- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Articles

- Cryptocurrency

- More downside for major cryptos?

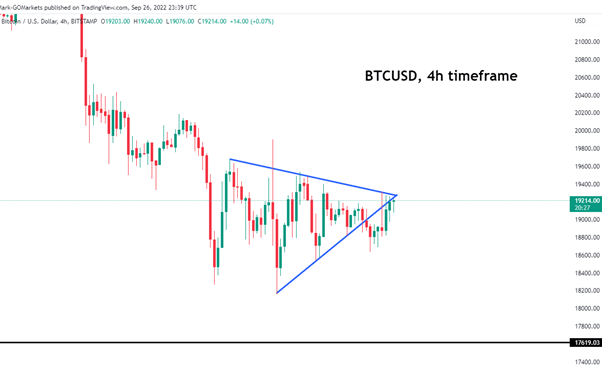

News & AnalysisFollowing the previous Bitcoin analysis (https://www.int.gomarkets.com/articles/economic-updates/bitcoin-usd-technical-analysis/), bitcoin continues to break below pattern after pattern, recently breaking out and re-testing a descending flag pattern on a 4h time frame as seen below:

With the next major support sitting around $17,619, it won’t be a surprise if bitcoin comes down to that area.

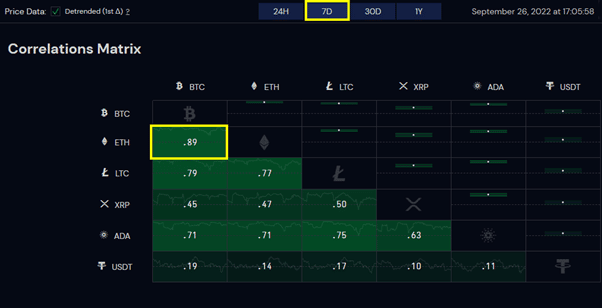

Looking at the correlation between Bitcoin and Ethereum, the last 7 days of price action shows a correlation of .89, which is a positive value that indicates a positive correlation between the two. A positive correlation means that the two moves very similar to one another.

(https://cryptowat.ch/correlations)

(https://cryptowat.ch/correlations) For ETHUSD (Ethereum), making similar patterns to BTCUSD, has also recently broken out of a descending flag pattern, signalling a probable continuation of the 4h downtrend, there is a high probability of ETHUSD reaching the next major support around $1012.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

Next Article

GO Markets wins in the Global Forex Awards – Retail

GO Markets has won three awards in this year’s Global Forex Awards; Best Forex Fintech Broker - Global Best Forex Trading Support - Asia Most Trusted Broker - Europe The Global Forex Awards recognise forex and related businesses from around the world, “who are pushing the boundaries of innovation in retail forex trading solution...

September 27, 2022Read More >Previous Article

ASX200 resting on a knifes edge

Inflation and recessionary pressures have caused the aggressive sell offs of some of the largest global indices, however so far, the ASX200 or XJO has...

September 26, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading