- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Nike tops Wall Street estimates

- 1 Month -4.73%

- 3 Month -18.03%

- Year-to-date -33.70%

- 1 Year -27.47%

- Cowen & Co. $133

- Deutsche Bank $152

- Credit Suisse $130

- Citigroup $123

- Baird $150

- UBS $168

- Morgan Stanley $159

- HSBC $132

- Wells Fargo $150

News & AnalysisNike Inc. (NKE) reported its latest financial results for its fiscal 2022 fourth quarter after the closing bell in the US on Monday. World’s largest sporting goods company topped both revenue and earnings per share estimates.

The company reported revenue of $12.234 billion for the quarter vs. $12.061 billion expected.

Earnings per share reported at $0.90 per share vs. estimate of $0.80 per share.

”NIKE’s results this fiscal year are a testament to the unmatched strength of our brands and our deep connection with consumers,” John Donahoe, President and CEO of Nike said in a press release after the results.

”Our competitive advantages, including our pipeline of innovative product and expanding digital leadership, prove that our strategy is working as we create value through our relentless drive to serve the future of sport,” Donahoe added.

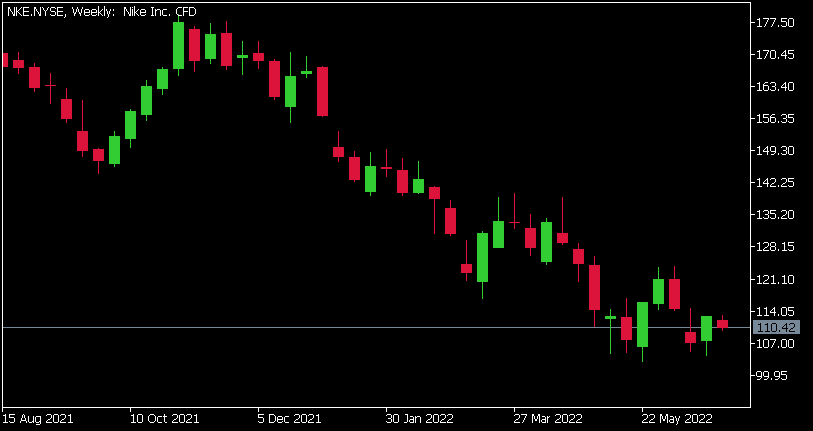

Nike Inc. (NKE) chart

Shares of Nike were down by around 2.13% at the end of trading day on Monday at $110.42 per share.

Here is how the stock has performed in the past year:

Nike price targets

Nike Inc. is the 61st largest company in the world with a market cap of $173.90 billion.

You can trade Nike Inc. (NKE) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Nike Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Australian Gold companies slump to yearly lows

Some of Australia’s largest gold miners have slumped to their 52-week price lows as rising costs and labour shortages have pushed their share prices down. St Barbara, (SBM), Ramelius Resources, (RMS) and now Evolution Mining, (EVN) have all reported disappointing updates to the market. The collective weakness has reverberated across the sector wi...

June 29, 2022Read More >Previous Article

The Week Ahead – Stock Markets

After weeks of relentless selling the market provided a decent rally to end the week. The S&P 500 saw a nice jump rising 3.44% during Friday’s t...

June 27, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading