- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Trading

- Trading

- Markets

- Markets

- Products overview

- Forex

- Commodities

- Metals

- Indices

- Shares

- Cryptocurrencies

- Treasuries

- Platforms

- Platforms

- Platforms

- Platforms

- Platforms overview

- MetaTrader 4

- MetaTrader 5

- Education

- Education

- Education

- Education

- News & analysis

- Education Hub

- Economic calendar

- Help & support

- Help & support

- About

- Home

- News & Analysis

- Shares and Indices

- Rivian Q2 results have arrived

- 1 month +26.34%

- 3 months +60.29%

- Year-to-date -62.44%

- HSBC $28

- Mizuho $48

- Citigroup $41

- Morgan Stanley $31

- B of A Securities $26

- UBS $32

- Barclays $34

News & AnalysisRivian Automotive Inc. (RIVN) announced its Q2 financial results after the closing bell in the US on Thursday.

The American automaker reported revenue of $364 million vs. estimate of $335.378 million.

The company reported a loss per share of -$1.62 per share vs. -$1.63 per share expected.

”The second quarter of 2022 represented important progress as we delivered against key operational and commercial milestones. We continued to ramp production on our R1 and RCV platform lines, producing 4,401 total vehicles during the quarter compared to 2,553 in the first quarter of 2022. We also rolled out EDV 700s with Amazon in more than a dozen cities in the United States, started production validation builds for the EDV 500, launched our fast charging Rivian Adventure Network, and initiated our new consumer vehicle reservation system. We remain focused on fully ramping our 150,000 installed annual units of capacity in Normal, Illinois to meet the strong demand for our products. Our net consumer pre-order backlog as of June 30, 2022 was approximately 98,000 and momentum continues to increase,” the company said in a letter to shareholders.

”In the second quarter of 2022, we produced 4,401 vehicles. Our equipment, people, systems, and supply chain continue to show progress as we work towards our 2022 production guidance of 25,000 units. Supply chain continues to be the limiting factor of our production; however, through close partnership with our suppliers we are making progress. We expect to be able to add a second shift for vehicle assembly towards the end of the third quarter.”

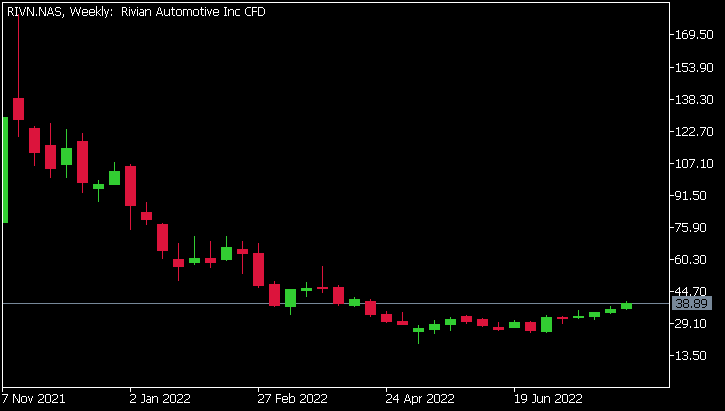

Rivian Automotive Inc. (RIVN) chart

Shares of Rivian were up by 4.14% at the close of trading on Thursday at $38.89 a share.

Here is how the stock has performed year-to-date:

Rivian price targets

Rivian is the 518th largest company in the world with a market cap of $34.01 billion.

You can trade Rivian Automotive Inc. (RIVN) and many other stocks from the NYSE, NASDAQ, HKEX and the ASX with GO Markets as a Share CFD.

Sources: Rivian Automotive Inc., TradingView, MetaTrader 5, Benzinga, CompaniesMarketCap

The information provided is of general nature only and does not take into account your personal objectives, financial situations or needs. Before acting on any information provided, you should consider whether the information is suitable for you and your personal circumstances and if necessary, seek appropriate professional advice. All opinions, conclusions, forecasts or recommendations are reasonably held at the time of compilation but are subject to change without notice. Past performance is not an indication of future performance. Go Markets Pty Ltd, ABN 85 081 864 039, AFSL 254963 is a CFD issuer, and trading carries significant risks and is not suitable for everyone. You do not own or have any interest in the rights to the underlying assets. You should consider the appropriateness by reviewing our TMD, FSG, PDS and other CFD legal documents to ensure you understand the risks before you invest in CFDs. These documents are available here.

#Indice #Indices #IndicesTrading #IndexTrading #Shares #Stockmarket #StocksNext Article

Buying opportunity on the GBPAUD

Buying opportunity on the GBPAUD A short/medium term trading opportunity has arisen on the GBPAUD. The Pound has been weakening after the Bank of England came out last week and forecast that the economy would fall into a 15 month recession later this year. Whilst the bearish sentiment was somewhat of shock it was not totally unexpected...

August 12, 2022Read More >Previous Article

Disney company tops Wall Street estimates

The Walt Disney Company (DIS) reported the latest financial results for its third fiscal quarter after the closing bell on Wednesday. World’s lar...

August 11, 2022Read More >Please share your location to continue.

Check our help guide for more info.

- Trading