- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- Canada – Taking A Look At The Loonie Economy

- Home

- News & Analysis

- Geopolitical Events

- Canada – Taking A Look At The Loonie Economy

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

Canada News Flying Under The Radar

Canada has been a predominant feature in financial news in the recent few months, with many discussions centered around the NAFTA and ‘new NAFTA’ agreement, the USMCA trade deal. But despite being such a significant story, it has arguably been overshadowed by the big moves in equity markets, Brexit negotiation drama and the trouble in emerging markets, i.e., Turkey, Brazil, and even Italy’s budget woes.

So with the Canadian central bank, BoC, expectedly hiking rates a by 25 basis points on Wednesday 24th October, we decided to give Canada its time in the limelight it deserves and take a look at the Canadian economy. For more information on the BoC rate decision, take a look at our Analyst Klavs’ article right here – > The Bank of Canada Rate Decision.

USDCAD Chart – BoC Tax Hike causes 100pip drop before trend continues

Canadian Currency Moves And Economic Stance

Perhaps the best place to start would be to address the most recent price swings in the Canadian Dollar and some of the driving forces behind it. In the chart above, we saw a 100pip push lower in the USDCAD (USD weakening, CAD strengthening) on the back of the BoC’s decision to hike rates by a further 25 basis points to 1.75%. Now despite the highly anticipated nature of this announcement, it’s the overtly hawkish comments from the executive committee members that perpetuated the move lower in the pair.

So what was said and what does it mean for Canada going forward? Let’s begin with rates as that was the initial stimulus in the move. BoC’s Wilkins, the Senior Deputy Governor, stated that “Policy Rate will need to rise to a neutral stance to achieve inflation target” that the BoC “Don’t have a preordained rate path” and that the “pace of rate hikes is dependent on the inflation outlook.”

In short, this translates to the stance that most Central banks seem to be adopting and that is an accommodative and data dependent bias. Meaning that while their long-term goal remains the same, i.e., raising the rate to preserve the value of money by keeping inflation low, stable and predictable, the timing with which they are willing to make changes is flexible and the comments from both Wilkins as Governor Poloz support this.

Poloz went on to state that the removal of the word ‘Gradual’ from monetary policy forward guidance “Permits us to raise rates at a faster or slower pace depending on developments.” This statement helped to perpetuate the move higher in the Canadian Dollar because it demonstrated that Canada’s government is taking the action it needs to maintain its mandate and not blindly sticking to a set term of rate hikes regardless of momentary data blips.

Canadian Dollar Crosses Overlay – Shows Canadian Strength across the board during comments

Trade Agreements And Policies

The next aspect we’ll take a look at is the elephant in the room, the United States-Mexico-Canada Agreement (USMCA). Our analyst Deepta takes an extensive look at USMCA here – USMCA – NAFTA 2.0 – and what it means for Canada, so what I want to focus on is BoC’s Wilkins’ comments. She states that the Canadian “Economy is becoming more resilient.” And that “USMCA reduces uncertainty,” and that fact alone is good news, Governor Poloz does also state the caveat that “Tensions between US & China could hit Canadian export growth.”

Since the comments, the USD/CAD rate has seen quite a bit of activity however it has not moved much from where it was beforehand. The market seems to be interpreting the hawkish comments from the BoC members regarding both rates and USMCA as positive for the Canadian Economy and is pricing it in accordingly.

Are Canadian Stock Markets In Trouble?

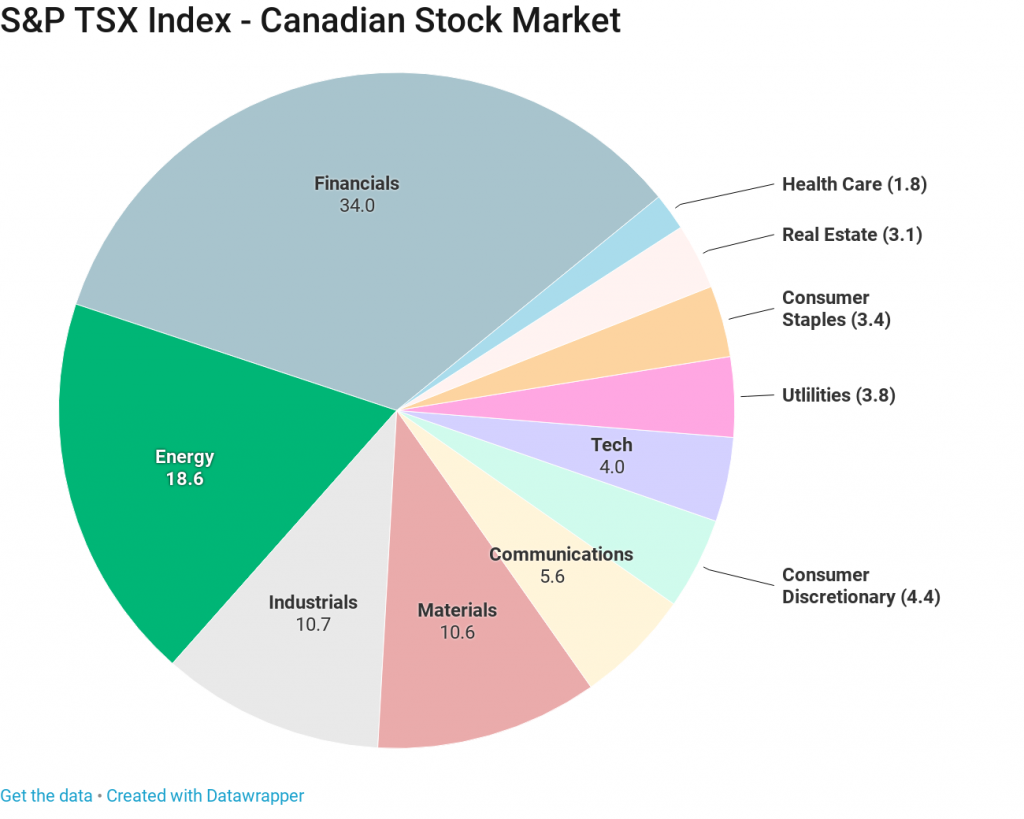

Amid the recent ‘Global Stock Rout’ the S&P TSX ended October down 6.51% following a somewhat hard month. However, during this risk-off flight to safety, the S&P TSX Index may have had its pain exacerbated by the heavy makeup of energy companies populating the Canadian index.

As discussed in previous articles – Oil – Can basic Economics be responsible for an 11% decline – Oil has seen some very aggressive sell-offs. Current market conditions have the commodity breaking below the $50 a barrel level amid supply concerns and growing global tensions. Keep in mind with Canada’s energy companies occupying an 18.6% weighting of the S&P TSX; undoubtedly this has been a weight around the Index’s neck dragging it lower.

Contrary Views To The Health Of Canada’s TSX Index

Chief Investment Strategist for BMO Capital Markets, Brian Belski stated that the similar declines were seen in 2012 & 2014 (of 11.5% and 12.5% respectively) on average saw rebounds of 18.22%. And he considers this particular sell-off as no different given that it was a flight to safety out of equities and that the major US indices led the TSX’s decline.

RBC Global Asset Management chief economist Eric Lascelles mirrored this sentiment and stated that despite the reason decline and consumer concern over rising interest rates, the Canadian Economy is healthy and he cannot see it declining further into bear territory. Lascelles also says that instead of fearfully selling off, investors should seek opportunities to buy as the stock market dips since the financial crisis have typically unwound quickly.

So with proactive steps being taken by the Canadian central bank and consensus for a turn around in the Canadian stock market, we could be looking a further strengthening in both the Canadian Economy and potentially the Canadian currency crosses — certainly ones to consider for the watchlist over the coming months with the next BoC decision taking place on December 6th.

For more information or any questions feel free to reach out to me on twitter – @Alex_GoMarkets

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

What Has Moved The Markets So Far This Week?

December started on a positive note, though it was short-lived. During the G20 meeting, there was more optimism in the financial markets than the market participants had anticipated. Investors were therefore hopeful that December would be promising. Post G20 Reactions – Bullish Gaps Monday started on a buoyant note with a few bullish gaps, a...

December 6, 2018Read More >Previous Article

Is Trump the Santa Stock Markets Need?

Without any doubt it was a difficult year for the stock markets. Recently nearly all equity indices have erased their 2018 gains. October has also ...

November 30, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading