- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Dow Jones rally Q1 2021

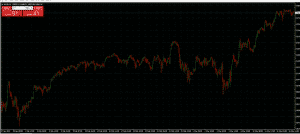

News & Analysis2021 has been a profitable year for stocks in the Dow Jones Index. Since the turn of the year, the Dow has seen what appears to be a roaring rally with no end in sight, fuelled by a return of investor confidence and a stimulus package aiming to revitalise a stagnant U.S economy.

In the first quarter of 2021, we’ve seen an increase of over 3000 points (approx. 10%) in the Dow Jones, setting all-time records daily.

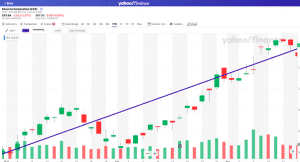

One of the main stocks pushing the price ever higher is Chevron. With the resurgence of international travel and consumer demand plus the price of oil rebounding from historical lows, companies like Chevron and Halliburton have seen a wave of new investment. This in turn has boosted their stock price, contributing to the bullish wave in the Dow Jones Index.

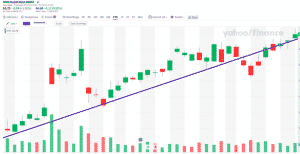

One cannot ignore the rise of tech stocks. During the COVID Pandemic, YTD has seen a strong push for Intel (up 30.03% since 31/12/2020) which has contributed significantly to the rally.

All indicators point to a bullish market for some time to come whilst bearing in mind we are still in a COVID volatile environment and everything can change. The market speaks for itself and the market is well and truly behind the rally.

Intel Chart Above

Source: Yahoo Finance

Chevron Chart Above

Source: Yahoo Finance

By Hasan Albandar

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Up next: Bank of England rate decision

With Bank of Canada and the Fed interest rate announcements wrapped up, it’s time for Bank of England to announce their decision whether to increase, decrease or leave the interest rate unchanged. The decision is set to be announced at 12:00 PM London time on Thursday. About Interest Rates Interest rates are set by Bank of England’...

March 18, 2021Read More >Previous Article

Up next: the Bank of Canada rate decision

One of the must-watch economic events this week will be the Bank of Canada interest rate decision. The rate decision is due to be announced at 1...

March 10, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading