- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Crude Oil – Saudi Production Cuts Spark Rally

- Home

- News & Analysis

- Oil, Metals, Soft Commodities

- Crude Oil – Saudi Production Cuts Spark Rally

News & AnalysisNews & Analysis

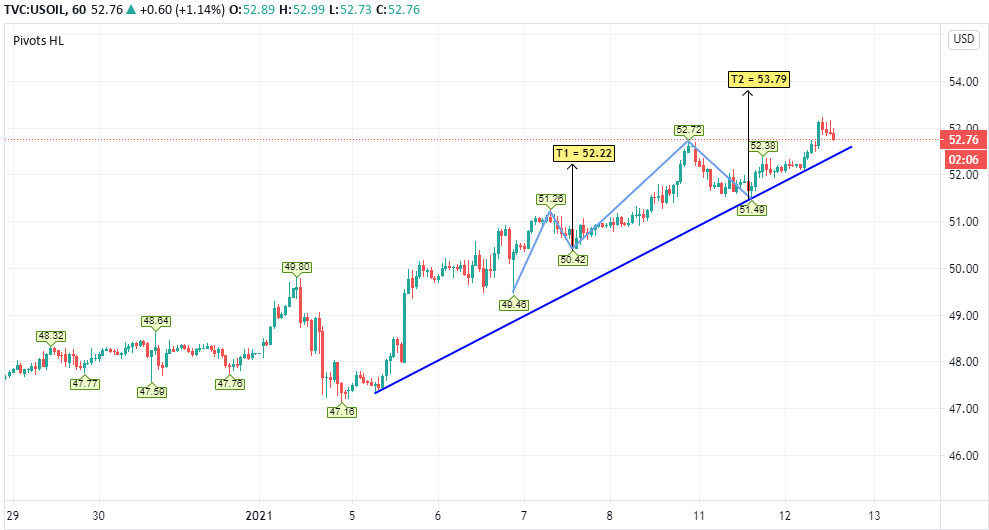

News & AnalysisNews & AnalysisUSOIL- Hourly

USOIL-

It’s been an impressive start to the year for Crude Oil prices so far, with prices steadily rising to over $50 per barrel and returning to pre-pandemic levels. It would seem many underestimated such a speedy recovery.

Still, with the general uptick in global commodity prices and a pledge from Saudi Arabia to cut production heavily over the next year, Crude Oil has benefited significantly, and today we’re looking more at short-term levels using the hourly chart above.

First, we have a validated bullish trendline that emerged on January 5th and continues to provide adequate price support for Crude Oil. This trend’s strength appears fairly robust following a barrage of tests over the most recent trading sessions.

In terms of potential targets, the chart shows some DiNapoli levels T1 & T2 calculated from the following price points (49.46 / 51.26 / 50.42) and (50.42 / 52.72 / 51.49). Since the first price target reached on the 8th, the focus now will be T2, which is $53.79 a barrel.

Perhaps we may see a further re-test of the current trendline as support before advancing to the higher levels. However, should this region succumb to downward selling pressure, the areas of $51.49 and $49.80 could become alternative levels to consider for levels of demand/support.

Note: Click on charts to enlarge.

Sources: Go Markets, Meta Trader 5, TradingView, Bloomberg

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#SpotGold #SpotSilver #GoldTrading #SilverTrading #SpotWTICrudeOil #WTICrudeOil #SpotBrentCrudeOil #BrentCrudeOil #OilTrading #Commodities #CommoditiesTrading #CommodityMarket #CommodityTradingNext Article

Electric Car Stocks on the Move

2020 was a good year for electric car space. We have seen shares of most electric car makers surge considerably and take steps to take the industry to the next level, most notably Tesla and NIO. Top 5 automakers by market cap* Tesla at $790.53 billion Toyota at $209.83 billion NIO at $97.21 billion BYD at $94.21 billion Volkswagen at...

January 13, 2021Read More >Previous Article

COTD: PFE – A Booster Shot For Pfizer Shares?

Pfizer (PFE)- Daily PFIZER - Before Christmas, the pharmaceutical giant Pfizer drew much speculation in the market once it became the first company...

January 5, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading