- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Baby formula Shortage presents an opportunity for Aussie companies

- Home

- News & Analysis

- Shares and Indices

- Baby formula Shortage presents an opportunity for Aussie companies

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe USA has seen a peculiar instance of widespread baby formula shortages. In many states around the country, more than half of the formula has been sold out in stores. Across the entire country, 40% of the formula is out of stock.

Causes

Firstly, and quite tragically, there were recently two infants who died from a rare infection associated with one of the manufacturing plants of the formula. Investigators found traces of the pathogen Cronobacter Sakasakii in a Michigan production plant. In response, the FDA recalled several brands of formula, and the public was advised to avoid buying products tied to the plant. This has added further pressure as some in the market packed and have been hoarding the safe baby formula.

Secondly, the pandemic has caused large issues in the supply chain. Whilst many other products had to deal with supply chain crunches, for some reason the baby formula was hit particularly hard as consumers hoarded formula to extreme levels. The high volatility meant that producers could not get a clear gauge of how much supply the market needed. There was also an increase in births across the country, and the need for supply jumped again. In summary, manufacturers were unable to accurately predict the supply that was needed due to the extreme changes in the demand.

Lastly, the USA’s trade arrangement and regulatory processes made it very difficult for overseas manufacturers to supply formulas to the USA. European products and suppliers tend to have a hard time passing FDA regulatory processes. The process is strict and can become quite drawn out. Consequently, the international market has not yet been able to support the shortfall.

Opportunities

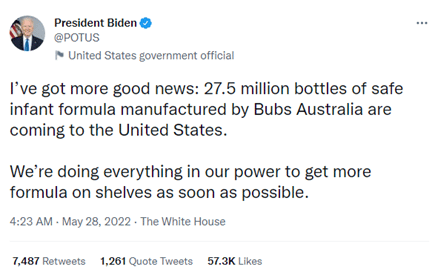

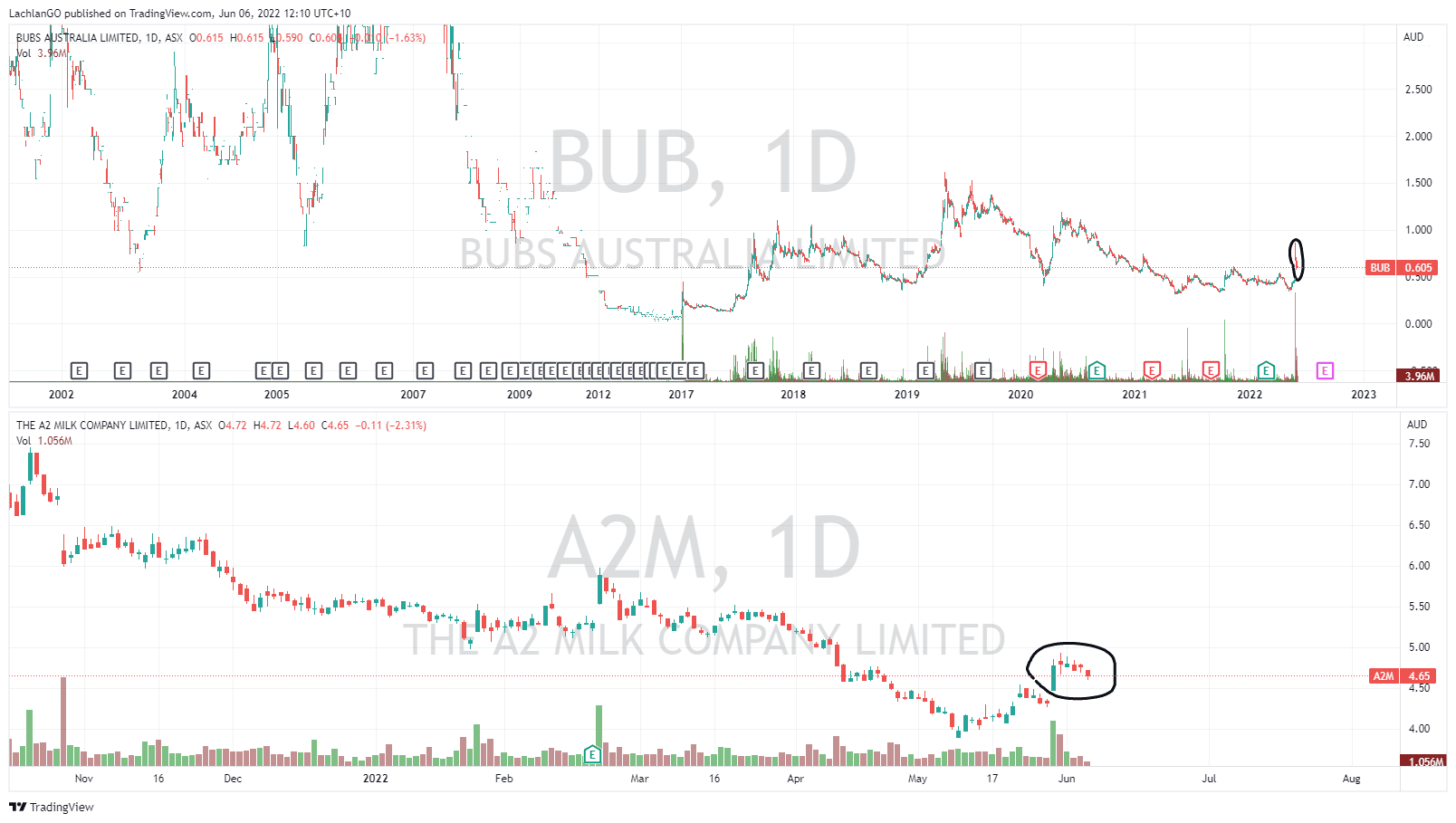

The shortage has provided some opportunities for companies within Australia. Specifically, Bubs Australia and A2M Milk have been able to benefit from the shortage. Both companies saw their share prices jump as the market reacted to the news. Furthermore, BUB was given fast-track approval from the FDA to supply its formula to consumers in the USA. With the shortage set to continue in the short-term future, A2M and Bubs may continue to some positive momentum in the short-term future.

he immediate share price of BUBS opened higher on the news before selling off as long terms investors ‘sold the news’ and A2M saw a strong jump in share price. Both share prices have now settled as the market determines what to do next.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Popular Expert Advisors on MetaTrader:

The following EAs are examples of Expert Advisors rated on Trustpilot. They have been rated by traders in general, however, please understand that past performances are not indication of future success. Below is a list of EAs, which you can purchase online, however there are several free ones you can find on the market, these are labelled (f), plea...

June 7, 2022Read More >Previous Article

Gas and electricity crisis hits the East Coast of Australia

Australians have been hit with a massive spike in gas and electricity bills as the country deals with a sudden shortage in power. Electricity prices w...

June 3, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading