- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Apple Reports Third Quarter Results

- revenue between $61 billion and $64 billion

- gross margin between 37.5 per cent and 38.5 per cent

- operating expenses between $8.7 billion and $8.8 billion

- other income/(expense) of $200 million

- tax rate of approximately 16.5 per cent

News & AnalysisApple Reports Third Quarter Results

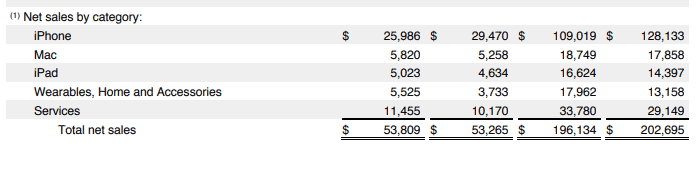

Apple announced its financial results for the June quarter after the closing bell on Tuesday. The Company reported revenue of $53.8 billion, which represents a 1% increase from the year-ago quarter.

It is the first time in years that the iPhone revenue ($25.99bn) is less than half of Apple’s total revenue. However, the strength of other Apple products has offset the weakness in the flagship product.

“This was our biggest June quarter ever — driven by all-time record revenue from Services, accelerating growth from Wearables, strong performance from iPad and Mac and significant improvement in iPhone trends,” said Tim Cook, Apple’s CEO.

The iPhone business is struggling as consumers are upgrading less often which is prompting Apple to focus on its consumer services like iCloud, the App Store, Apple Music, Apple Pay for diversification and growth. Wearables like Apple Watch, AirPods, and Beats headphones are also products that are growing at an accelerating rate.

The CEO has the tough job of maintaining interest in Apple into the post-iPhone era. The popularity of iPhones is not the same as it used to be. In the last few years, the company reported its first iPhone sales drop and earlier this year, they issued a rare warning that the first-quarter earnings will be weaker than previously expected.

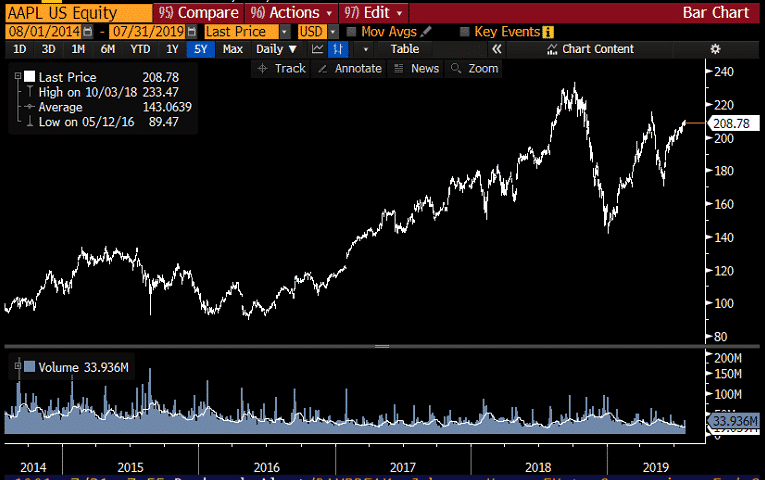

After reaching its peak in early 2018, its share price had been under pressure throughout 2018. After a strong recovery since the beginning of the year, the stock plunged throughout the month of May.

Source: Bloomberg TerminalIts share price is close to recouping losses made in May. After the release of the quarterly updates, Apple’s share price rose more than 4% in the after-hours trading.

Apple is providing the following guidance for its fiscal 2019 fourth quarter:Click here for more information on trading Share CFDs, also, see our Index Trading page for information in trading Indicies.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Dissecting the FOMC Statement

Dissecting the FOMC Statement The US Federal Reserve cut interest rates overnight by 25 basis points, taking the US Federal Funds rate to 2.25%. The rate cut was mostly seen as a hawkish one. In the press conference, Chair Powell said that the central bank’s rate cut was a “mid-cycle adjustment to policy” rather than “the beginning of a ...

August 1, 2019Read More >Previous Article

The “Dovish” or “Hawkish” Rate Cut

A “Dovish” or “Hawkish” Rate Cut The Federal Reserve (Fed) is poised for its first-rate cut in a decade-long of economic expansion. Trade pr...

July 31, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading