- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- NIO Q1 results announced

- 1 Month +44.35%

- 3 Month +42%

- Year-to-date -40.31%

- 1 Year -55.78%

- B of A Securities $26

- UBS $32

- Mizuho $60

- Morgan Stanley $34

- Barclays $34

- Deutsche Bank $70

- Goldman Sachs $56

News & AnalysisNIO Inc. (NIO) reported its first quarter financial results before the market open in the US on Thursday.

The Chinese electric vehicle maker reported revenue of $1.563 billion in the first quarter (up by 24.2% year-over-year), topping analyst estimate of $1.561 billion.

Loss per share reported at -$0.12 per share, lower than the -$0.15 loss per share expected.

The company delivered a total of 25,768 vehicles in Q1 2022, an 28.5% increase vs. Q1 2021.

William Bin Li, founder, chairman and CEO of the EV company commented on NIO’s performance in Q1: ”We set new record-high quarterly deliveries of 25,768 vehicles in the first quarter of 2022, and hit the milestone of exceeding 200,000 vehicle deliveries in May within four years since our first delivery.”

“Despite the volatilities of supply chain and the challenges in vehicle delivery resulting from the recent COVID-19 resurgence, we witnessed robust demand for our complementary products and achieved an all-time high order inflow in May 2022. On April 29, 2022, the first batch of tooling trial builds of the ET5 rolled off the production line at the new manufacturing plant at NeoPark in Hefei. We expect to start delivery of the ET5 in September 2022. In addition, we will further enhance our product offering by introducing the ES7, a new mid-to-large five-seater SUV based on NIO Technology 2.0 (NT2.0), in June and expect to start its delivery in late August,” Li added.

The company expects deliveries of between 23,000 to 25,000 in Q2 and revenue of between $1.473 billion and $1.591 billion.

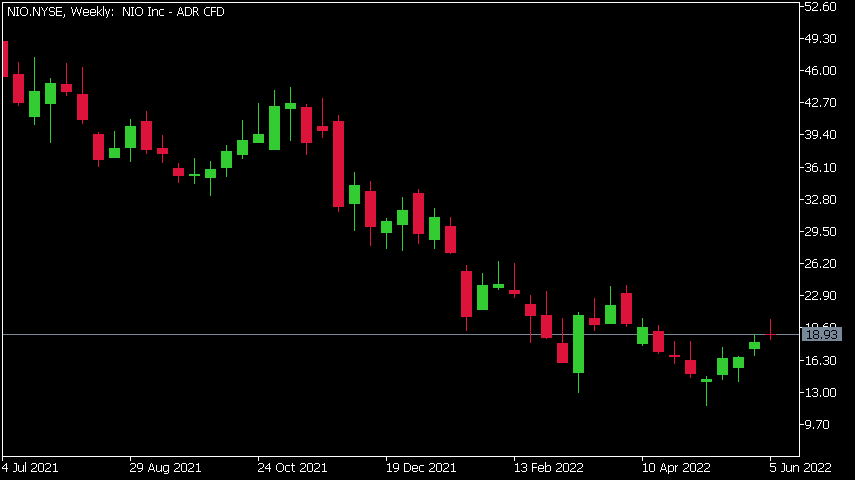

NIO Inc. chart

Shares of NIO fell by around 6% during the trading day on Thursday at $18.93 per share despite beating analyst estimates for Q1, mainly due to future outlook for Q2.

Here is how the stock has performed in the past year:

NIO price targets

NIO is the 14th largest automaker in the world with a market cap of $31.54 billion.

You can trade NIO Inc. (NIO) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: NIO Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

AUD/USD finds new buyers at the 0.70 price mark

As depicted in the AUD/USD hourly chart above, the pair has recently reached a monthly low of 0.69117 as it enters today’s European session. As it continues to decrease in value, it generates a sloping resistance line at 0.6970, this is the trendline from Friday’s prices. Although the trend might appear bearish at the moment, the MACD in...

June 14, 2022Read More >Previous Article

Are we at risk of ‘Stagflation’?

The world economy is grappling with inflation that is surging out of control. Inflation rates have surged to decade highs across multiple countries. C...

June 10, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading