- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- Brexit Breakthrough

- The Irish border

- The divorce bill

- Citizen’s rights

- European Court of Justice (ECJ)

News & AnalysisBrexit Breakthrough

After months of discussions and nearly a year and a half after the Brexit referendum took place, there has been a breakthrough in the Brexit talks. Both sides have now agreed on major key issues which was vital before moving onto the trade talks, which are estimated to begin in February of next year.

Overview of the dealOne of the key issues which stopped Theresa May agreeing to a deal earlier was the Irish border. No one wants a hard border between the Irish neighbours, and it looks like this quirk of Ireland can be preserved. The deal means there would be no new regulatory barriers between Northern Ireland and rest of the United Kingdom, and therefore Northern Irish businesses will be able to continue to have access to the UK market, which was a key concern for the Democratic Unionist Party (DUP).

Since the negotiations began a few months ago, there were different amounts mentioned starting from £20 billion and going up to £100 billion. When the British people voted to leave the EU, they did not expect to pay such large amounts to not be part of bloc but instead were looking to spend the promised £350 million per week on NHS which was promoted by the Leave campaign. Now Britain is likely to pay between £35 and £39 billion to the EU under the Brexit deal.

Another major promise from Theresa May was ensuring EU citizens rights would be guaranteed after UK formally leaves the EU and the same rules to be applied to the UK citizens living in the EU. The deal also includes a point which will allow family members who do not live in the UK to join them in the future.

This deal will potentially anger the Brexiteers as it means that ECJ will continue to have a role overseeing rights of EU nationals in the UK for eight years after the withdrawal date. Donald Tusk, the President of the European Council has said that UK must respect EU law during the transition period which is expected to last for around two years after the official leaving date of March 2019.

Financial markets

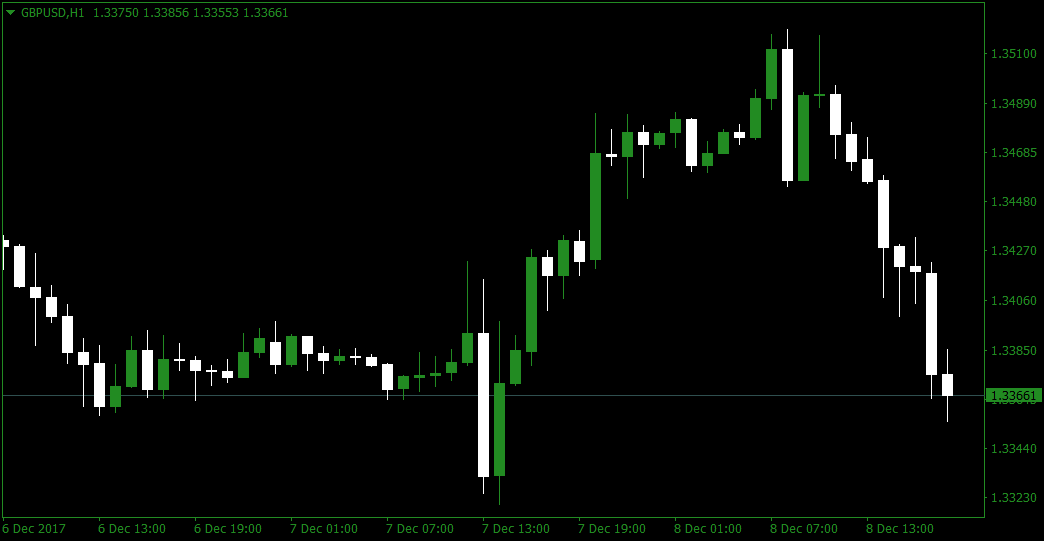

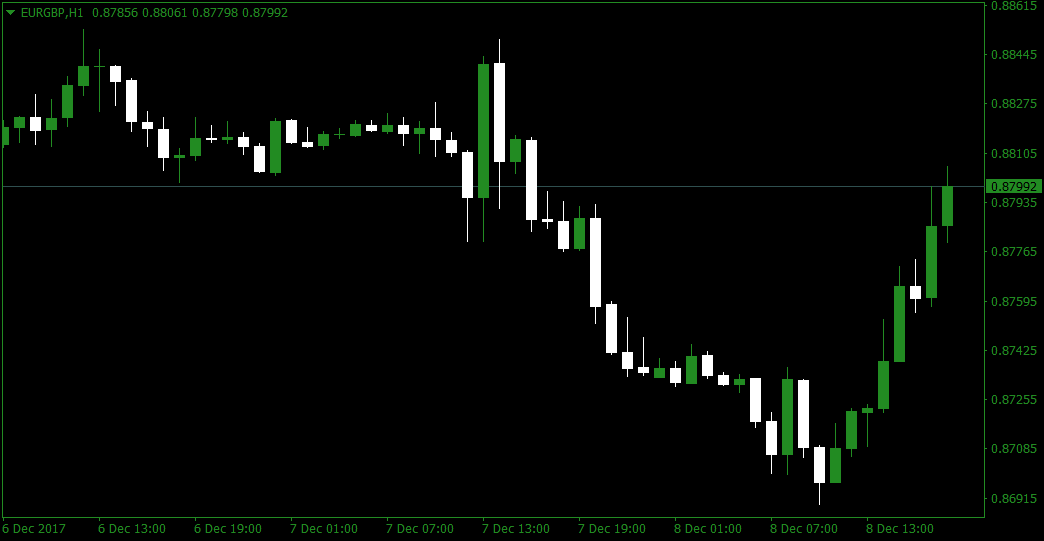

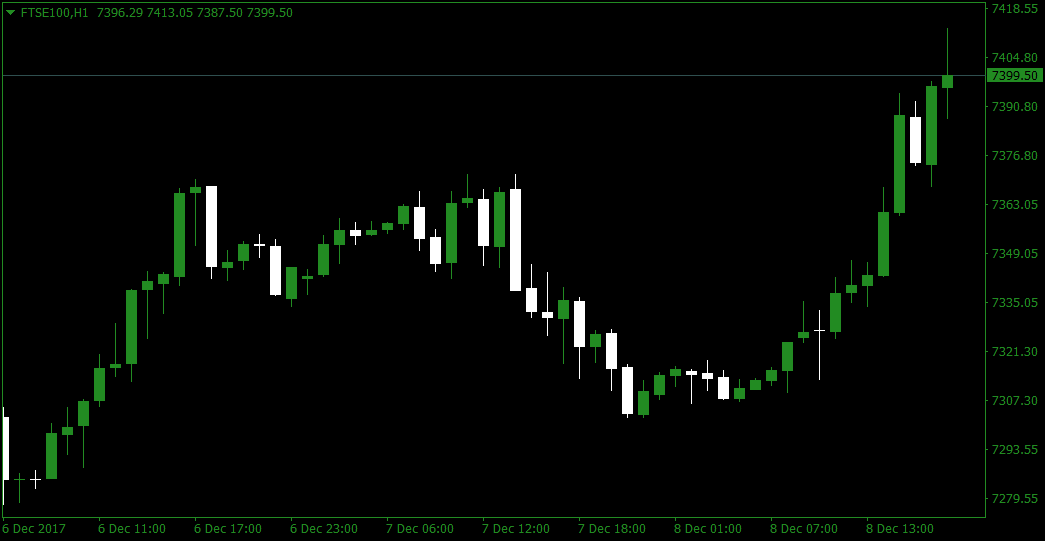

We did not see too much movement in the financial markets after the news of a breakthrough deal came out. The Pound weakened against the US Dollar on Friday by around -0.81% to 1.33 level. The Euro strengthened against the Pound and was up by around 0.75% at the end of the close at 0.87 level. Different story for FTSE100, it was up by around 1.10% at 7,399 at the end of the European close on Friday.

GBPUSD:

Source: GO Markets MT4

The Euro strengthened against the Pound when the news came out, which has caused more uncertainty around the matter. The Euro is up by around 21% against the Pound since January and we could see more gains for the Euro as the UK economy keeps outperforming in the coming months.

EURGBP

Source: GO Markets MT4

As the Pound fell, we saw the FTSE100 jump higher as a weak Pound boosts the earnings for London listed companies with international profits. The Index is up 3% since the start of the year.

FTSE100

Source: GO Markets MT4The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Neom – The Future of Saudi Arabia

Neom - The Future of Saudi Arabia Back in October the Saudi Prince Mohammad bin Salman announced plans to build a new city called Neom. This ambitious plan for a city would be located in the northwest region of the Kingdom and span across Saudi Arabia, Jordan and Egypt. Neom is part of Saudi Arabia’s vision 2030, a plan to reduce its d...

December 18, 2017Read More >Previous Article

Deal or No Deal

Deal or No Deal Brexit negotiations have been ongoing for some months now, and even while officials state that ‘sufficient progress’ in the talks...

December 6, 2017Read More >Please share your location to continue.

Check our help guide for more info.

- Trading