- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Procter & Gamble beats estimates – the stock is up

- Home

- News & Analysis

- Shares and Indices

- Procter & Gamble beats estimates – the stock is up

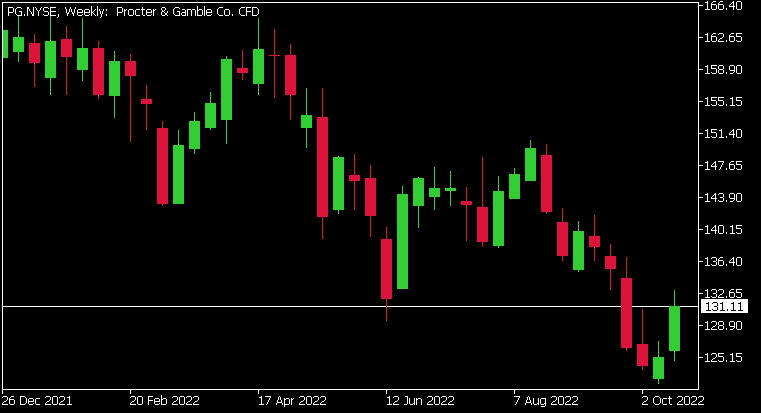

- 1 month: -3.34%

- 3 months: -7.32%

- Year-to-date: -19.80%

- 1 year: -7.10%

- Credit Suisse: $140

- JP Morgan: $140

- Raymond James: $155

- Deutsche Bank: $155

- Morgan Stanley: $160

- Wells Fargo: $150

- Barclays: $154

- Truist Securities: $160

News & AnalysisNews & Analysis

News & AnalysisNews & AnalysisThe Procter & Gamble Company (NYSE:PG) reported its latest financial results before the opening bell on Wednesday.

The largest consumer goods company in the world topped both revenue and earnings per share (EPS) estimates for the quarter – sending the stock price higher at the open.

Revenue reported at $20.612 billion (up by 1% year-over-year) vs. $20.33 billion expected.

EPS at $1.57 per share (down by 2% year-over-year) vs. $1.547 per share estimate.

”We delivered solid results in our first quarter of fiscal 2023 in a very difficult cost and operating environment,” Jon Moeller, CEO of The Procter & Gamble Company said in a press release.

”These results enable us to maintain our guidance ranges for organic sales and EPS growth for the fiscal year despite continued significant headwinds. We remain committed to our integrated strategies of a focused product portfolio, superiority, productivity, constructive disruption and an agile and accountable organization structure. These strategies have enabled us to build and sustain strong momentum. They remain the right strategies to navigate through the near-term challenges we’re facing and continue to deliver balanced growth and value creation,” Moeller concluded.

The stock was up by around 2% following the latest results, trading at $131.11 a share.

Stock performance

Procter & Gamble price targets

The Procter & Gamble Company is the 17th largest company in the world with a market cap of $313.81 billion.

You can trade The Procter & Gamble Company (NYSE:PG) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: The Procter & Gamble Company, TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Is Credit Suisse running out of Credit?

This year has not been kind to the domestic and global economy. The financial woes keep rolling in, this time an old issue has rear its head with one of largest global investment banks seeing its share price drop significantly. That institution in question, is stalwart Credit Suisse. Credit Suisse’s share price is down more than 70% – from 1...

October 20, 2022Read More >Previous Article

Tesla Q3 revenue falls short of Wall Street expectations – price target raised by Bank of America

Tesla Inc. (NASDAQ:TSLA) reported its Q3 financial results after the closing bell on Wednesday. World’s largest automaker exceeded earnings per sha...

October 20, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading