- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- Latest US Jobs Report

News & AnalysisThe Buraeu of Labor Statistics have released the latest jobs report for September. Let’s take a look at the latest numbers.

The total non-farm payroll employment increased by 134,000, the U.S. Bureau of Labor Statistics reported today versus the forecast of 185,000. Biggest job gains were in professional and business services, in health care, and in transportation and warehousing.

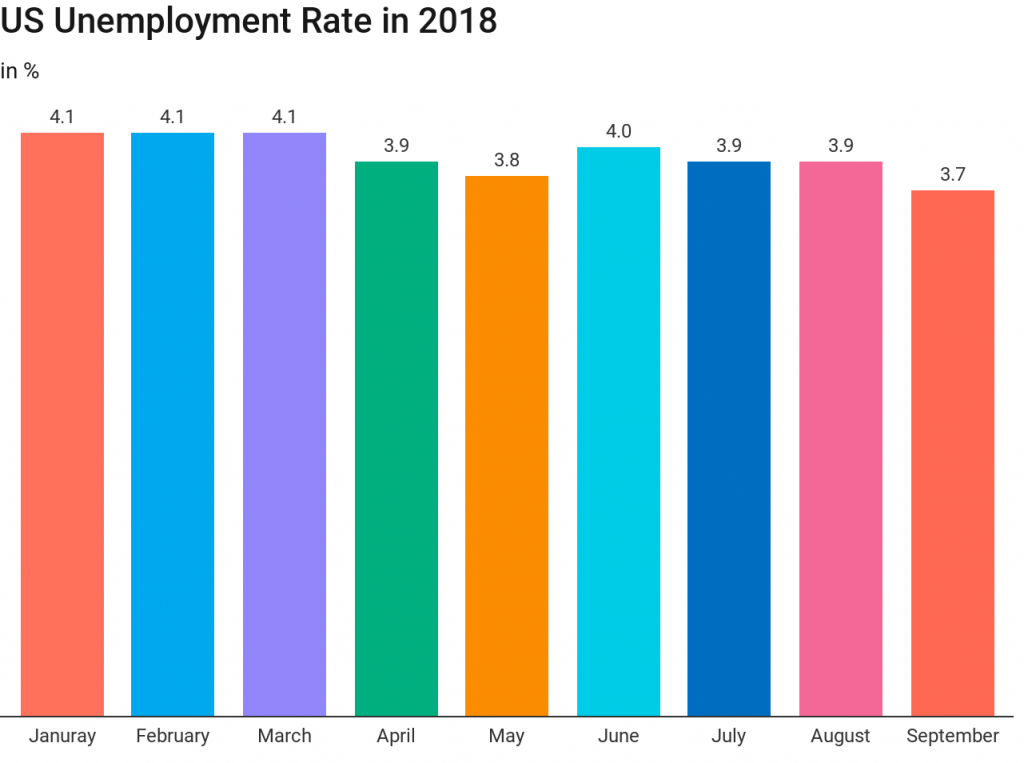

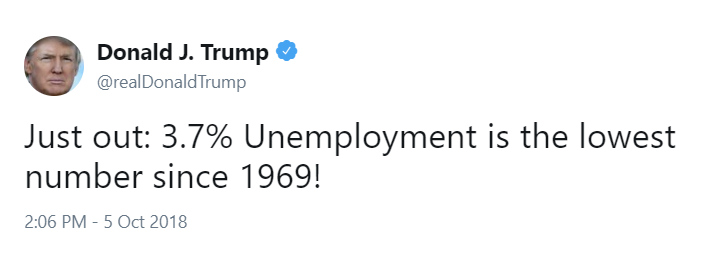

The unemployment rate declined by 0.2% to 3.7% in September better than the forecast of 3.8%. Worth pointing out that the latest unemployment rate is the lowest level for 49 years. The number of unemployed people decreased by 270,000 to 6 million.

Average hourly earnings dropped from 2.9% to 2.8% as anticipated.

The reaction

Initially we saw some weakness in the US dollar as the latest figures were released, however, since then the Dollar has recovered some losses.

Average hourly earnings dropped from 2.9% to 2.8% as anticipated.

USD/JPY Hourly Chart

GBP/USD Hourly Chart

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: Bloomberg, Go Markets MT4

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Weekly USD Round-up: 08/10/18

Last week's ATR: 95-96.1 From the daily chart below, we can see that the US Dollar Index is currently testing its right shoulder, and I have marked the left and right shoulders by two red rectangles. It will take weeks for the price to tumble around the rectangle area, and there might be a lot of fake movements occur, thus it is still too soon to...

October 8, 2018Read More >Previous Article

What Lies Ahead For Japan

In the midst of Wednesday afternoon's global bond sell-off, we saw government bond yields rise across the board and in one particular 10-year bond we ...

October 5, 2018Read More >Please share your location to continue.

Check our help guide for more info.

- Trading