- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Geopolitical Events

- The Perfect Storm Brewing in the Oil Market

- Home

- News & Analysis

- Articles

- Geopolitical Events

- The Perfect Storm Brewing in the Oil Market

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Perfect Storm Brewing in the Oil Market

The oil and gas industry has been undergoing significant challenges due to the structural shift within the industry. A pandemic-induced economic downturn and an oil price war have now added another layer of uncertainty to the oil markets.

Tensions between Saudi Arabia and Russia have disrupted the stability that the oil industry requires to be able to remain afloat during such difficult times.

Demand and Supply Shock

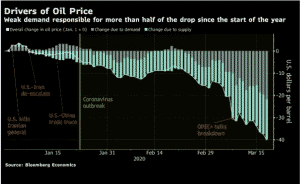

The oil market is facing both a demand and supply shock, simultaneously. In other words, there is a flood of supply at a moment of diminishing demand.

Demand: Different forms of lockdowns across the globe due to the pandemic means empty roads, grounded aircraft, plunging car sales and disrupted supply chains. These industries are key consumers of oil.

Supply: An oil price war between Saudi Arabia and Russia was the tip of the iceberg and triggered the flash crash in March. The oil kingdom raised output to full capacity to fight a price war with its rivals, destabilising the oil market at a critical time during the coronavirus pandemic.

Tensions among oil producers are not uncommon but crude oil prices experienced steep declines, due to weak fundamentals and geopolitical tensions.

Multi-year Low

The flash crash in March has nearly halved crude oil prices. During the month, trading was highly volatile – WTI and Brent Crude traded more than 45% lower to a multi-year low at $20.50 and $24.

Stimulus Packages Brought Some Stability

The bold actions from central bankers and governments to implement new and massive monetary and fiscal packages to stem the downturn helped the oil market from a temporary bottom. As of writing, WTI and Brent Crude have stabilised and have consolidated around the $22 and $26 levels, respectively.

USOUSD AND UKOUSD (Monthly Chart)

Source: GO MT4An Oil Storage Problem

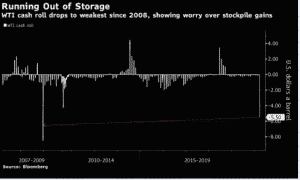

Global activities are slowing down on a massive scale, sapping demand while big producers like Saudi Arabia and Russia tugged in a price war are raising productions. At this rate, giant oil producers are set to run out of storage capacities within a few weeks or months.

The US and Saudi Arabia Negotiations

The oil market had a breather this week. Risk sentiment has improved, and it was also reported that the US and Saudi Arabia are in discussions to end the price war and bring some stability to the oil markets. Investors will rely on political intervention to halt the freefall.

An oil storage problem, higher storage costs, faltering demand and a significant rise in production are creating a perfect storm for the oil market.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#GeoPolitical #GeoPolitics #Markets #CurrenciesNext Article

Quick trading Tip…Be Calm and Develop Trading Patience

When we first start to trade, or subsequently (as a more experienced trader) when we trade a new symbol or system we are often “excited” as we see a “hope” for better results. We often forget that the development of expertise in other areas we have in life (think about what you do in work now for example), you must invest time,...

March 30, 2020Read More >Previous Article

Investment Opportunities in the Health Care Sector

It might be difficult to stay optimistic in such plunging markets. Global equities are in a bear market and investors are moving away from riskier...

March 24, 2020Read More >Please share your location to continue.

Check our help guide for more info.

- Trading