- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- Brexit Aftermath Rolls On

News & AnalysisUpcoming News

» Day One EU Economic Summit EUR

» 10:30pm Final GDP USD

» 12:00am CB Consumer Confidence USDBrexit aftermath rolls on. On the back of David Cameron’s resignation more MPs have stepped down in the wake of Friday’s shock result. Over three million people have signed a petition for a second referendum to be held. While I understand the despair the chances of that happening are slim to nil. Scotland is very upset by the Brexit vote has talked about the possibility of a new independence referendum or vetoing the Brexit result to remain in the EU.

US markets last night continued selling off with the SPX500, US30, AUS200, GBPUSD making new post-Brexit lows. While the DAX and UK100 saw heavy selling they failed to make new lows, Gold also put on $8 overnight but failed to hold. These are good signs for me. We have been seeing an Asain session recovery which could continue into tonight’s session, I believe there’s a fair chance this will happen.

EU economic summit has started today. The main topic will be Britain’s decision to the leave the EU. I hope to see some strong comments made to reinforce the European Union as an entity. We did here talk on Friday of other member states being open to their open referendums but this has died down a touch. I hope to see solidarity come out of the EU summit this week. I feel it’s very important at this time of uncertainty.

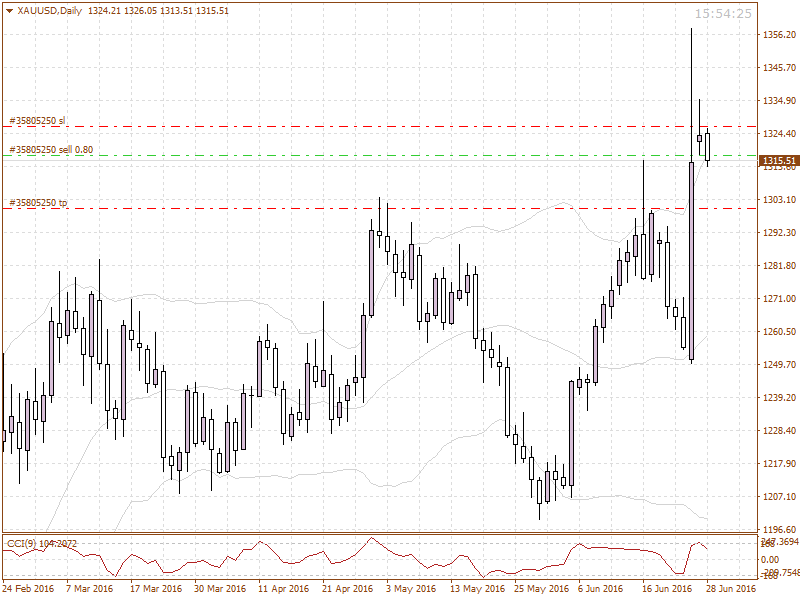

XAUUSD – I am looking for a recovery in risk. I have a trade idea on gold. Last night buyers took it but failed to hold while US markets closed at new lows. Failed high is the pattern, low break the trigger. Looking for 1300 area if selling continues.

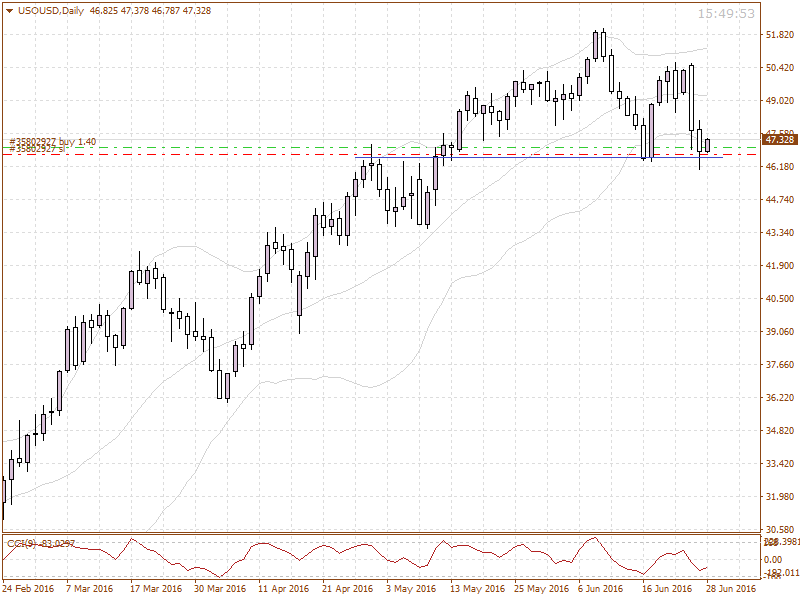

USOUSD – Support found at 46.70 with a failed low gave me the pattern. Off the 4H we had a high break for the trigger. Daily Oil looks to have found a short-term base. If buying continues looking for a move up to test $48.30.

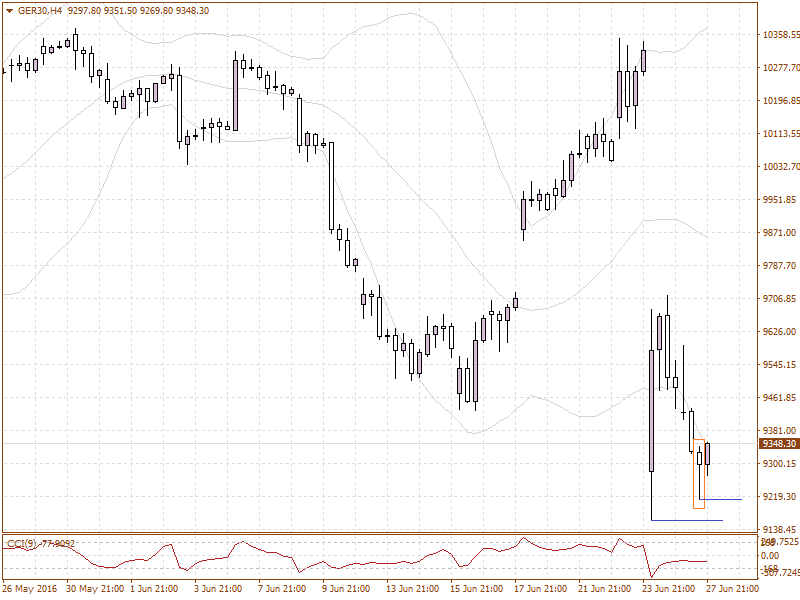

GER30 – We have an inside bar on the daily that has failed at an attempt to move lower. I’m looking for buying to continue this evening. Posible buy idea if we have a test and break of yesterday’s last 4H candle. If buyers continue on, I’m looking for a test of 9443 to the upside.

Trading thought for the day.

“A handful of patience is worth a bushel of brains”

Good Trading.

All times are in AEST.Please note that trading Forex and Derivatives carries a high level of risk, including the risk of losing substantially more than your initial investment. Also, you do not own or have any rights to the underlying assets. You should only trade if you can afford to carry these risks. Our offer is not designed to alter or modify any individual’s risk preference or encourage individuals to trade in a manner inconsistent with their own trading strategies.

Joseph Jeffriess, GO Markets Market Strategist

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

The Aftermath of Brexit – Point & Figure Analysis

Aftermath of Brexit Today we'll take a look at the aftermath of the Brexit vote using point and figure analysis. As we begin to process the magnitude of last week’s ‘Brexit’ vote, it is important to understand that we are still not of the woods yet regarding event risk and market stability. It may well be the start of an extremely volatile pe...

June 28, 2016Read More >Previous Article

9 Reasons Why is MT4 is Rated One of the Best Online Forex Trading Platforms

Forex has grown considerably in popularity over the last 5 years, resulting in many new and popular online Forex trading platforms hitting the global ...

June 23, 2016Read More >Please share your location to continue.

Check our help guide for more info.

- Trading