- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Li Auto Q2 results are here

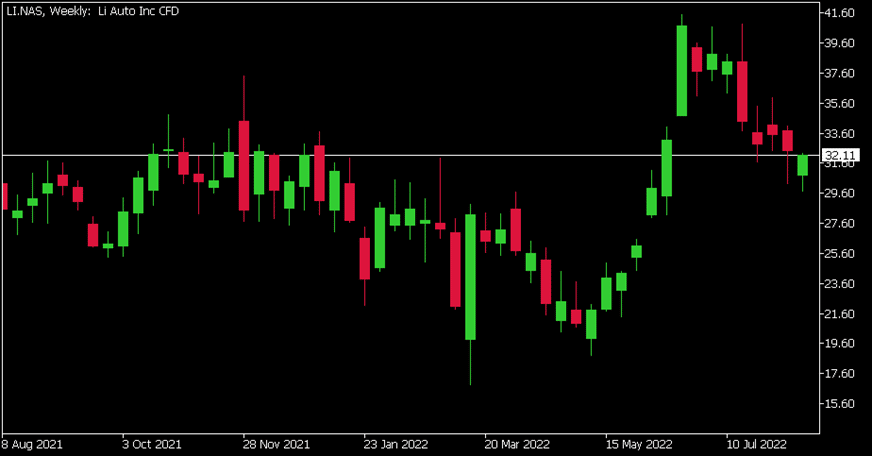

- 1 Month -18.62%

- 3 Month +44.73%

- Year-to-date -0.72%

- 1 Year +15.22%

- Citigroup $58

- UBS $52

- Morgan Stanley $41

- Barclays $40

- Deutsche Bank $35

- Jefferies $44

News & AnalysisLi Auto Inc. (LI) reported its unaudited second quarter financial results on Monday. The Chinese automaker fell short of analyst estimates for the quarter.

World’s 16th largest automaker reported revenue of $1.207 billion vs. $1.416 billion expected.

The company reported a loss per share of -$0.04 for the quarter vs. -$0.02 loss per share expected.

”We delivered solid second quarter results in an environment with challenges and uncertainties through operational and product excellence. Our vehicles continued to win family users, not only illustrating the strength of our vehicle and the growing appeal of our brand, but also reaffirming the effectiveness of our strategy,” Xiang Li, founder, chairman, and CEO of Li Auto said in a press release.

Tie Li, CFO of Li Auto also commented on the latest results: ”We are pleased with our solid second quarter results in the face of numerous pandemic-related challenges. Driven by our strong vehicle deliveries, our revenues reached RMB8.73 billion for the second quarter, up 73.3% year over year. The power of our product, our execution consistency, and operational resilience enabled us to mitigate the cost inflation affecting the entire industry. As a result, our second quarter gross margin remained relatively solid at 21.5%, up 2.6 percentage points year over year, and our cash flow from operations reached RMB1.13 billion. In addition, with the ongoing at-the-market offering of up to US$2.0 billion of American depositary shares, we are further strengthening our capital base to support our robust growth trajectory going forward.”

Li Auto delivered 28,687 vehicles in Q2 – an increase of 63.2% year-over-year.

Li Auto Inc. (LI) chart

The share price of Li Auto was down by around 1% on Monday, trading at $32.11 a share.

Here is how the stock has performed in the past year:

Li Auto price targets

Li Auto is the 585th largest company in the world with a market cap of $30.74 billion.

You can trade Li Auto Inc. (LI) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Li Auto Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Oil continues its sell-off as it drops after weaker Chinese and US economic figures

Oil has continued its tumble from its March 2022 high of $131 per barrel down to $82 a barrel. The drop has been in response to weak economic figures from China and the USA which has added to the recessionary anxiety gripping the market. Furthermore, as Iran edges closer to a nuclear deal, the removal of economic sanctions on the country may be ...

August 16, 2022Read More >Previous Article

The week ahead –RBNZ, RBA and FOMC in the spotlight and set to drive the AUD, NZD and USD

US equity markets finished off the week with a blockbuster of a session, pushing all the major indices to a 4th straight week of gains with the growth...

August 15, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading