- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Mastercard Q4 results announced

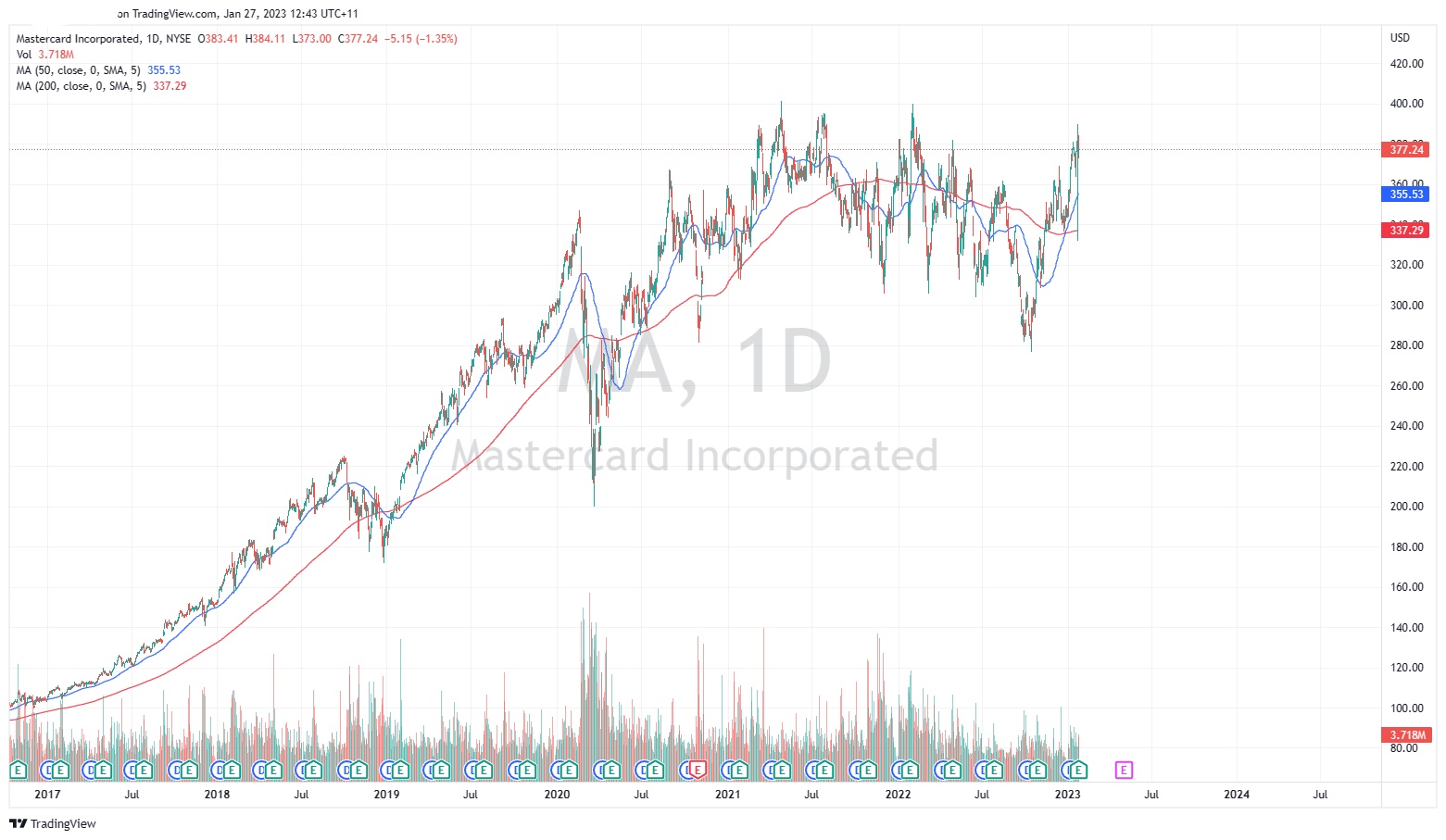

- 1 month: +7.91%

- 3 months: +17.65%

- Year-to-date: +8.06%

- 1 year: +7.19%

- Baird: $410

- Barclays: $427

- Truist Securities: $450

- Jefferies: $430

- Keybanc: $425

- UBS: $441

- Wells Fargo: $405

- Mizuho: $380

- Morgan Stanley: $437

News & AnalysisMastercard Inc. (NYSE: MA) announced the latest financial results for the previous quarter before the market open on Thursday.

World’s third largest financial services company beat both revenue and earnings per share (EPS) estimates for Q4 2022.

The company reported revenue of $5.817 billion vs. $5.793 billion estimate.

EPS at $2.65 per share in Q4 vs. $2.575 per share expected.

CEO commentary

”We closed out the year with strong financial results and notable wins which will help us capitalize on the tremendous secular shift to digital payments,” Michael Miebach, CEO of the company said in a press release.

”As we look at the broader economy, we see the continued recovery of cross-border travel, with volumes up 59% versus a year ago and we’re encouraged by Asia opening up further. While macroeconomic and geopolitical uncertainty persists, consumer spending has been remarkably resilient. We are well prepared to adjust our investment profile quickly if needed,” Miebach concluded.

Stock reaction

Share price of Mastercard dipped by around 2% on Thursday, trading at around $374 a share.

Stock performance

Mastercard stock price targets

Mastercard is the 19th largest company in the world with a market cap of $363.31 billion.

You can trade Mastercard Inc. (NYSE: MA) and many other stocks from the NYSE, NASDAQ, HKEX, ASX, LSE and DE with GO Markets as a Share CFD.

Sources: Mastercard Inc., TradingView, MarketWatch, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

AUD hits $0.71 for first time since August 2022

The Australian dollar has continued its rise against the USD reaching the highest level in almost 3 months. With risk on assets receiving a boost and the USD weakening the Australian dollar has been a big beneficiary. As hopes for a Federal Reserve pivot increase the greenback has seen aa pullback and growth assets have seen an influx of money. Wit...

January 27, 2023Read More >Previous Article

Tesla posts mixed Q4 results

Tesla Inc. (NASDAQ: TSLA) reported Q4 2022 financial results after the market close in the US on Wednesday. World’s largest automaker reported re...

January 26, 2023Read More >Please share your location to continue.

Check our help guide for more info.

- Trading