- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- How do dividend adjustments work on my Index CFD position?

- Home

- News & Analysis

- Shares and Indices

- How do dividend adjustments work on my Index CFD position?

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisCash stock indices such as the Dow 30, FTSE 100 and ASX 200 are made up of constituent stocks which is where their price is derived from.

These constituent stocks of an index will periodically pay dividends to shareholders, causing a drop in that stocks price and impacting the overall value of the index.

With GO Markets this index adjustment will be made at the open of the index on the ex-dividend date of the underlying stock(s). This price drop in the index will affect the PnL on an open index CFD trade, to compensate this, there will be credit or debit that will be included in the swap that is made around 00:00 server time.If you have a long index position you PnL will be negatively affected so you will receive a credit in the same amount as the dividend adjustment.

If you have a short index position you PnL will be positively affected so you will receive a debit in the same amount as the dividend adjustment.

It’s an important point to remember that index traders do not profit or loss from these adjustments. It is a zero sum situation where any PnL change has a corresponding debit or credit to compensate.

Example 1:

You have a buy position on the ASX200 contract of 10 lots at 00:00 server time. The next trading day multiple companies go ex-dividend resulting in a 20 point drop in the ASX200 at the open. The swap on this position will be credited $200 AUD (20 points * $10 per point exposure).

The ASX200 will open 20 points lower than it would have without the adjustment. As a result, the PnL on the buy position is $200 worse off, which was compensated for by the swap credit you received.Example 2:

You have a sell position on the FTSE100 contract of 10 lots at 00:00 server time. The next trading day multiple companies go ex-dividend resulting in a 15 point drop in the FTSE100 at the next open. The swap on this position will be debited £150 GBP (15 points * £10 per point exposure).The FTSE100 will open 15 points lower than it would have without the adjustment. As a result, the PnL on the sell position is £150 better off, which was compensated for by the swap debit you received.

(Please note, as dividends are combined with normal financing adjustments, the swap will not be exactly the same as the dividend only)

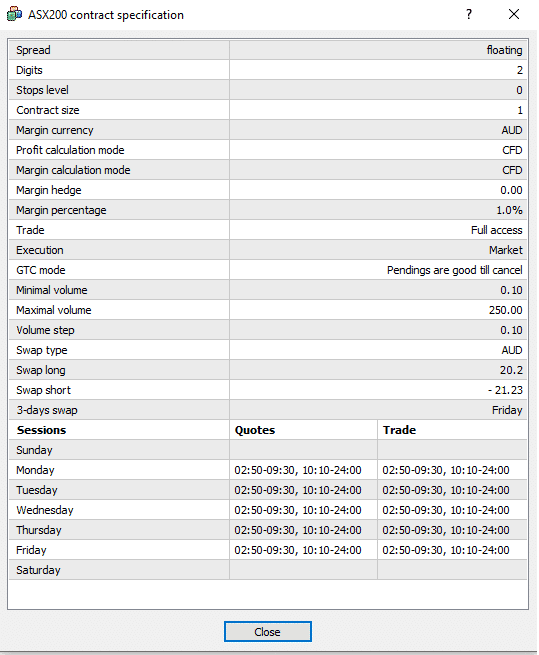

You can view the trading hours and upcoming swap/dividend adjustments in the specifications of an instrument. Example of ASX200 before a 20 point adjustment below:

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

NIO August delivery numbers are in

NIO reported its latest delivery numbers for last month before the opening bell on Wednesday. The ''Chinese Tesla'' delivered a total of 5,880 vehicles in August – a 48.3% year-on-year increase. About NIO NIO is a Chinese car manufacturer founded in 2014 by William Li, a Chinese business executive, and entrepreneur. Its headquarters are bas...

September 2, 2021Read More >Previous Article

Zoom beats Q2 expectations

Zoom reported its second quarter financial numbers after the market close on Monday. The video-calling software company reported total revenue of $...

August 31, 2021Read More >Please share your location to continue.

Check our help guide for more info.

- Trading