- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- PepsiCo tops Q2 estimates

- 1 Month +9.71%

- 3 Month -1.17%

- Year-to-date -1.40%

- 1 Year +11.98%

- Deutsche Bank $178

- Barclays $183

- JP Morgan $185

- UBS $182

- Wells Fargo $172

- Credit Suisse $168

- Morgan Stanley $198

News & AnalysisPepsiCo Inc. (PEP) reported its Q2 earnings results before the opening bell on Wall Street on Tuesday.

The US beverage and food company reported revenue of $20.225 billion for the quarter vs. analyst forecast of $19.513 billion.

Earnings per share also reported above analyst expectations at $1.86 per share vs. $1.74 per share estimate.

”We are pleased with our results for the second quarter as our business momentum continued despite ongoing macroeconomic and geopolitical volatility and higher levels of inflation across our markets,” Chairman and CEO Ramon Laguarta commented on the latest results following the announcement.

”Our results are indicative of our highly dedicated employees, the strength and resilience of our categories, agile supply chain and go-to-market systems and strong marketplace execution. Our performance also gives us confidence that our investments to become an even Faster, even Stronger, and even Better organization by winning with pep+ are working. Given our year-to-date performance, we now expect our full-year organic revenue to increase 10 percent (previously 8 percent) and we continue to expect core constant currency earnings per share to increase 8 percent,” Laguarta concluded.

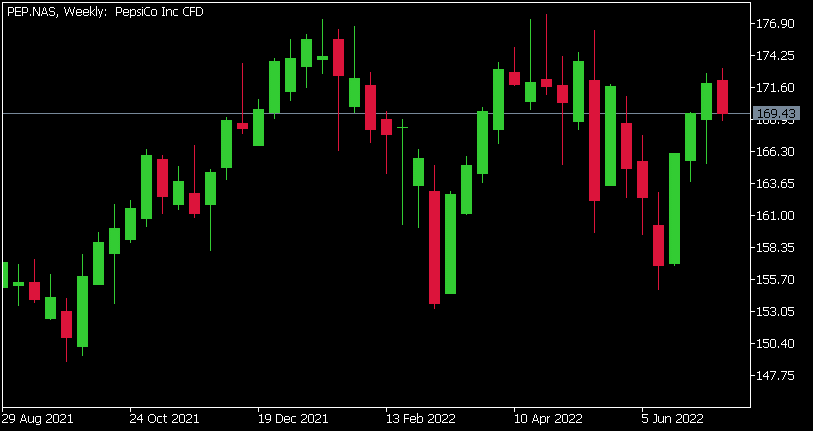

PepsiCo (PEP) chart

The latest results did not have a huge impact on the shares price, the stock was down by 0.57% at $169.34 per share on Tuesday.

Here is how the stock has performed in the past year:

PepsiCo price targets

PepsiCo Inc. is the 36th largest company in the world with a market cap of $236.89 billion.

You can trade PepsiCo Inc. (PEP) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: PepsiCo Inc., TradingView, MarketWatch, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Oil dips to the bottom of its range as recession fears hit the market.

Oil has seen its first real slip up in price since March. The commodity had been running on the back of high inflation and supply issues stemming from the Russian and Ukraine crisis. During the run Oil peaked at $137 a barrel before entering a period of consolidation. The recent catalyst for the drop was OPEC announcing that 2023 would likely re...

July 13, 2022Read More >Previous Article

Market Update – The week ahead

Equity Indices saw some positive price action over the last week. The US continued to rally, albeit with a sense of unsurety. The S&P 500 finished...

July 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading