- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Oracle beats estimates

- 1 Month -1.61%

- 3 Month -12.26%

- Year-to-date -18.91%

- 1 Year -13.38%

- Jefferies $80

- JP Morgan $82

- BMO Capital $86

- Stifel $72

- Cowen & Co. $98

- Morgan Stanley $88

News & AnalysisOracle Corporation (ORCL) reported its latest financial after the closing bell in the US on Monday. The company beat both revenue and earnings per share estimates, sending the stock price higher.

The US software and hardware manufacturer reported revenue of $11.84 billion for the quarter (up by 5% year-over-year and up 10% in constant currency) vs. $11.61 billion expected.

Earnings per share reported at $1.54 per share vs. $1.37 per share estimate.

”We continued to improve our top line results again this quarter with total revenue growing 10% in constant currency,” Oracle CEO, Safra Catz commented on the latest results after the announcement.

”These consistent increases in our quarterly revenue growth rate typically have been driven by our market leading Fusion and NetSuite cloud applications. But this Q4, we also experienced a major increase in demand in our infrastructure cloud business—which grew 39% in constant currency. We believe that this revenue growth spike indicates that our infrastructure business has now entered a hyper-growth phase. Couple a high growth rate in our cloud infrastructure business with the newly acquired Cerner applications business—and Oracle finds itself in position to deliver stellar revenue growth over the next several quarters,” Catz concluded.

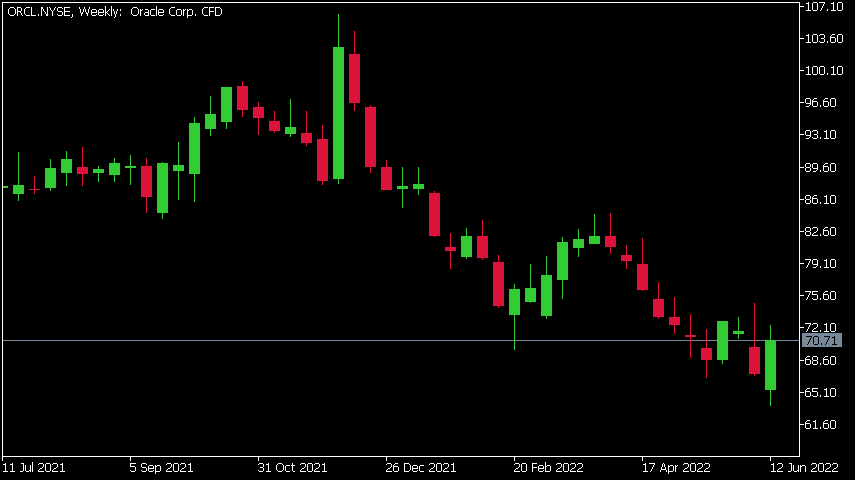

Oracle Corporation (ORCL) chart

Share price of Oracle was up by over 10% on Tuesday after the latest earnings beat, trading at $70.71 per share.

Here is how the stock has performed in the past year:

Oracle price targets

Oracle Corporation is the 45th largest company in the world with a market cap of $197.79 billion.

You can trade Oracle Corporation (ORCL) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Oracle Corporation, TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Are ETFs really Passive?

What is an ETF Most people have heard of ETFs but not everyone knows what they are. An ETF is an Exchange Traded Fund and they are extremely popular amongst retail investors and novice investors. Companies such as Beta shares, Vanguard, Blackrock and others create and manage these holdings on behalf of investors. An ETF is a collections of stock...

June 15, 2022Read More >Previous Article

AUD/USD finds new buyers at the 0.70 price mark

As depicted in the AUD/USD hourly chart above, the pair has recently reached a monthly low of 0.69117 as it enters today’s European session. As ...

June 14, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading