- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Geopolitical Events

- Trade Deadline Delayed – “Substantial Progress”

- Home

- News & Analysis

- Geopolitical Events

- Trade Deadline Delayed – “Substantial Progress”

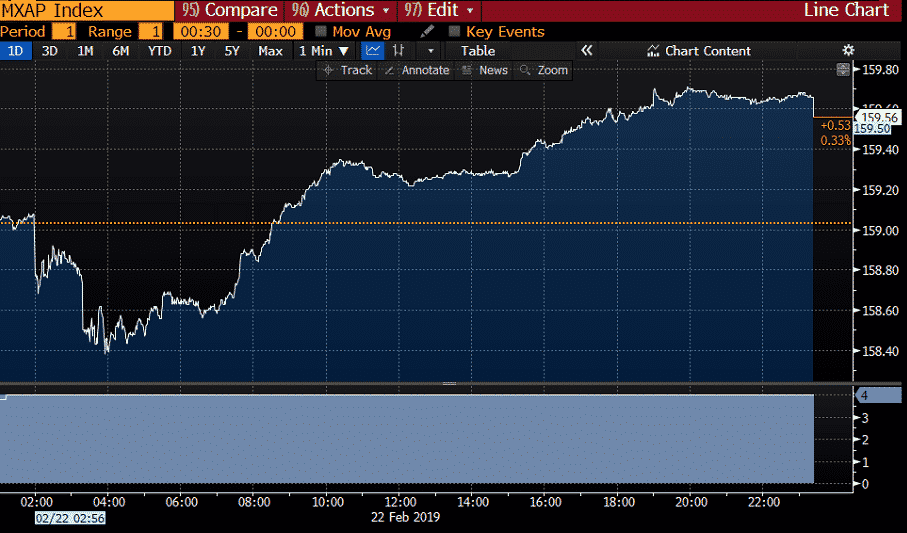

- MSCI Asia Pacific Index rose by 0.5% as of writing. Asian stocks edged higher as investors are cheering up the latest signs of progress.

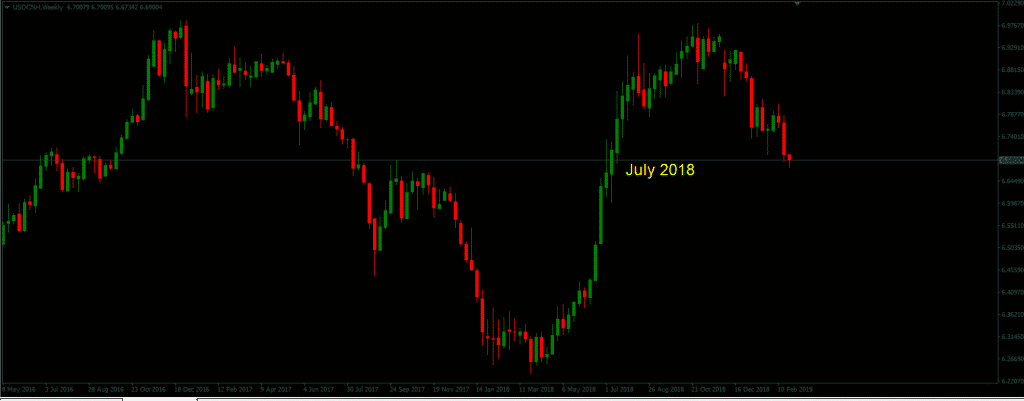

- USDCNH – The Yuan is climbing higher sending the USDCNH pair to its lowest level since July 2018.

- The Antipodeans being trade-sensitive currencies are finding buyers on trade optimism. However, we can see that AUDUSD and NZDUSD are finding resistance as domestic fundamentals are keeping a lid on the gains. After a strong Retail Sales figures, the NZD pairs gapped higher on the open. However, the pairs are unable to keep the bullish momentum due to the weak fundamentals. On the technical side, the pairs are in the overbought conditions as per the RSI.

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

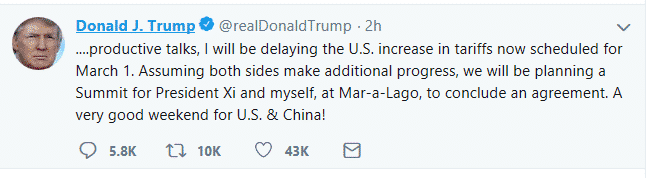

Monday started on a buoyant note as the weekend negotiations between the US and the Chinese officials on structural issues, including intellectual property protection, technology transfer, agriculture among others were productive which encouraged President Trump to extend the 1st March deadline.

Asian stocks and trade-sensitive currencies like the Antipodeans are flashing green. Given that the deadline has been extended, the chances of a trade deal between the two world largest economies also rises which is boding well with investors.

Source: Bloomberg TerminalIn the Australian share market, the real estate sector was the biggest dragger on the ASX today. However, the broad optimism in the market helped the index to close in positive territory despite paring gains in the afternoon trade.

USDCNH (Weekly Chart)

Source: GO MT4NZDUSD and AUDUSD (Hourly Chart)

Source: GO MT4The move in the financial markets in the Asian session following the “delay” announcement has not been huge, but it lifted sentiment and brought relief to the markets!

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

From Singapore to Hanoi – Summit 2.0

President Trump is on the “Tweet Rally” with positive headlines on the trade front and much confidence ahead of the Summit in Hanoi, Vietnam. Singapore Summit The Singapore Summit marked the first-ever meeting between the Head of State of North Korea and the United States. Both leaders signed a joint statement during the Summit and agr...

February 26, 2019Read More >Previous Article

The Dalian Port – “China’s Coal Ban”

Wednesday was the bearer of bad news for Australia. Despite the buoyant employment report which briefly lifted its local currency, the Australian...

February 21, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading