- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Meta earnings results are in – the stock falls in the after-hours

- Home

- News & Analysis

- Shares and Indices

- Meta earnings results are in – the stock falls in the after-hours

- 1 Month +1.76%

- 3 Month -4.64%

- Year-to-date -50.40%

- 1 Year -55.31%

- Keybanc $190

- Mizuho $250

- Rosenblatt $181

- Deutsche Bank $235

- Morgan Stanley $280

- Credit Suisse $245

- Citigroup $270

- Cowen & Co. 275

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisMeta earnings results are in – the stock falls in the after-hours

28 July 2022 By Klavs ValtersMeta Platforms (META) announced its Q2 financial results after the closing bell in the US on Wednesday.

The social media giant fell short of analyst expectations for the quarter.

Revenue reported at $28.822 billion in Q2 (down by 1% year-over-year), vs. analyst estimate of $28.908 billion.

Earnings per share at $2.46 per share (down by 32% year-over-year) vs. $2.54 per share expected.

“It was good to see positive trajectory on our engagement trends this quarter coming from products like Reels and our investments in AI,” Mark Zuckerberg, Meta founder and CEO said in a press release following the announcement of the latest results.

“We’re putting increased energy and focus around our key company priorities that unlock both near and long term opportunities for Meta and the people and businesses that use our services,” Zuckerberg added.

Q3 2022 projections

David Wehner, CFO of Meta: “We expect third quarter 2022 total revenue to be in the range of $26-28.5 billion. This outlook reflects a continuation of the weak advertising demand environment we experienced throughout the second quarter, which we believe is being driven by broader macroeconomic uncertainty. We also anticipate third quarter Reality Labs revenue to be lower than second quarter revenue. Our guidance assumes foreign currency will be an approximately 6% headwind to year-over-year total revenue growth in the third quarter, based on current exchange rates.”

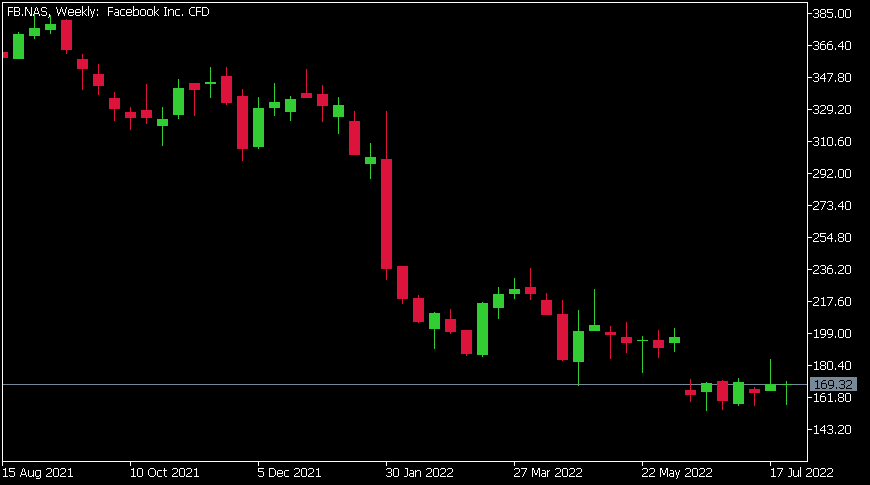

Meta Platforms (META) chart*

*Meta Platforms (META) is displayed as Facebook Inc. (FB) on the GO Markets MetaTrader 5 platform

Share price of Meta was up by 6.55% at the closing bell on Wednesday, trading at $169.32 per share. The stock fell by around 3% in the after-hours trading.

Here is how the stock has performed in the past year:

Meta Platforms price targets

Meta Platforms is the 11th largest company in the world with a market cap of $451.42 billion.

You can trade Meta Platforms (META) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Meta Platforms, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Equities, gold, crypto and oil soar, Dollar dumps as Powell tilts dovish

As expected, the Federal reserve hiked rates 75bp on Wednesday as the Fed battles to control record inflation whilst attempting to avoid a deep recession. Markets were relatively behaving as expected on the decision and statement up until the Fed chair Powell’s presser anyway. Whilst Powell reiterated the Feds mission to tame inflation stateme...

July 28, 2022Read More >Previous Article

Australian CPI figures increase to 6.1%

The Australian Consumer data was released today with Consumer Price Index rising to 6.1% over the past 12 months. For the quarter, the CPI rose by 1.8...

July 27, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading