- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Netflix’s Second-Quarter Results Analysed

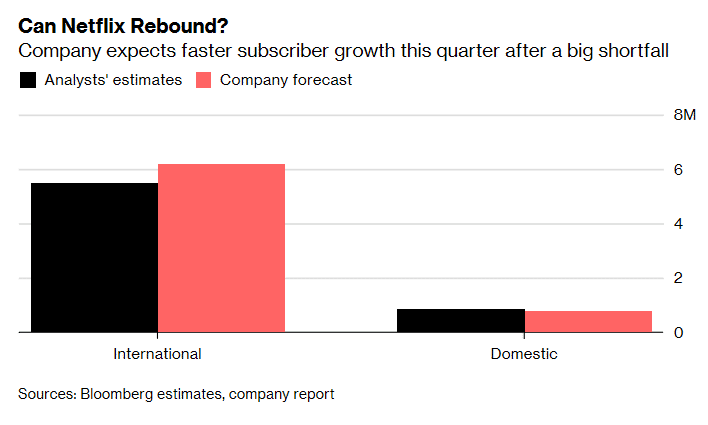

- New paid memberships grew only by 2.7 million compared to 5 million forecasted. In comparison to the Q2 2018, paid membership was less by 2.8 million.

- Profit in the second quarter of 2019 fell to $271m.

- The missed forecasts were across all regions, but it has been more prominent in the region with the price hikes. However, the company didn’t think that the price increase was the issue.

- The Company blamed the miss in new subscribers on a lack of original content rather than competition.

News & AnalysisNetflix’s Second-Quarter Results

Netflix, Inc. (NASDAQ: NFLX) has released its second-quarter 2019 earnings report on Wednesday after the US close. The company tumbled by more than 10% in after-hours trading as the streaming giant missed new memberships forecasts.

Below are the main highlights of the financial results:

“We don’t believe the competition was a factor since there wasn’t a material change in the competitive landscape during Q2, and competitive intensity and our penetration is varied across regions (while our over-forecast was in every region). Rather, we think Q2’s content slate drove less growth in paid net adds than we anticipated”

Netflix moved away from licensed shows and is relying more on its original films, anime shows and programs. The lack of strong content could have been the reason that the streaming company failed to bring in more subscribers.

In the face of serious competition with other companies like Disney, Apple, Hotstar, YouTube, among others offering streaming entertainment, Netflix will have to upstage its original content and stay relevant.

The company see subscribers picking up in Q3 due to the release of new seasons of popular shows. Also, popular shows like The Office and Friends will be wound down over the coming years, which will help to free up budget to allow Netflix to create more original content.

The rise of competition and the type of content are the major factors that Netflix will have to tackle to achieve the large projected ticks in subscribers in the third quarter.

Click here for more information on trading Share CFDs, also, see our Index Trading page for information in trading Indicies.

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Share CFD chart of the day – Todays REAL market example attached and how it works

As many of you know GO Markets now offer ASX Share CFDs (and will soon add US Share CFDs to the products you can access). Alongside the launch of access of these we offer an online course for those who are interested in learning, and potentially ultimately trading, this financial instruments in combination with other vehicles you are currently tra...

July 19, 2019Read More >Previous Article

Fundamental Analysis: Macro Factors

Fundamental Analysis: Macro Factors The rapidly growing global interconnectedness means that the health of one country's economy can impact the worl...

July 18, 2019Read More >Please share your location to continue.

Check our help guide for more info.

- Trading