- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Adobe latest results are here

- 1 Month -10.80%

- 3 Month -21.47%

- Year-to-date -37.22%

- 1 Year -37.06%

- UBS $415

- Stifel $500

- Baird $450

- Deutsche Bank $500

- Wells Fargo $425

- Mizuho $480

- Citigroup $380

News & AnalysisAdobe Inc. (ADBE) announced its latest earnings results after the closing bell on Thursday for its second quarter fiscal year 2022 ended June 3.

The American software company reported revenue of $4.386 billion for the quarter (up 14% year-over-year), beating analyst forecast of $4.345 billion.

Earnings per share also reported above analyst expectations at $3.35 per share vs. $3.31 per share estimate.

”Adobe achieved record Q2 revenue with strong demand across Creative Cloud, Document Cloud and Experience Cloud,” Shantanu Narayen, chairman and CEO of Adobe said following the latest financial results.

”We are winning in our established businesses and seeing significant momentum in new categories from content authoring for a broad base of creators to PDF functionality on the web to the leading real-time customer data platform for global enterprises,” Narayen concluded.

”We delivered another quarter of strong financial results, with greater than $2 billion in operating cash flows demonstrating the strength of Adobe’s growing revenue streams and financial discipline,” said Dan Durn, executive vice president and CFO of Adobe.

”Our operating model continues to fuel consistent growth, enabling the company to invest in category-leading cloud solutions and emerging innovations that are gaining traction in the marketplace,” Durn added.

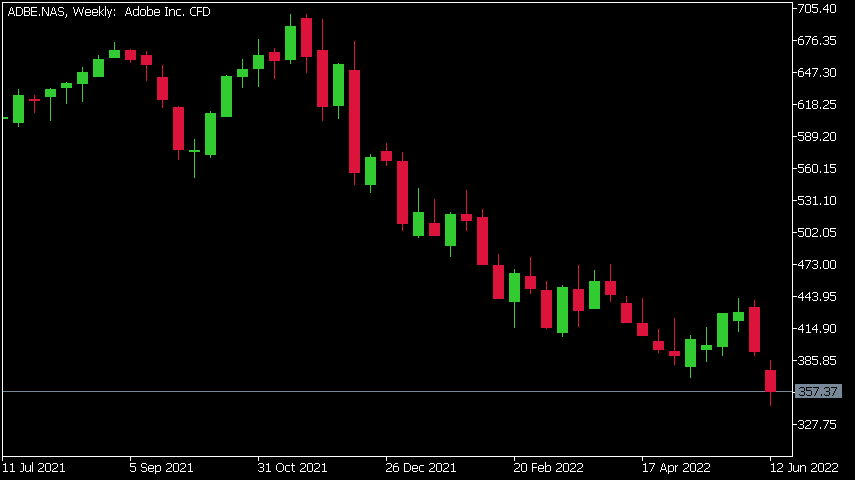

Adobe Inc. (ADBE) chart

Share price of Adobe was down by around 2% at the market open on Friday, trading at $357.37 per share.

Here is how the stock has performed in the past year:

Adobe price targets

Adobe is the 59th largest company in the world with a market cap of $167.63 billion.

You can trade Adobe Inc. (ADBE) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Adobe Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Bitcoin teetering above key $20,000 level

Bitcoin and other cryptocurrencies have seen their prices decline rapidly in recent times as inflation has wreaked havoc across the market. The capitulation has seen Bitcoin lose almost 75% of its value since November 2021. The aggressive selling has seen the price fall to its lowest levels since November 2020. The theory that Bitcoin would be a...

June 22, 2022Read More >Previous Article

The CHF rallies after surprise 50-point interest rate hike

The Swiss National Bank, (SNB) has surprised the market and raised interest rates by 0.5% to combat inflation. The SNB was one of the last central ban...

June 17, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading