- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- ‘FAANG’ Stocks and Their Role In The Markets

- Home

- News & Analysis

- Shares and Indices

- ‘FAANG’ Stocks and Their Role In The Markets

News & AnalysisNews & Analysis

News & AnalysisNews & Analysis

If you follow any form of financial market publication, news source or have ever watched 15 minutes of Bloomberg, then you will undoubtedly have heard the term ‘FAANG’ stocks.

But what does ‘FAANG’ mean?

In simple terms, it is the acronym for the shares of Facebook, Amazon, Apple, Netflix, and Google (now Alphabet inc.) Coined due to the popularity of these individual stocks, the term’FAANG’ has provided investors with spectacular returns by speculating in the booming sector.

Why are they so important?

The reason is that as these companies grew, they became ever popular with investors due to the phenomenal returns, and subsequently increased the market cap of these companies enormously.

The sheer size of these companies is unimaginable.

In 2018, both Amazon and Apple crossed the threshold to becoming the only two companies worth over $1 Trillion. Since then, they have both since dropped below that level, but for a time it held comfortably. This example illustrates the gigantic scale of these companies and that particular aspect is what we need to focus our attention on.

A side effect of scale

Because the ‘FAANG’ stocks have such a huge market cap it means that they carry a fairly hefty weighting within the Index’s to which they belong. Initially, this was just the Nasdaq (NDX100) but because they have become such powerhouse companies they have all found their spot within the S&P 500, as 5 of the leading companies in the United States.

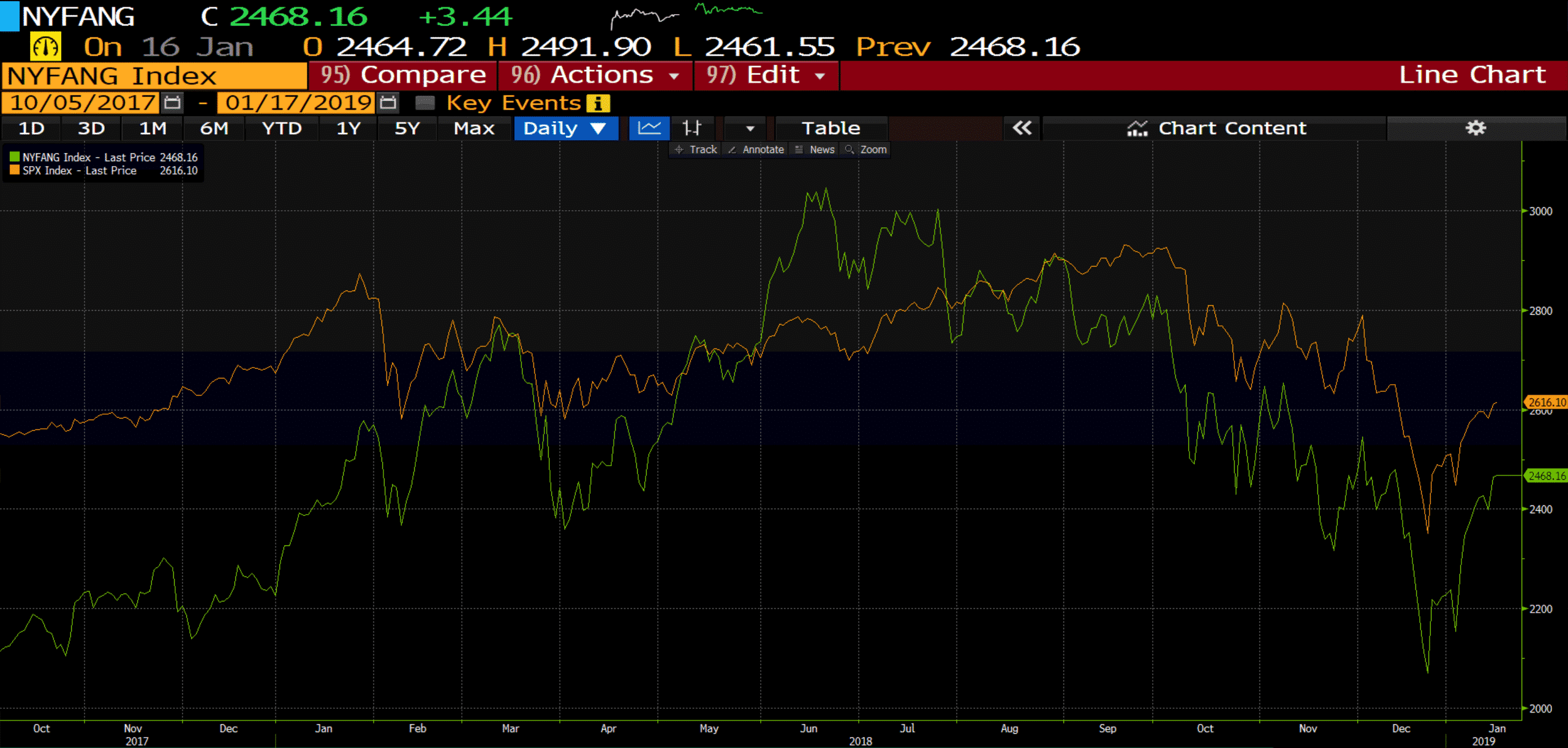

Such is the popularity and importance of these stocks that they have elevated themselves further, there is now the NYSE FANG Index dedicated to representing the ‘segment of the technology and consumer discretionary sectors consisting of highly-traded growth stocks of technology and tech-enabled companies such as Facebook, Apple, Amazon, Netflix and Alphabet’s Google.’

The chart above shows clearly how much sway these ‘FAANG’ stocks can have on the S&P just via the similar price action shown on the NYSE FANG Index (Green) and the S&P500 Index (Orange).

A Way to trade the ‘FAANG’ space

How can paying attention to these particular stocks help in day-to-day trading? Well, because the ‘FAANG’ stocks have the weighting that they do within the S&P and Nasdaq Index’s then by paying attention to the individual stocks and the FANG Index it could give us insight into the potential moves within the respective indices.

For example, if we are seeing both Apple (AAPL) and Amazon (AMZN) beginning to rally then and other FAANG members behaving the same way, there is a higher probability that the Nasdaq/S&P could also follow suit. Essentially, this allows us to take a position with this acting as a form of confirmation.

This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions. Trading Forex and Derivatives carries a high level of risk.

Sources: The Fortune Teller, Seeking Alpha, Bloomberg

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Margin Call Podcast – S1 E1: Vee Leung Phan of Track Record Asia

Vee Leung Phan (@TrackRecordAsia) is the Founder of TrackRecord Asia and former Head of Trading across multiple divisions for Deutsche Bank and Morgan Stanley. Vee made his way into the industry by chance, after realising there was no real opportunity back home during the 1997 Asia Financial Crisis. Fast forward 13+ years and Vee had co-founded...

January 20, 2019Read More >Previous Article

432-202 – Biggest Defeat in Modern Times

Theresa May suffered the worst defeat in recent times in British history. The House has spoken, and Theresa May stated that the government will...

January 16, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading