- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- International Monetary Fund (IMF): Growth Warnings

- Home

- News & Analysis

- Geopolitical Events

- International Monetary Fund (IMF): Growth Warnings

- Germany is experiencing weakness in the auto industry, following new fuel emissions standards and soft private investment.

- Italy is facing weak domestic demand and high borrowing costs.

- France is being dragged by yellow vest protests and weak industrial production.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

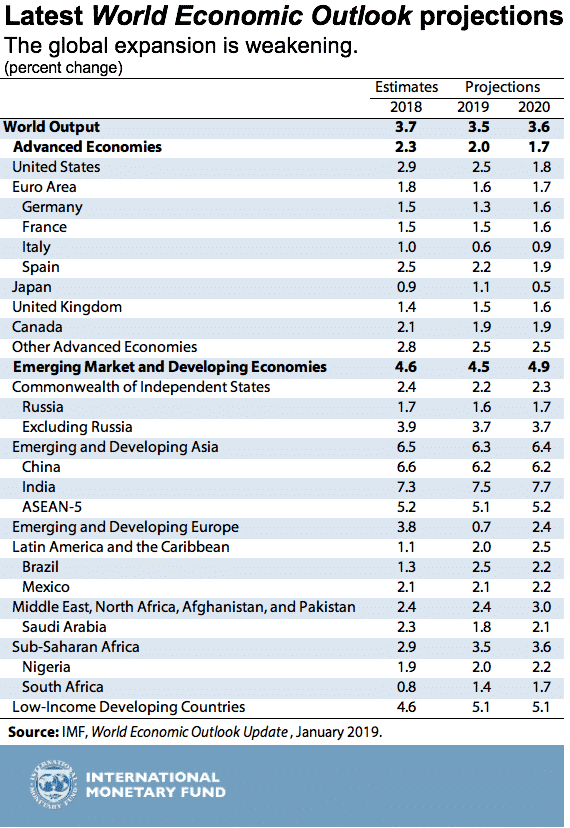

The World Economic Outlook has further shifted to the downside. The growth estimates for 2019 and 2020 were downgraded in October 2018 mainly due to trade tensions. The recent further downward revisions were the result of the weakening momentum in key industrialised economies.

The table below depicts the “Weakening Global Expansion”:

The outlook for Developed Economies

Eurozone Area: The most significant revisions came from Europe- mainly Germany and Italy.

In addition to the above, the rise in populism in the Eurozone area, Brexit and cross-border spillovers are some other Europe-specific factors that are weighing on economic activity.

United States: Washington is in gridlock, and the fiscal sugar rush died down. The US expansion continues, but growth momentum will soften. In comparison with the Eurozone area, the US’s growth will remain high. The prolonged US government shutdown is also posing risks to economic activity.

Japan and the United Kingdom: Despite natural disasters in Japan and Brexit in the UK, IMF has upgraded growth forecasts for these two economies. Japan’s fiscal support and mitigating measures to the tax hike enabled the IMF to revise the estimates to the upside. Given that the uncertainty around Brexit is eliminated and a deal has been reached, the UK economy is expected to move up because data has shown that it is not as sluggish as the Eurozone area.

The Outlook for Emerging & Developing Economies

China: Despite the recent stimulus program which will tackle some of the impacts of trade frictions, China’s economy is forecasted to slow towards the lower range of 6%. A combination of financial regulatory tightening, trade dispute and rout in commodity prices have caused a deeper slowdown than initially forecasted. The warnings from IMF is a reminder that China’s slowdown will have a global impact.

Saudi Arabia: Tumbling oil prices have forced IMF to also lower growth forecasts for Saudi Arabia.

India and Brazil: “India’s economy is poised to pick up in 2019, benefiting from lower oil prices and a slower pace of monetary tightening than previously expected, as inflation pressures ease.” The main factor behind the revisions is the declining commodity prices, which will eventually aid policy easing. Brazil’s recovery is expected to continue, which allowed IMF to upgrade its forecasts.

These moderate downward revisions to forecasts which were already revised down in October 2018 are warnings that investors will be keen to keep an eye on. IMF stretched the importance of recognising the growing risks, even though we are not anticipating a significant downturn at this stage.

This may be the reason why the World Economic Outlook is placing more emphasis on the Multilateral Cooperation, and call for policies as well to reverse the current headwinds and prepare for the forecasted downturn.

As of writing, the concerns about the global economic outlook have resurfaced with IMF warnings and its impact on risk sentiment can be seen in the Asian markets today.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Preview: The European Central Bank Rate Decision

On Thursday, the European Central Bank will announce its first policy decision of the year on whether to increase, decrease or maintain the interest rates. The decision is scheduled to be announced at 12:45 PM UK time. Why Is The Announcement Important? The European Central Bank is the central bank for the Eurozone, the countries which have adopt...

January 23, 2019Read More >Previous Article

China’s Stimulus Program

Fears of slowing growth and weak Chinese data have forced China to ramp up its efforts to stimulate its economy and reassure investors: Record...

January 22, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading