- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Liontown Resources, (LTR) secures offtake agreement with Ford

- Home

- News & Analysis

- Shares and Indices

- Liontown Resources, (LTR) secures offtake agreement with Ford

News & AnalysisNews & Analysis

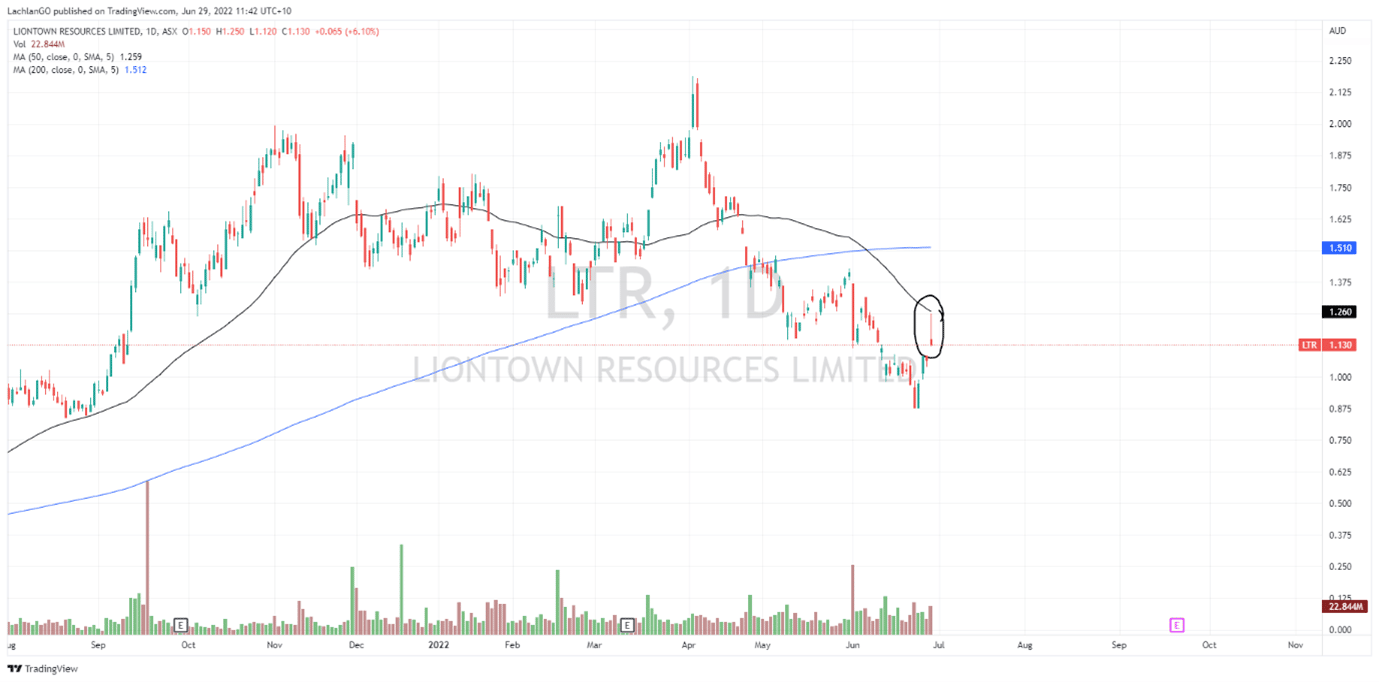

News & AnalysisNews & AnalysisAustralian lithium company, Liontown Resources, has secured another offtake agreement for its Kathleen Lithium project. The agreement with global car manufacturer Ford, means that it will now be the third offtake partner as part of the foundational financing for the development of the Project. Lithium is key for the batteries in electric vehicles in order to allow the vehicles to store electrical energy.

The agreement specifies that LTR will supply Ford with up to 150,000 dry metric tonnes, (DMT) per annum of spodumene concentrate. For the first year, they will provide 75,000 DMT, 125,000 DMT in year 2, and then 150,000 DMT for the remaining 3 years of the initial term of the agreement. Lisa Drake, Ford Vice President of EV industrialisation stated, “Ford continues working to source more deeply into the battery supply chain to meet our goals of delivering more than 2 million EV’s annually for our customers by 2026.”

This makes up a third of the foundational offtakes for the Kathleen Project with Tesla and LG also committing to offtake agreements with the company. The current Kathleen project will be able to produce approximately 500,000 tonnes of spodumene concentrate per annum before expanding to approximately 700,000 tonnes once production starts. The financing of the development will be supported by an agreement in which, Ford will supply $300,000,000 AUD. This combined with $463,000,000 AUD raised by LTR last year should cover the development of the project until production.

The LTR share price was up by 5.4% to $1.12 as of 11.41 EST 29 June 2022 as the market reacted to the news.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

KFC operator share price shoots up after a strong year

The operator of KFC and Taco Bell restaurants across Australia, Europe and South East Asia Collins Foods Limited, (CKF) saw its share price shoot up by above 11% on Tuesday after releasing its annual report. The company saw its revenue increase to 1,184,521,000 and increased its profit by an impressive 47%. The company also saw a decrease in its...

July 1, 2022Read More >Previous Article

Australian Gold companies slump to yearly lows

Some of Australia’s largest gold miners have slumped to their 52-week price lows as rising costs and labour shortages have pushed their share prices...

June 29, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading