- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- AutoZone latest results have arrived

- 1 month: -6.28%

- 3 months: +8.69%

- Year-to-date: +3.30%

- 1 year: +36.62%

- UBS: $2260

- Wells Fargo: $2450

- Raymond James: $2350

- Goldman Sachs: $2296

- Morgan Stanley: $2420

- Citigroup: $2250

- JP Morgan: $2200

News & AnalysisAutoZone Inc. (AZO) reported its fourth quarter financial results for the period ending August 27, 2022 on Monday.

The largest US retailer of aftermarket automotive parts reported revenue of $5.348 billion (up by 8.9% from the same period last year) vs. $5.164 billion expected.

The company reported earnings per share of $40.51 for the quarter vs. $38.51 earnings per share expected.

”Our results are a testament to our AutoZoners’ ongoing commitment to delivering exceptional customer service every day. Our retail business performed well this quarter ending with positive same store sales on top of last year’s strong performance. And, our commercial business growth continued to be exceptionally strong at 22%. The investments we have made in both inventory availability and technology are enhancing our competitive positioning. We are optimistic about our growth prospects heading into our new fiscal year,” Bill Rhodes, Chairman, President and CEO of AutoZone commented on the results.

During the quarter, AutoZone opened 118 new stores and closed one in the United States.

As of August 27, 2022, the company had 6,943 stores within the United States (6,168), Mexico (703) and Brazil (72).

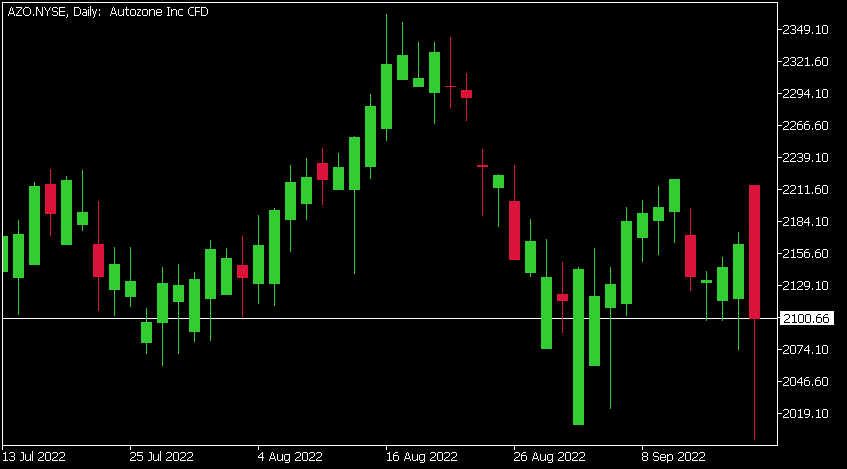

AutoZone Inc. (AZO) chart

Shares of AutoZone were down by around 2% on Monday, trading at $2100.66 a share.

Stock performance

AutoZone price targets

AutoZone is the 364th largest company in the world with a market cap of $42.20 billion.

You can trade AutoZone Inc. (AZO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: AutoZone Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

USDJPY showing signs of another breakout

The USDJPY has been one of the strongest performing currency pairs since the beginning of the year. With geopolitical volatility and record high inflation rates impacting the global economy, the strength of the USD has just continued to be on show. On the contrary, the JPY has been pillaged from pillar to post as the Bank of Japan has refused to ch...

September 20, 2022Read More >Previous Article

Nasdaq breaks its trend as it heads lower

August proved to be a bearish month for the Nasdaq (NDX 100) and is showing no signs of slowing down. With a strong break below the daily trend line (...

September 19, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading