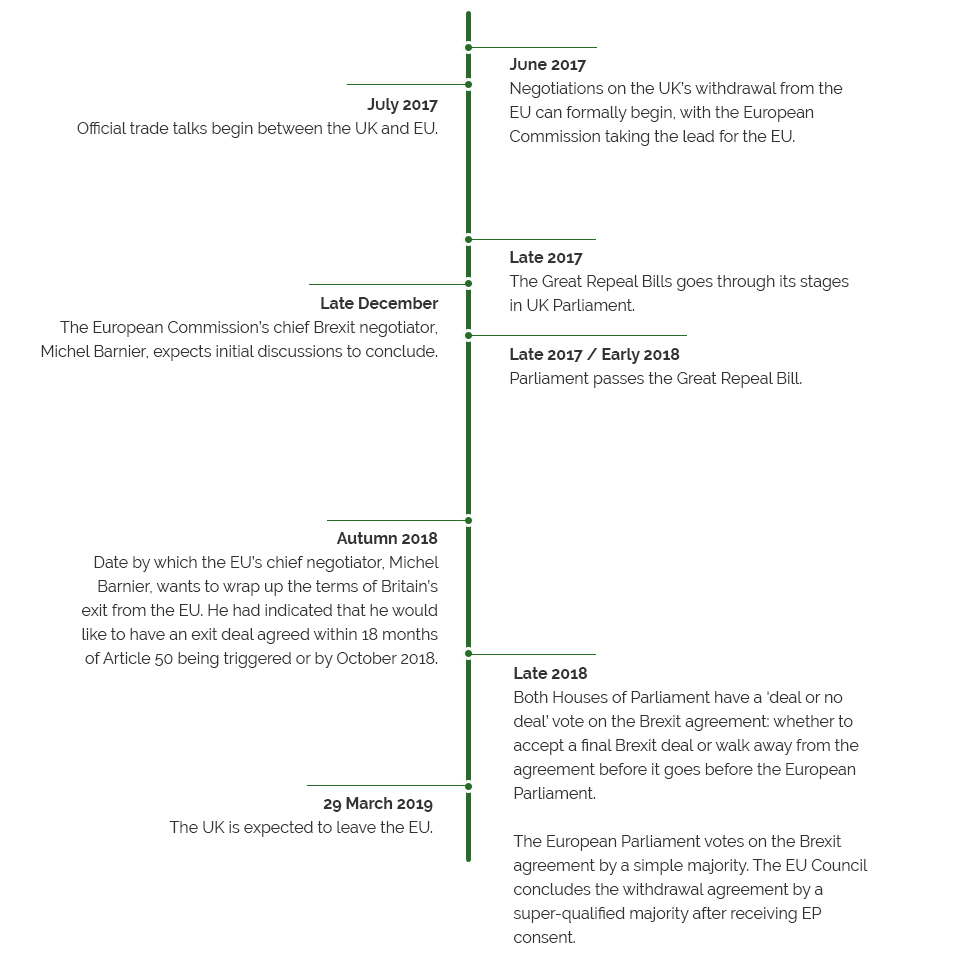

Brexit timeline

June 2017 saw the start of what looks to be a two year journey which culminates in The United Kingdom leaving the EU. Source: http://www.parliament.uk/

Source: http://www.parliament.uk/By: Klavs Valters

GO Markets

GO Markets may recommend use of software, information, products, or web sites that are owned or operated by other companies (“third-party resources”). We offer or facilitate this recommendation by hyperlinks or other methods to aid your access to the third-party resource.

While we endeavor to direct you to helpful, trustworthy resources, we cannot endorse, approve, or guarantee software, information, products, or services provided by or at a third-party resource. Thus, we are not responsible for the content or accuracy of any third-party resource or for any loss or damage of any sort resulting from the use of, or for any failure of, products or services provided at or from a third-party resource. We recommend these resources on an “as is” basis.

When you use a third-party resource, you will be subject to its terms and licenses and no longer be protected by our privacy policy or security practices, which may differ from the third policy or practices or other terms. You should familiarise yourself with any license or use terms of, and the privacy policy and security practices of, the third-party resource, which will govern your use of that resource.Whilst Go Markets has used reasonable endeavours to ensure that the information provided by Go Markets in the newsletters/reports is accurate and up to date as at the time of issue, it reserves the right to make corrections and does not warrant that it is accurate or complete. News will change with time. Go Markets hereby disclaims all liability to the maximum extent permitted by law in relation to the newsletters/reports and does not give any warranties (including any statutory ones) in relation to the news. This is a free service and therefore you agree by receiving any newsletter(s)/report(s) that this disclaimer is reasonable. Any copying, redistribution or republicationof Go Markets newsletter(s)/report(s), or the content thereof, for commercial gain is strictly prohibited.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

G20 Summit and what to expect from the market.

Friday 7th July 2017 saw the official start of the two-day G20 summit in Hamburg, Germany, were delegates from 19 countries come together to discuss matters ranging from free trade to Global warming. We have compiled this quick guide to what you can expect from the markets after this year’s summit. What is G20? The G20 started in 1999 as a...

July 9, 2017Read More >Previous Article

US Dollar Index Futures with GO Markets

US Dollar Index Futures with GO Markets For stock traders, trading indices is a cost-effective way to gain exposure to many different companies in one...

June 26, 2017Read More >Please share your location to continue.

Check our help guide for more info.

- Trading